- Switzerland

- /

- Semiconductors

- /

- SWX:AMS

Analysts Have Made A Financial Statement On ams-OSRAM AG's (VTX:AMS) Second-Quarter Report

ams-OSRAM AG (VTX:AMS) shareholders are probably feeling a little disappointed, since its shares fell 6.5% to CHF7.80 in the week after its latest second-quarter results. It was an okay report, and revenues came in at €1.2b, approximately in line with analyst estimates leading up to the results announcement. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

See our latest analysis for ams-OSRAM

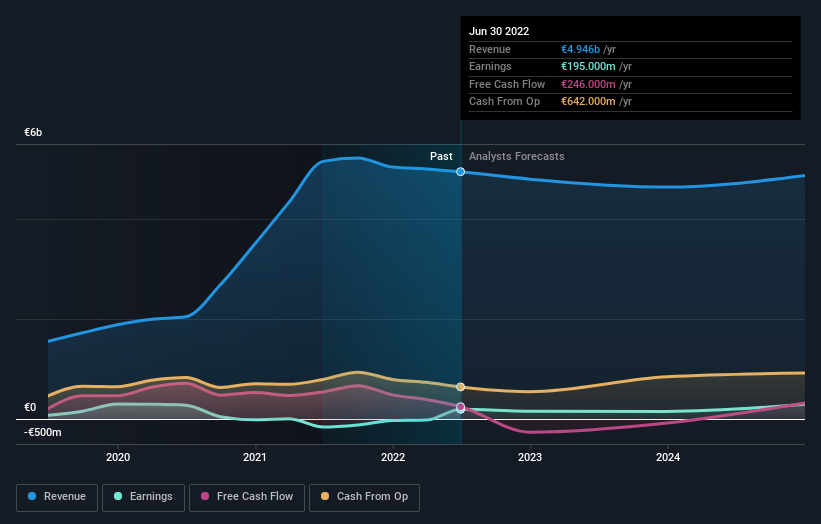

Taking into account the latest results, the current consensus, from the ten analysts covering ams-OSRAM, is for revenues of €4.80b in 2022, which would reflect a small 3.0% reduction in ams-OSRAM's sales over the past 12 months. Statutory earnings per share are forecast to crater 20% to €0.59 in the same period. Yet prior to the latest earnings, the analysts had been anticipated revenues of €4.82b and earnings per share (EPS) of €0.44 in 2022. There was no real change to the revenue estimates, but the analysts do seem more bullish on earnings, given the sizeable expansion in earnings per share expectations following these results.

The consensus price target was unchanged at CHF13.21, implying that the improved earnings outlook is not expected to have a long term impact on value creation for shareholders. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on ams-OSRAM, with the most bullish analyst valuing it at CHF23.17 and the most bearish at CHF8.00 per share. We would probably assign less value to the analyst forecasts in this situation, because such a wide range of estimates could imply that the future of this business is difficult to value accurately. As a result it might not be a great idea to make decisions based on the consensus price target, which is after all just an average of this wide range of estimates.

Of course, another way to look at these forecasts is to place them into context against the industry itself. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 5.9% by the end of 2022. This indicates a significant reduction from annual growth of 39% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 13% per year. It's pretty clear that ams-OSRAM's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards ams-OSRAM following these results. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting sales are tracking in line with expectations - although our data does suggest that ams-OSRAM's revenues are expected to perform worse than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have forecasts for ams-OSRAM going out to 2024, and you can see them free on our platform here.

Don't forget that there may still be risks. For instance, we've identified 3 warning signs for ams-OSRAM (1 doesn't sit too well with us) you should be aware of.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:AMS

ams-OSRAM

Engages in the design, manufacture, and sale of LED and optical sensor solutions in Europe, the Middle East, Africa, the Americas, and the Asia/Pacific.

Undervalued with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion