Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Swiss Prime Site AG (VTX:SPSN) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

How Much Debt Does Swiss Prime Site Carry?

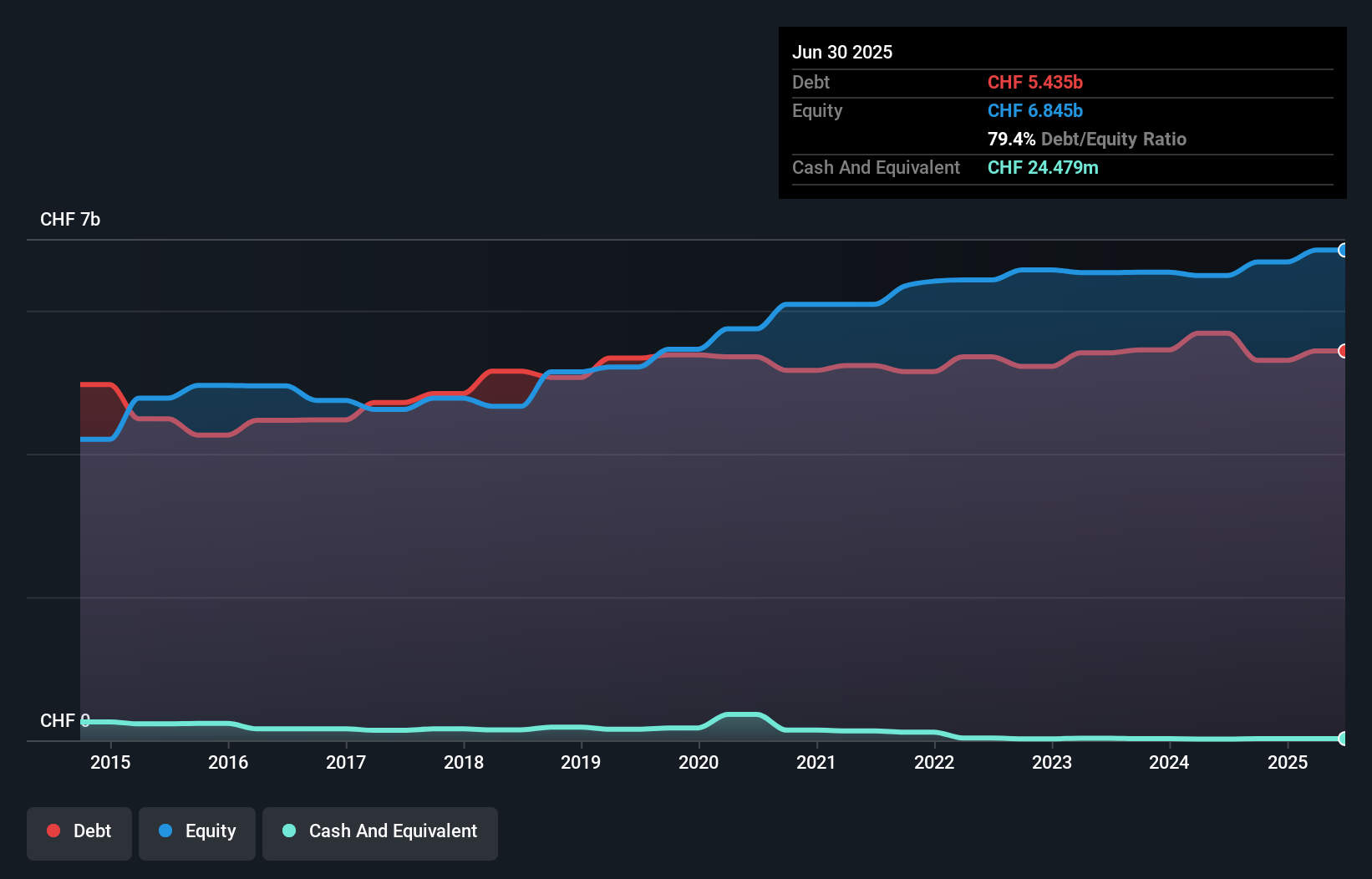

The image below, which you can click on for greater detail, shows that Swiss Prime Site had debt of CHF5.44b at the end of June 2025, a reduction from CHF5.68b over a year. And it doesn't have much cash, so its net debt is about the same.

How Strong Is Swiss Prime Site's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Swiss Prime Site had liabilities of CHF1.37b due within 12 months and liabilities of CHF5.86b due beyond that. Offsetting these obligations, it had cash of CHF24.5m as well as receivables valued at CHF65.3m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CHF7.15b.

This is a mountain of leverage even relative to its gargantuan market capitalization of CHF9.01b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

Check out our latest analysis for Swiss Prime Site

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With a net debt to EBITDA ratio of 12.9, it's fair to say Swiss Prime Site does have a significant amount of debt. However, its interest coverage of 3.1 is reasonably strong, which is a good sign. Notably, Swiss Prime Site's EBIT was pretty flat over the last year, which isn't ideal given the debt load. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Swiss Prime Site's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Swiss Prime Site generated free cash flow amounting to a very robust 93% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

Swiss Prime Site's net debt to EBITDA and interest cover definitely weigh on it, in our esteem. But the good news is it seems to be able to convert EBIT to free cash flow with ease. Looking at all the angles mentioned above, it does seem to us that Swiss Prime Site is a somewhat risky investment as a result of its debt. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Swiss Prime Site (of which 1 doesn't sit too well with us!) you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:SPSN

Swiss Prime Site

Through its subsidiaries, operates as a real estate company in Switzerland.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.