- Switzerland

- /

- Software

- /

- SWX:TEMN

Temenos (SWX:TEMN) Valuation in Focus After Beating Q3 Estimates and Raising 2025 Guidance

Reviewed by Simply Wall St

Temenos (SWX:TEMN) caught investors' attention after third quarter results surpassed market expectations, and the company lifted its full-year 2025 outlook. This comes amid leadership changes, as the interim CEO stepped in this September.

See our latest analysis for Temenos.

Temenos’s share price has surged in response to the upbeat Q3 results and raised outlook, with a remarkable 1-day share price return of 19.7% and a 1-week gain of 16.7%. While the momentum is clearly building in the short term, the company’s 1-year total shareholder return of 25.1% stands out compared to a more modest three-year performance and longer-term volatility.

If Temenos’s recent rally has you watching for other fast-moving opportunities, it could be the perfect time to hunt for fast growing stocks with high insider ownership.

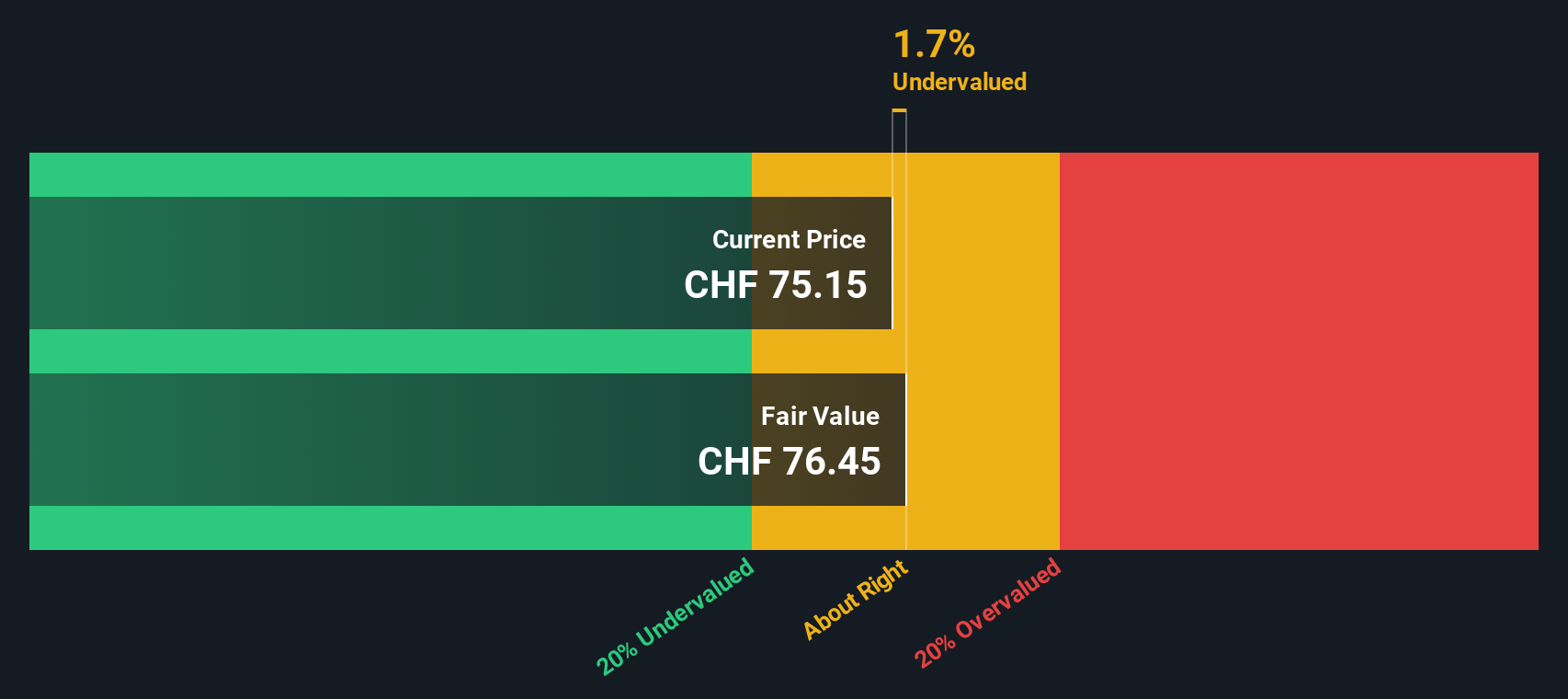

With Temenos’s strong run and lifted forecasts, the key question now is whether the recent optimism means the shares are still trading below their true value, or if the market has already priced in all of that future growth potential.

Price-to-Earnings of 21.3x: Is it justified?

Temenos is currently trading at a price-to-earnings (P/E) ratio of 21.3x, notably lower than the European Software industry average of 28x and the peer average of 50.3x. This positions the shares as comparatively attractively valued on this commonly used metric.

The P/E ratio assesses what investors are willing to pay today for a company's earnings. For software companies like Temenos, a lower-than-average P/E could indicate the market is underestimating future profit potential or that there is caution regarding sustainable growth.

Given that Temenos’s earnings growth over the last year has significantly exceeded both its 5-year average and the rest of the industry, the market may not be fully rewarding its recent performance with a higher multiple. If sentiment changes, the P/E could move closer to the industry mean, indicating potential upside.

Result: Price-to-Earnings of 21.3x (UNDERVALUED)

See what the numbers say about this price — find out in our valuation breakdown.

However, risks remain, including slower annual revenue growth and recent declines in net income. These factors could temper investor optimism if performance weakens further.

Find out about the key risks to this Temenos narrative.

Another View: Discounted Cash Flow Tells a Different Story

While the earnings multiple suggests Temenos shares may be undervalued, our DCF model offers a more cautious perspective. According to this approach, Temenos is trading slightly above its estimated fair value, which suggests that recent optimism might already be priced in. Is the rally overdone, or could forecasts shift again?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Temenos for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 854 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Temenos Narrative

If you have a different take on Temenos or want to dive into the numbers yourself, it takes just a few minutes to build your own analysis and see where the data leads. Do it your way

A great starting point for your Temenos research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their radar up for compelling opportunities. Don’t let your next winning idea slip past. Use the same tools the pros trust.

- Uncover strong financials and growth trends by checking out these 3579 penny stocks with strong financials poised to shake up traditional markets.

- Tap into tomorrow’s technology and catch the momentum with these 26 AI penny stocks transforming industries through artificial intelligence advancements.

- Boost your income by reviewing these 21 dividend stocks with yields > 3% offering solid yields and proven reliability for savvy portfolios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Temenos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:TEMN

Temenos

Develops, markets, and sells integrated banking software systems to banking and other financial services institutions.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives