- China

- /

- Healthcare Services

- /

- SHSE:603368

Undiscovered Gems And 2 Other Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets experience a divergence in performance, with major indices like the S&P 500 and Nasdaq reaching record highs while the Russell 2000 sees a decline, investors are increasingly focused on small-cap stocks that may offer untapped opportunities. In this environment of mixed economic signals and sector-specific gains, identifying promising small-cap stocks requires a keen eye for companies with strong fundamentals and growth potential that can thrive amid broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| African Rainbow Capital Investments | NA | 37.52% | 38.29% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Guangxi LiuYao Group (SHSE:603368)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangxi LiuYao Group Co., Ltd operates in the wholesale and retail of pharmaceutical products in China, with a market capitalization of approximately CN¥7.65 billion.

Operations: The company generates revenue primarily through the wholesale and retail of pharmaceutical products in China. Its financial performance is highlighted by a focus on efficient cost management, contributing to its profitability.

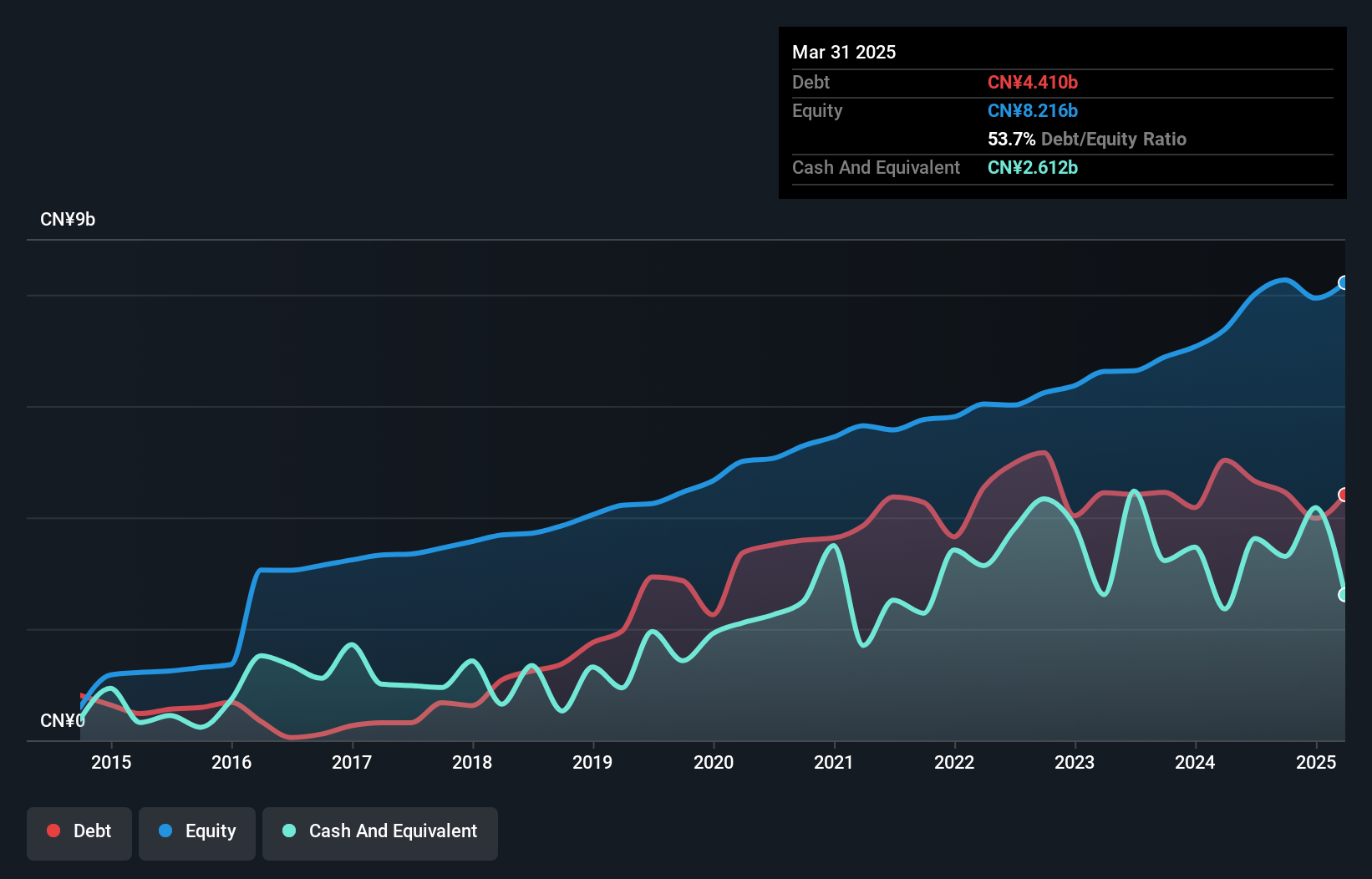

Guangxi LiuYao Group, a smaller player in the healthcare sector, has shown robust financial health with its interest payments well covered by EBIT at 7.4 times. The company's net debt to equity ratio stands at a satisfactory 13.9%, reflecting prudent financial management over the past five years as it reduced from 64.3% to 53.8%. Despite shareholder dilution recently, earnings grew by an impressive 11.3%, outpacing the industry average of -5.7%. With a price-to-earnings ratio of just 8.6x compared to the market's 37.6x, it presents good value alongside high-quality earnings and positive free cash flow generation.

SKAN Group (SWX:SKAN)

Simply Wall St Value Rating: ★★★★★☆

Overview: SKAN Group AG, along with its subsidiaries, specializes in providing isolators, cleanroom devices, and decontamination processes for the pharmaceutical and chemical industries across Asia, Europe, the Americas, and internationally; it has a market capitalization of CHF1.64 billion.

Operations: SKAN Group derives its revenue primarily from Equipment & Solutions, contributing CHF254.17 million, and Services & Consumables, adding CHF89.84 million.

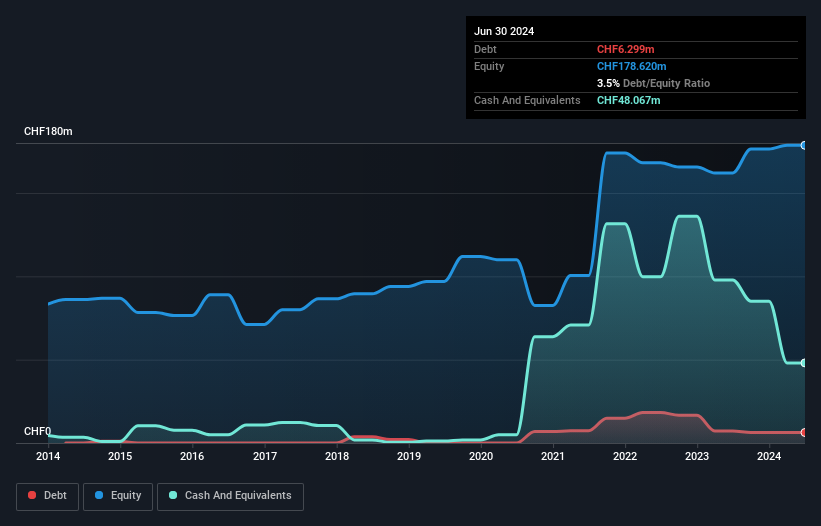

SKAN Group, a player in the Life Sciences sector, has shown robust earnings growth of 17.9% over the past year, outpacing the industry average of 4.3%. With its debt to equity ratio rising modestly to 3.5% over five years, SKAN still holds more cash than total debt, which implies financial stability. Despite trading at a discount of 22.5% below estimated fair value, free cash flow remains negative due to significant capital expenditures and acquisitions totaling US$8 million recently. Earnings are projected to grow by about 18.74% annually, suggesting potential for future expansion amidst current challenges in free cash flow management.

- Click here and access our complete health analysis report to understand the dynamics of SKAN Group.

Explore historical data to track SKAN Group's performance over time in our Past section.

Ability Enterprise (TWSE:2374)

Simply Wall St Value Rating: ★★★★★★

Overview: Ability Enterprise Co., Ltd. is engaged in the development, manufacturing, and sales of digital cameras, optical product components, and film/video accessories across Japan, China, Taiwan, and international markets with a market capitalization of NT$14.90 billion.

Operations: With a market capitalization of NT$14.90 billion, Ability Enterprise generates revenue primarily from its Optoelectronics Products Business Department, contributing NT$8.50 billion, and the Policy Investment business division at NT$1.24 billion.

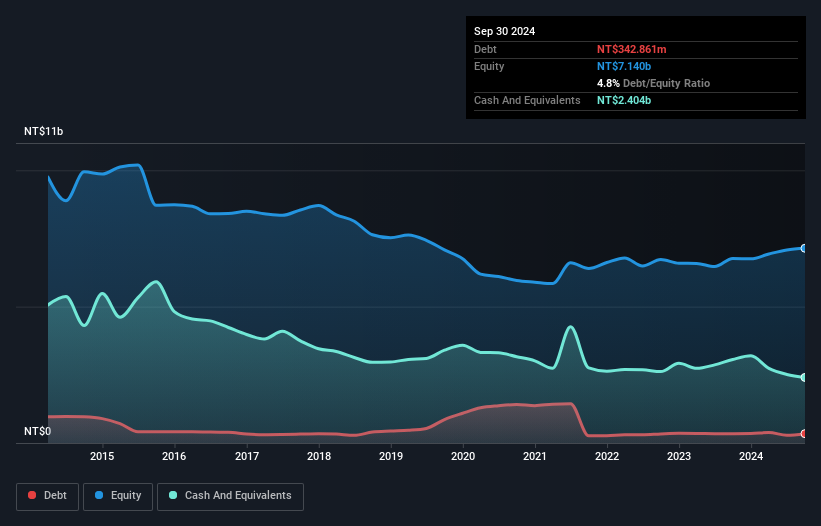

Ability Enterprise has been demonstrating robust financial health, with a significant reduction in its debt to equity ratio from 12.1% to 4.8% over the past five years. This small cap player in the Consumer Durables sector outpaced industry earnings growth with an impressive 153% increase last year. While net income for Q3 was TWD 137.79 million, down from TWD 239.02 million a year ago, nine-month figures showed improvement at TWD 434.75 million compared to TWD 232.64 million previously, indicating potential resilience and adaptability despite quarterly fluctuations in earnings per share and sales performance metrics like basic EPS which fell to TWD 0.48 from TWD 0.84 year-on-year for Q3 but improved over nine months period reaching TWD 1.52 up from TWD .82 last year same period..

Next Steps

- Unlock our comprehensive list of 4628 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603368

Guangxi LiuYao Group

Engages in the wholesale and retail of pharmaceutical products in China.

6 star dividend payer with solid track record.