- Switzerland

- /

- Real Estate

- /

- SWX:WARN

Warteck Invest AG's (VTX:WARN) Stock Has Shown A Decent Performance: Have Financials A Role To Play?

Most readers would already know that Warteck Invest's (VTX:WARN) stock increased by 3.1% over the past three months. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Particularly, we will be paying attention to Warteck Invest's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Warteck Invest

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Warteck Invest is:

7.4% = CHF29m ÷ CHF396m (Based on the trailing twelve months to June 2020).

The 'return' refers to a company's earnings over the last year. That means that for every CHF1 worth of shareholders' equity, the company generated CHF0.07 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Warteck Invest's Earnings Growth And 7.4% ROE

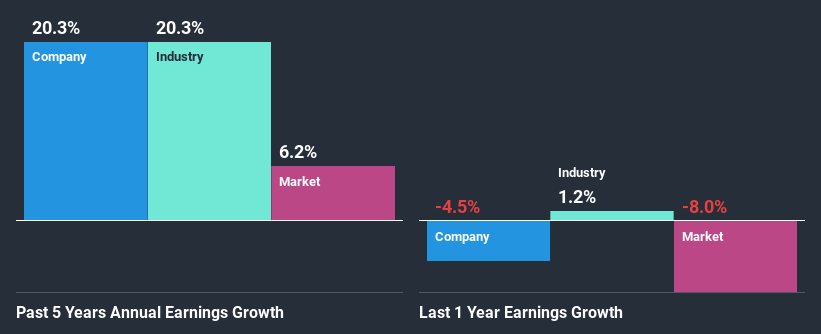

When you first look at it, Warteck Invest's ROE doesn't look that attractive. However, its ROE is similar to the industry average of 7.2%, so we won't completely dismiss the company. Looking at Warteck Invest's exceptional 20% five-year net income growth in particular, we are definitely impressed. Considering the moderately low ROE, it is quite possible that there might be some other aspects that are positively influencing the company's earnings growth. For instance, the company has a low payout ratio or is being managed efficiently.

As a next step, we compared Warteck Invest's net income growth with the industry and found that the company has a similar growth figure when compared with the industry average growth rate of 20% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Warteck Invest's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Warteck Invest Making Efficient Use Of Its Profits?

The high three-year median payout ratio of 74% (implying that it keeps only 26% of profits) for Warteck Invest suggests that the company's growth wasn't really hampered despite it returning most of the earnings to its shareholders.

Moreover, Warteck Invest is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years. Our latest analyst data shows that the future payout ratio of the company is expected to rise to 104% over the next three years. Accordingly, the expected increase in the payout ratio explains the expected decline in the company's ROE to 4.1%, over the same period.

Conclusion

In total, it does look like Warteck Invest has some positive aspects to its business. While no doubt its earnings growth is pretty substantial, we do feel that the reinvestment rate is pretty low, meaning, the earnings growth number could have been significantly higher had the company been retaining more of its profits. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. So it may be worth checking this free detailed graph of Warteck Invest's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

If you’re looking to trade Warteck Invest, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Warteck Invest might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:WARN

Warteck Invest

Engages in the rental of real estate properties in Switzerland.

Average dividend payer with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026