- Switzerland

- /

- Hospitality

- /

- SWX:LMN

The lastminute.com (VTX:LMN) Share Price Is Up 103% And Shareholders Are Boasting About It

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But if you buy shares in a really great company, you can more than double your money. For example, the lastminute.com N.V. (VTX:LMN) share price has soared 103% in the last three years. How nice for those who held the stock!

Check out our latest analysis for lastminute.com

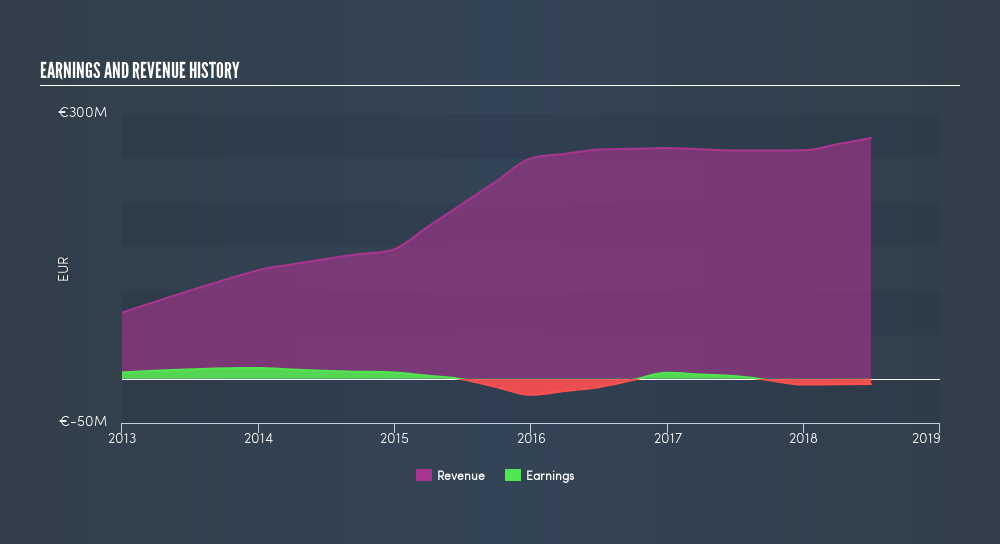

lastminute.com isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 3 years lastminute.com saw its revenue grow at 6.1% per year. That's not a very high growth rate considering it doesn't make profits. In contrast, the stock has popped 27% per year in that time - an impressive result. We'd need to take a closer look at the revenue and profit trends to see whether the improvements might justify that sort of increase. It seems likely that the market is pretty optimistic about lastminute.com, given it is losing money.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

Take a more thorough look at lastminute.com's financial health with this freereport on its balance sheet.

A Different Perspective

It's nice to see that lastminute.com shareholders have gained 28% (in total) over the last year. So this year's TSR was actually better than the three-year TSR (annualized) of 27%. The improving returns to shareholders suggests the stock is becoming more popular with time. You could get a better understanding of lastminute.com's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this freelist of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CH exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SWX:LMN

lastminute.com

Operates in the online travel industry providing dynamic holiday packages in Italy, Spain, the United Kingdom, France, Germany, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives