- Switzerland

- /

- Specialty Stores

- /

- SWX:AVOL

Don't Race Out To Buy Avolta AG (VTX:AVOL) Just Because It's Going Ex-Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Avolta AG (VTX:AVOL) is about to trade ex-dividend in the next four days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Meaning, you will need to purchase Avolta's shares before the 17th of May to receive the dividend, which will be paid on the 22nd of May.

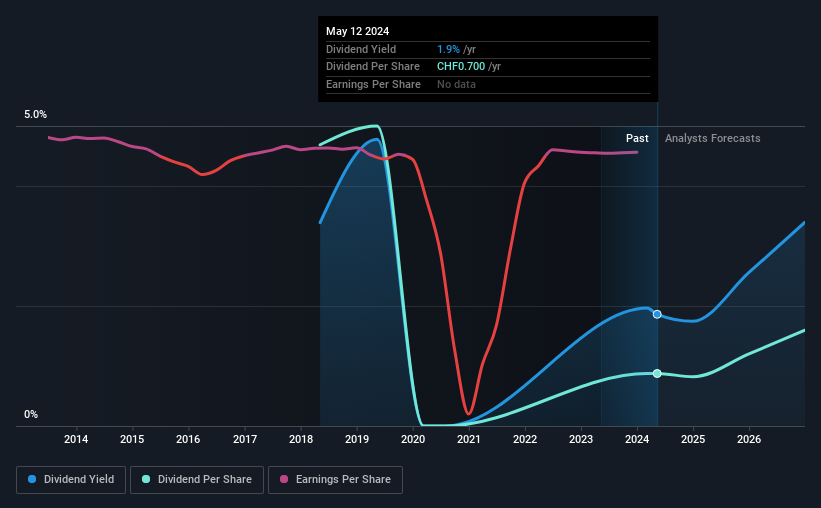

The company's upcoming dividend is CHF00.70 a share, following on from the last 12 months, when the company distributed a total of CHF0.70 per share to shareholders. Looking at the last 12 months of distributions, Avolta has a trailing yield of approximately 1.9% on its current stock price of CHF037.60. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. As a result, readers should always check whether Avolta has been able to grow its dividends, or if the dividend might be cut.

See our latest analysis for Avolta

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Last year, Avolta paid out 109% of its income as dividends, which is above a level that we're comfortable with, especially if the company needs to reinvest in its business.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Avolta's earnings per share have fallen at approximately 16% a year over the previous five years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Avolta's dividend payments per share have declined at 24% per year on average over the past six years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

The Bottom Line

From a dividend perspective, should investors buy or avoid Avolta? Not only are earnings per share shrinking, but Avolta is paying out a disconcertingly high percentage of its profit as dividends. It's not that we hate the business, but we feel that these characeristics are not desirable for investors seeking a reliable dividend stock to own for the long term. This is not an overtly appealing combination of characteristics, and we're just not that interested in this company's dividend.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with Avolta. Be aware that Avolta is showing 2 warning signs in our investment analysis, and 1 of those is potentially serious...

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

If you're looking to trade Avolta, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:AVOL

Reasonable growth potential with proven track record.

Market Insights

Community Narratives