- Switzerland

- /

- Real Estate

- /

- BRSE:SEGN

Top 3 Dividend Stocks On SIX Swiss Exchange In October 2024

Reviewed by Simply Wall St

The Switzerland market recently experienced a slight uptick, with the benchmark SMI closing marginally higher amid a lack of significant catalysts, reflecting cautious investor sentiment. In such a steady yet uncertain environment, dividend stocks on the SIX Swiss Exchange can offer investors potential stability and income through regular payouts, making them an attractive consideration for those seeking consistent returns.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.12% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.70% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.47% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.85% | ★★★★★★ |

| EFG International (SWX:EFGN) | 4.59% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 4.79% | ★★★★★☆ |

| Luzerner Kantonalbank (SWX:LUKN) | 3.81% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 3.37% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.69% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.55% | ★★★★★☆ |

Let's take a closer look at a couple of our picks from the screened companies.

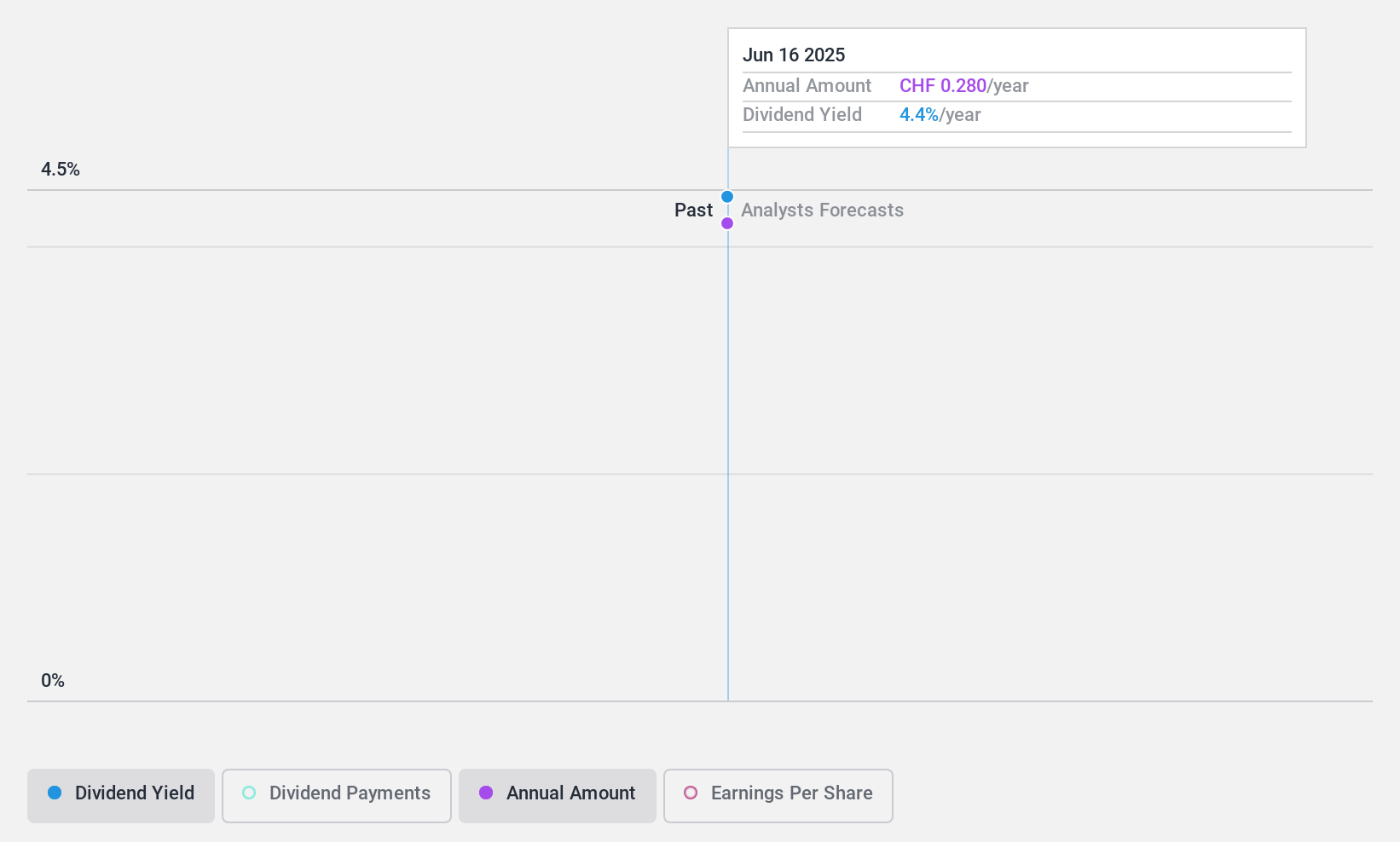

Procimmo Group (BRSE:SEGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Procimmo Group AG is a holding company that focuses on the investment, management, and sale of real estate properties in Switzerland, with a market cap of CHF178.83 million.

Operations: Procimmo Group AG generates revenue from its Real Estate & Property Managers segment, amounting to CHF30.64 million.

Dividend Yield: 5%

Procimmo Group AG has demonstrated a stable dividend payout, supported by its earnings and cash flows with a payout ratio of 63.3% and cash payout ratio of 51.8%. Despite only paying dividends for five years, the payments have been reliable with minimal volatility. The company's recent earnings report shows growth in both sales (CHF 16.2 million) and net income (CHF 8.17 million), indicating potential for continued dividend sustainability despite high debt levels and illiquid shares.

- Dive into the specifics of Procimmo Group here with our thorough dividend report.

- According our valuation report, there's an indication that Procimmo Group's share price might be on the cheaper side.

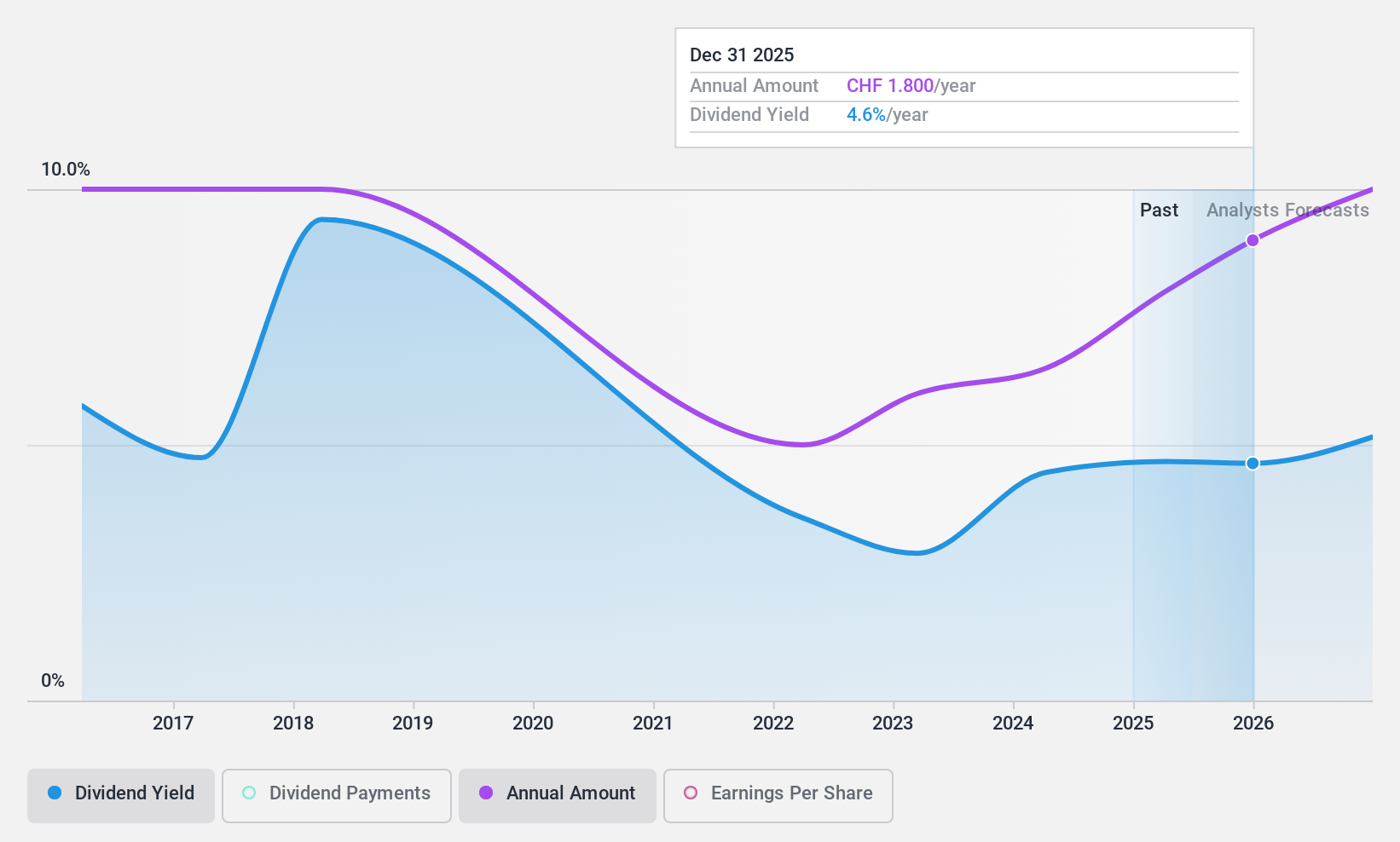

Meier Tobler Group (SWX:MTG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Meier Tobler Group AG operates as a trading and services company specializing in heat generation and air conditioning systems, with a market cap of CHF316.07 million.

Operations: The Meier Tobler Group AG generates revenue through its Service segment, which contributes CHF104.01 million, and its Distribution segment, accounting for CHF404.27 million.

Dividend Yield: 4.6%

Meier Tobler Group's dividend yield of 4.64% ranks in the top 25% among Swiss dividend payers, yet its dividends have been unreliable and volatile over the past decade. Although trading at a significant discount to its estimated fair value, the company's high cash payout ratio of 179.3% suggests dividends are not well covered by free cash flow, raising concerns about sustainability despite earnings coverage at a payout ratio of 76.3%.

- Click to explore a detailed breakdown of our findings in Meier Tobler Group's dividend report.

- Our valuation report here indicates Meier Tobler Group may be undervalued.

