Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that PSP Swiss Property AG (VTX:PSPN) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for PSP Swiss Property

How Much Debt Does PSP Swiss Property Carry?

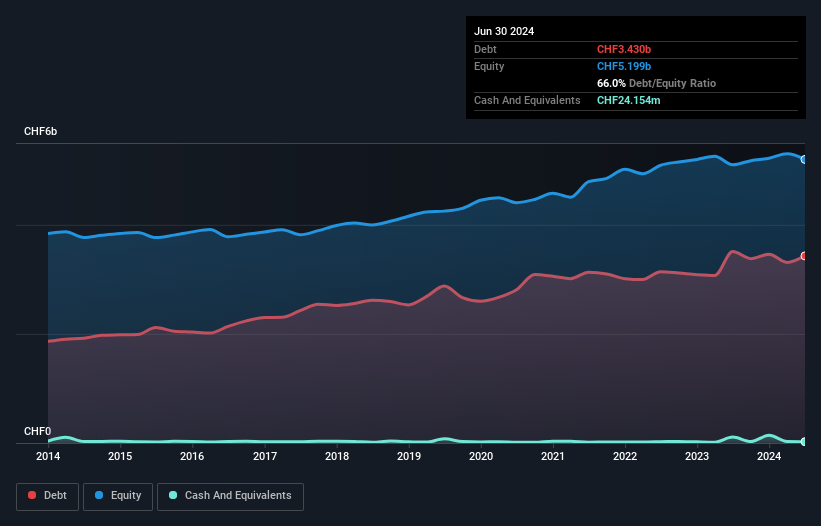

As you can see below, PSP Swiss Property had CHF3.43b of debt, at June 2024, which is about the same as the year before. You can click the chart for greater detail. Net debt is about the same, since the it doesn't have much cash.

How Strong Is PSP Swiss Property's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that PSP Swiss Property had liabilities of CHF432.2m due within 12 months and liabilities of CHF4.11b due beyond that. Offsetting this, it had CHF24.2m in cash and CHF33.5m in receivables that were due within 12 months. So it has liabilities totalling CHF4.48b more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of CHF5.54b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While PSP Swiss Property's debt to EBITDA ratio of 11.4 suggests a heavy debt load, its interest coverage of 9.4 implies it services that debt with ease. Overall we'd say it seems likely the company is carrying a fairly heavy swag of debt. PSP Swiss Property grew its EBIT by 3.3% in the last year. Whilst that hardly knocks our socks off it is a positive when it comes to debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine PSP Swiss Property's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, PSP Swiss Property generated free cash flow amounting to a very robust 96% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

Based on what we've seen PSP Swiss Property is not finding it easy, given its net debt to EBITDA, but the other factors we considered give us cause to be optimistic. There's no doubt that its ability to to convert EBIT to free cash flow is pretty flash. Looking at all this data makes us feel a little cautious about PSP Swiss Property's debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for PSP Swiss Property you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:PSPN

PSP Swiss Property

Owns and manages real estate properties in Switzerland.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives