- Switzerland

- /

- Real Estate

- /

- SWX:EPIC

EPIC Suisse (SWX:EPIC): Reassessing Valuation After Its CHF 70 Million Follow-On Equity Offering

Reviewed by Simply Wall St

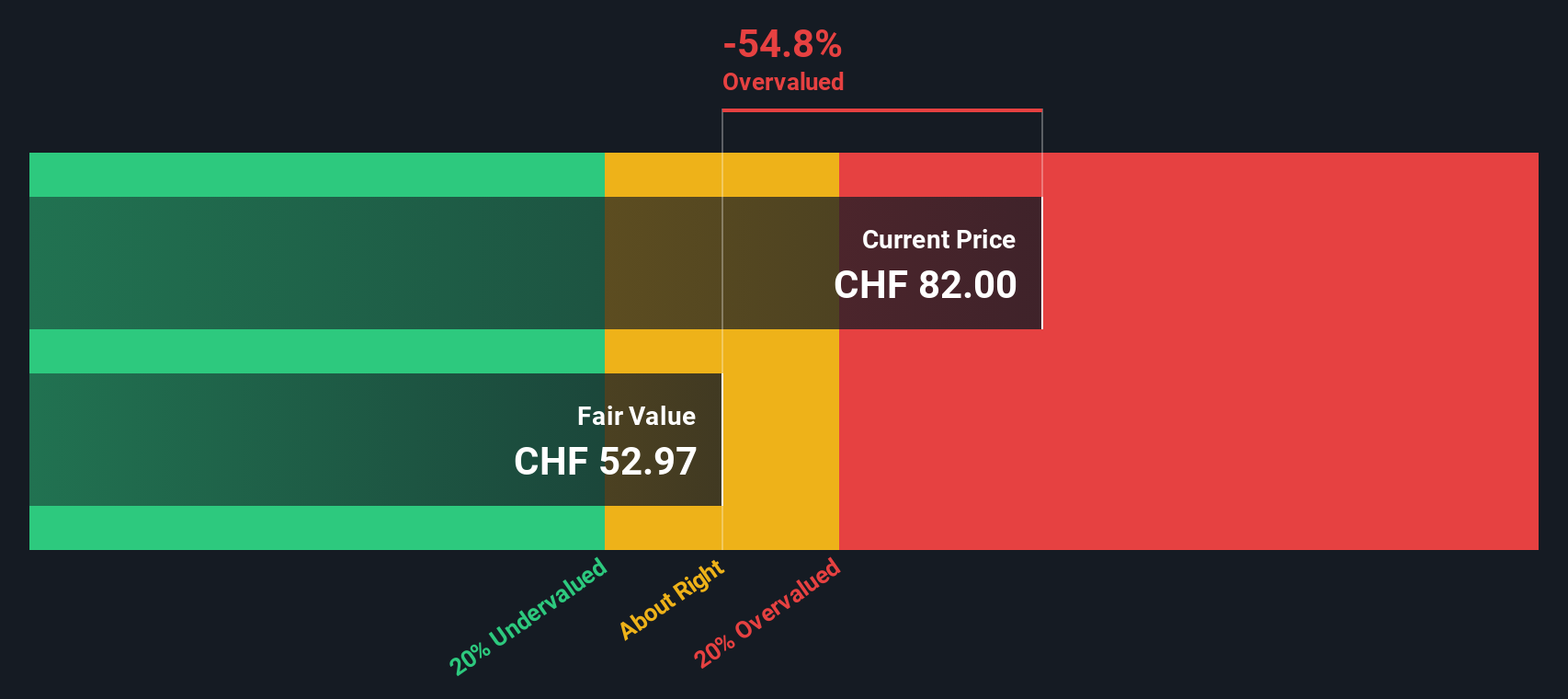

EPIC Suisse (SWX:EPIC) has just wrapped up a CHF 70 million follow on equity offering at about CHF 80 a share. This deal could subtly reset how investors think about its valuation.

See our latest analysis for EPIC Suisse.

Despite the modest discount to the CHF 80 offer price, the current CHF 81.8 share price and flat year to date share price return sit alongside a much stronger 1 year total shareholder return of 9.7 percent and robust 3 year total shareholder return of 53.9 percent. This suggests that near term momentum has cooled even as long term holders have done well.

If this capital raise has you rethinking your portfolio’s real estate exposure, it could be a good moment to explore fast growing stocks with high insider ownership as potential next ideas.

With EPIC Suisse now trading just above its offer price after years of strong total returns, the key question is whether investors are overlooking latent value or whether the latest capital raise means future growth is already priced in.

Price-To-Earnings of 15.5x: Is it justified?

EPIC Suisse trades on a 15.5x price to earnings ratio, slightly above both Swiss and European real estate peers even after the latest equity raise.

The price to earnings multiple compares today’s share price with the company’s per share earnings, which is a common way to benchmark income generating real estate stocks.

At 15.5x earnings, investors are paying more than the 13.7x peer average and the 14.5x wider European real estate average, which implies the market is willing to ascribe a premium to EPIC Suisse despite its longer term earnings decline of 7.3 percent per year over five years and only recently improved profit margins that were boosted by one off gains.

Compared with the broader Swiss market on 19.3x, EPIC Suisse still screens cheaper in absolute terms. However, relative to its direct real estate peers, the higher multiple signals that expectations for earnings stability or asset quality are more optimistic than for the sector as a whole.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 15.5x (OVERVALUED)

However, downside risks remain, including weaker Swiss commercial property demand or higher rates compressing valuations and limiting rental growth for EPIC Suisse’s portfolio.

Find out about the key risks to this EPIC Suisse narrative.

Another View: DCF Says the Shares Look Pricey Too

Our DCF model points in the same direction as the earnings multiple, suggesting EPIC Suisse is trading above fair value, with the share price around CHF 81.8 versus an estimated fair value of about CHF 70.64. If both lenses flag limited upside, what is the market really paying up for?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out EPIC Suisse for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own EPIC Suisse Narrative

If you want to dig into the numbers yourself and stress test these assumptions, you can build a complete narrative in just a few minutes. Do it your way.

A great starting point for your EPIC Suisse research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at a single stock when smart opportunities are waiting. Use the Simply Wall St Screener now and upgrade your watchlist instantly.

- Capitalize on mispriced businesses by tracking these 901 undervalued stocks based on cash flows that pair strong cash flows with attractive entry points before the crowd catches on.

- Position yourself for the next wave of innovation by targeting these 27 AI penny stocks that could reshape entire industries with scalable, real world AI solutions.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that can support consistent payouts while still leaving room for capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EPIC Suisse might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:EPIC

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026