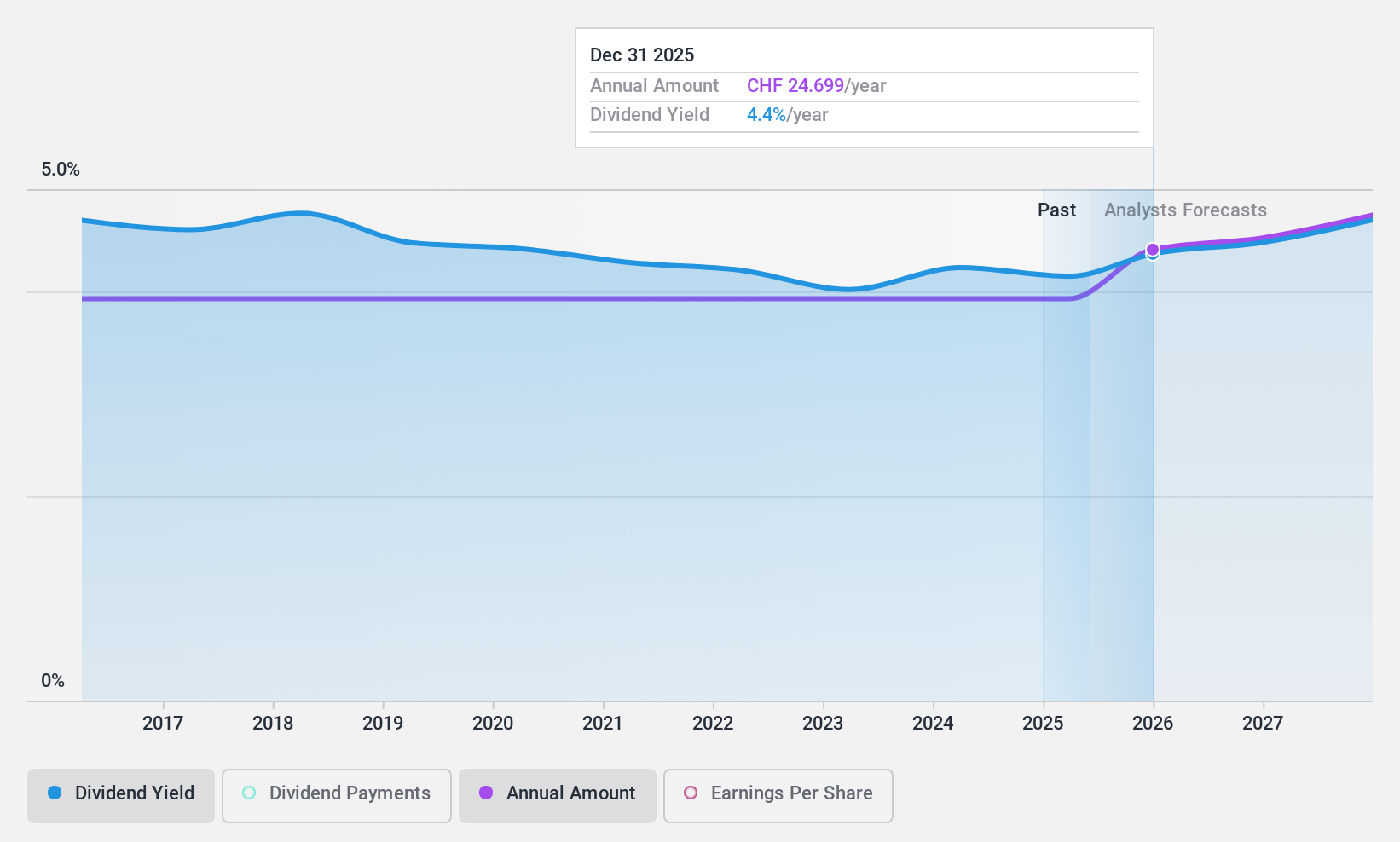

Swisscom (SWX:SCMN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swisscom AG is a telecommunications provider operating mainly in Switzerland, Italy, and internationally, with a market cap of CHF28.96 billion.

Operations: Swisscom AG generates revenue from several segments, including Fastweb with CHF2.61 billion, Swisscom Switzerland - Business Customers at CHF3.13 billion, Swisscom Switzerland - Residential Customers contributing CHF4.42 billion, and Swisscom Switzerland - Wholesale accounting for CHF535 million.

Dividend Yield: 3.9%

Swisscom's dividend yield of 3.94% is below the top 25% of Swiss dividend payers. Despite stable dividends per share over the past decade, they have not grown and are considered unreliable due to volatility. The payout ratios—67.1% for earnings and 69.5% for cash flows—indicate dividends are well-covered, suggesting sustainability despite a high debt level. Recent earnings show slight declines, with net income at CHF 381 million in Q2 compared to CHF 406 million last year.

- Click here to discover the nuances of Swisscom with our detailed analytical dividend report.

- The analysis detailed in our Swisscom valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Dive into all 27 of the Top SIX Swiss Exchange Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BRSE:SEGN

Procimmo Group

A holding company, engages in the investment, management, and sale of real estate properties in Switzerland.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives