- Switzerland

- /

- Semiconductors

- /

- SWX:MBTN

Analyst Forecasts Just Got A Lot More Bearish On Meyer Burger Technology AG (VTX:MBTN)

The analysts covering Meyer Burger Technology AG (VTX:MBTN) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analysts seeing grey clouds on the horizon. Shares are up 7.6% to CHF0.61 in the past week. It will be interesting to see if this downgrade motivates investors to start selling their holdings.

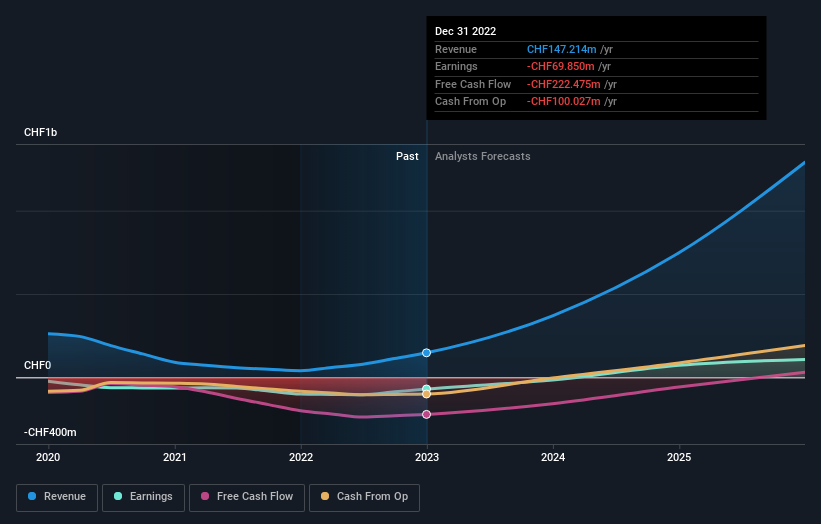

Following the downgrade, the current consensus from Meyer Burger Technology's nine analysts is for revenues of CHF369m in 2023 which - if met - would reflect a substantial 151% increase on its sales over the past 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 81% to CHF0.0036. Before this latest update, the analysts had been forecasting revenues of CHF409m and earnings per share (EPS) of CHF0.0004 in 2023. the analysts have made an abrupt about-face on Meyer Burger Technology, administering a slight decrease in to revenue forecasts and slashing earnings forecasts from profit to loss.

See our latest analysis for Meyer Burger Technology

There was no major change to the consensus price target of CHF0.68, signalling that the business is performing roughly in line with expectations, despite lower earnings per share forecasts. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values Meyer Burger Technology at CHF0.90 per share, while the most bearish prices it at CHF0.31. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. One thing stands out from these estimates, which is that Meyer Burger Technology is forecast to grow faster in the future than it has in the past, with revenues expected to display 151% annualised growth until the end of 2023. If achieved, this would be a much better result than the 42% annual decline over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 12% annually. Not only are Meyer Burger Technology's revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The biggest low-light for us was that the forecasts for Meyer Burger Technology dropped from profits to a loss this year. While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. We're also surprised to see that the price target went unchanged. Still, deteriorating business conditions (assuming accurate forecasts!) can be a leading indicator for the stock price, so we wouldn't blame investors for being more cautious on Meyer Burger Technology after the downgrade.

After a downgrade like this, it's pretty clear that previous forecasts were too optimistic. What's more, we've spotted several possible issues with Meyer Burger Technology's business, like dilutive stock issuance over the past year. Learn more, and discover the 1 other concern we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:MBTN

Meyer Burger Technology

A technology company, produces and sells solar cells and modules.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success