- Switzerland

- /

- Life Sciences

- /

- SWX:SKAN

Exploring Undiscovered Swiss Stocks July 2024

Reviewed by Simply Wall St

Despite a generally positive performance throughout the day, the Swiss market closed slightly lower on Monday, reflecting a cautious sentiment ahead of major global economic events. The SMI index's dip, influenced by last-minute selling and broader economic uncertainties, sets a backdrop for investors looking at potential opportunities in less explored areas of the market. In such times, identifying stocks with solid fundamentals and potential for growth becomes even more crucial for those interested in diversifying their portfolios with Swiss small-cap companies.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| StarragTornos Group | 12.77% | -2.98% | 29.42% | ★★★★★★ |

| APG|SGA | NA | 1.12% | -16.11% | ★★★★★★ |

| TX Group | 0.96% | -2.25% | 15.99% | ★★★★★★ |

| IVF Hartmann Holding | NA | 1.26% | -4.29% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Compagnie Financière Tradition | 49.32% | 1.35% | 11.45% | ★★★★★☆ |

| SKAN Group | 3.57% | 40.44% | 22.38% | ★★★★★☆ |

| Elma Electronic | 42.57% | 2.00% | -1.74% | ★★★★★☆ |

| naturenergie holding | 9.95% | 16.32% | 40.54% | ★★★★★☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

SKAN Group (SWX:SKAN)

Simply Wall St Value Rating: ★★★★★☆

Overview: SKAN Group AG operates globally, offering isolators, cleanroom devices, and decontamination processes primarily for the pharmaceutical and chemical industries, with a market capitalization of CHF 1.76 billion.

Operations: SKAN Group generates its revenue primarily through two segments: Equipment & Solutions, which contributed CHF 237.11 million, and Services & Consumables, accounting for CHF 82.91 million. The company consistently achieves a high gross profit margin, reflecting efficient cost management relative to its revenue generation.

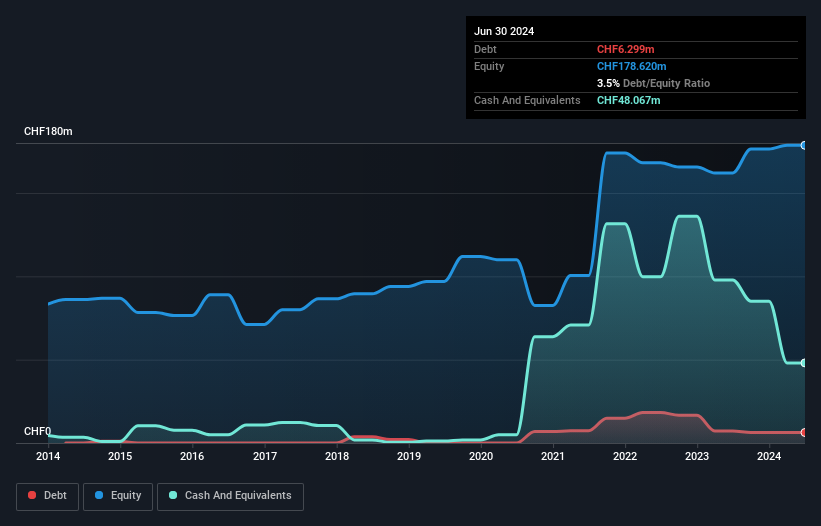

SKAN Group, a notable player in the Life Sciences sector, has demonstrated robust financial health with a 38.6% earnings growth over the past year—surpassing its industry's average of 6.5%. This performance is supported by high-quality earnings predominantly from non-cash sources and an impressive EBIT coverage of interest payments at 104.3 times. Despite an increase in debt-to-equity ratio from 2.2% to 3.6% over five years, SKAN maintains more cash than total debt, positioning it as a potentially valuable pick for discerning investors looking beyond mainstream options in Switzerland's market landscape.

- Navigate through the intricacies of SKAN Group with our comprehensive health report here.

Understand SKAN Group's track record by examining our Past report.

TX Group (SWX:TXGN)

Simply Wall St Value Rating: ★★★★★★

Overview: TX Group AG is a Swiss media company that manages a diverse portfolio of platforms and participations, offering information, orientation, entertainment, and support services; it has a market capitalization of CHF 1.72 billion.

Operations: The company generates revenue through diverse segments including media (Tamedia), advertising (Goldbach), publishing (20 Minutes), digital marketplaces (TX Markets), and new ventures (Groups & Ventures). It has demonstrated a gross profit margin of 41.83% as of the latest reporting period, reflecting its ability to manage production costs effectively relative to sales.

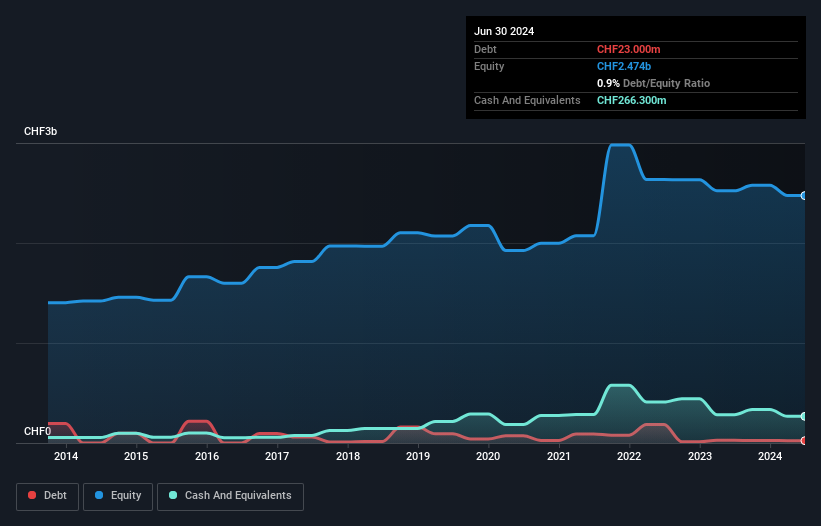

TX Group, a Swiss media firm, has recently turned profitable, an achievement that underscores its potential as an undiscovered gem. The company's debt to equity ratio impressively dropped from 7.6% to 1% in five years, reflecting robust financial management. Moreover, TX Group is trading at a striking 73.7% below its estimated fair value and forecasts suggest earnings could grow by about 23% annually. These factors combined with its positive free cash flow position make it a compelling consideration for investors looking beyond the mainstream.

- Click here to discover the nuances of TX Group with our detailed analytical health report.

Evaluate TX Group's historical performance by accessing our past performance report.

V-ZUG Holding (SWX:VZUG)

Simply Wall St Value Rating: ★★★★★★

Overview: V-ZUG Holding AG is a Swiss company that specializes in the development, manufacture, marketing, sale, and servicing of kitchen and laundry appliances for private households both domestically and globally, with a market capitalization of CHF 366.43 million.

Operations: V-ZUG Holding specializes in the production and sale of household appliances, generating revenue primarily through this segment. The company has experienced fluctuations in gross profit margins over recent years, highlighting a variable cost structure and operational challenges.

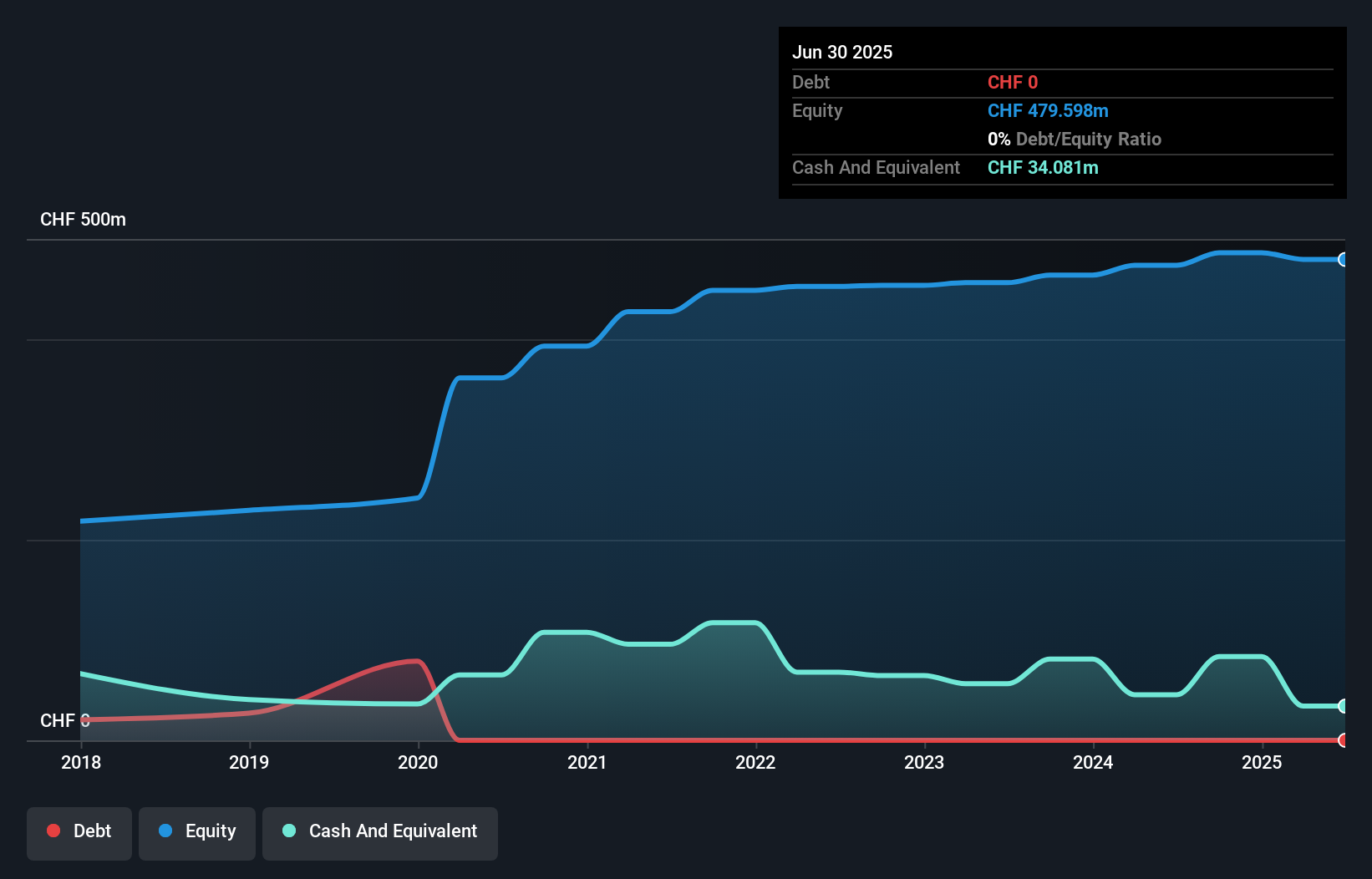

V-ZUG Holding AG, a lesser spotlighted Swiss company, recently showcased robust financial health with an 89.2% earnings growth surpassing its industry's near static pace. This year's first half saw sales of CHF 284 million and net income doubling to CHF 8.73 million from last year. Trading at a striking 78.9% below estimated fair value and maintaining a debt-free status since erasing its last debts five years ago, V-ZUG combines value with dynamic growth prospects, evidenced by a projected annual earnings increase of 38.68%.

- Click to explore a detailed breakdown of our findings in V-ZUG Holding's health report.

Gain insights into V-ZUG Holding's historical performance by reviewing our past performance report.

Summing It All Up

- Gain an insight into the universe of 18 SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SKAN

SKAN Group

Provides isolators, cleanroom devices, and decontamination processes for pharmaceutical and chemical industries in Asia, Europe, the Americas, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives