- Hong Kong

- /

- Consumer Durables

- /

- SEHK:2285

3 Stocks Estimated To Be Up To 30% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and interest rate expectations, U.S. stock indexes are climbing toward record highs, with growth stocks outperforming value shares. In this environment, identifying undervalued stocks can present opportunities for investors seeking to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.66 | US$36.99 | 49.6% |

| Hancom (KOSDAQ:A030520) | ₩24650.00 | ₩49094.79 | 49.8% |

| Nuvoton Technology (TWSE:4919) | NT$96.10 | NT$191.31 | 49.8% |

| Smurfit Westrock (NYSE:SW) | US$55.30 | US$109.74 | 49.6% |

| IDP Education (ASX:IEL) | A$12.12 | A$24.11 | 49.7% |

| Solum (KOSE:A248070) | ₩17610.00 | ₩34899.00 | 49.5% |

| Com2uS (KOSDAQ:A078340) | ₩48200.00 | ₩96034.26 | 49.8% |

| Saipem (BIT:SPM) | €2.341 | €4.67 | 49.8% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.8% |

| Constellium (NYSE:CSTM) | US$9.24 | US$18.27 | 49.4% |

Let's explore several standout options from the results in the screener.

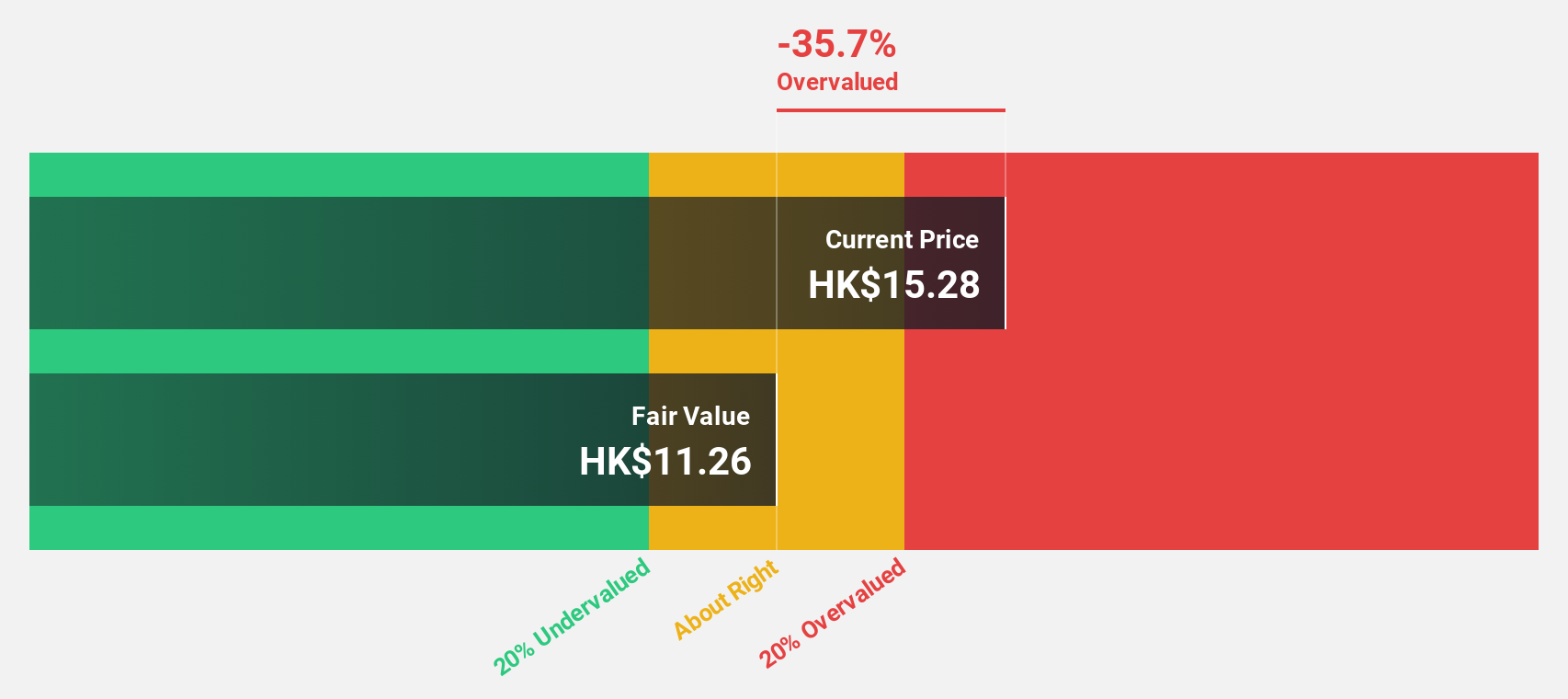

Chervon Holdings (SEHK:2285)

Overview: Chervon Holdings Limited operates in the research, development, manufacture, testing, sale, and servicing of power tools and outdoor equipment globally with a market cap of HK$9.78 billion.

Operations: The company's revenue is primarily derived from its Power Tools segment, which generated $575.75 million, and its Outdoor Power Equipment segment, which contributed $856.65 million.

Estimated Discount To Fair Value: 25.8%

Chervon Holdings is trading at HK$19.14, below its estimated fair value of HK$25.79, suggesting an undervaluation based on cash flows. The company anticipates a significant turnaround with a net profit of US$110 million to US$120 million for 2024, driven by improved sales and operational efficiency. Revenue is expected to grow at 16.3% annually, surpassing the Hong Kong market average of 7.8%, though Return on Equity remains modestly forecasted at 13.6%.

- The analysis detailed in our Chervon Holdings growth report hints at robust future financial performance.

- Dive into the specifics of Chervon Holdings here with our thorough financial health report.

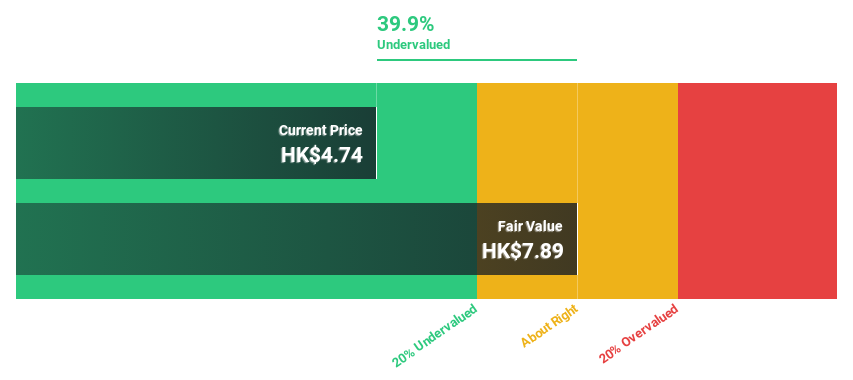

Newborn Town (SEHK:9911)

Overview: Newborn Town Inc. is an investment holding company that operates in the social networking sector globally, with a market capitalization of HK$7.25 billion.

Operations: The company generates revenue primarily from its Social Networking Business, which accounts for CN¥3.80 billion, and also from its Innovative Business segment, contributing CN¥406.28 million.

Estimated Discount To Fair Value: 30%

Newborn Town is trading at HK$5.14, below its estimated fair value of HK$7.34, highlighting an undervaluation based on cash flows. The company projects 2024 revenue between RMB 4,960 million and RMB 5,200 million due to strong growth in social networking and innovative businesses. Despite recent shareholder dilution from a private placement raising HKD 988.87 million, earnings are expected to grow at an annual rate of 24.7%, outpacing the Hong Kong market average of 11.7%.

- The growth report we've compiled suggests that Newborn Town's future prospects could be on the up.

- Take a closer look at Newborn Town's balance sheet health here in our report.

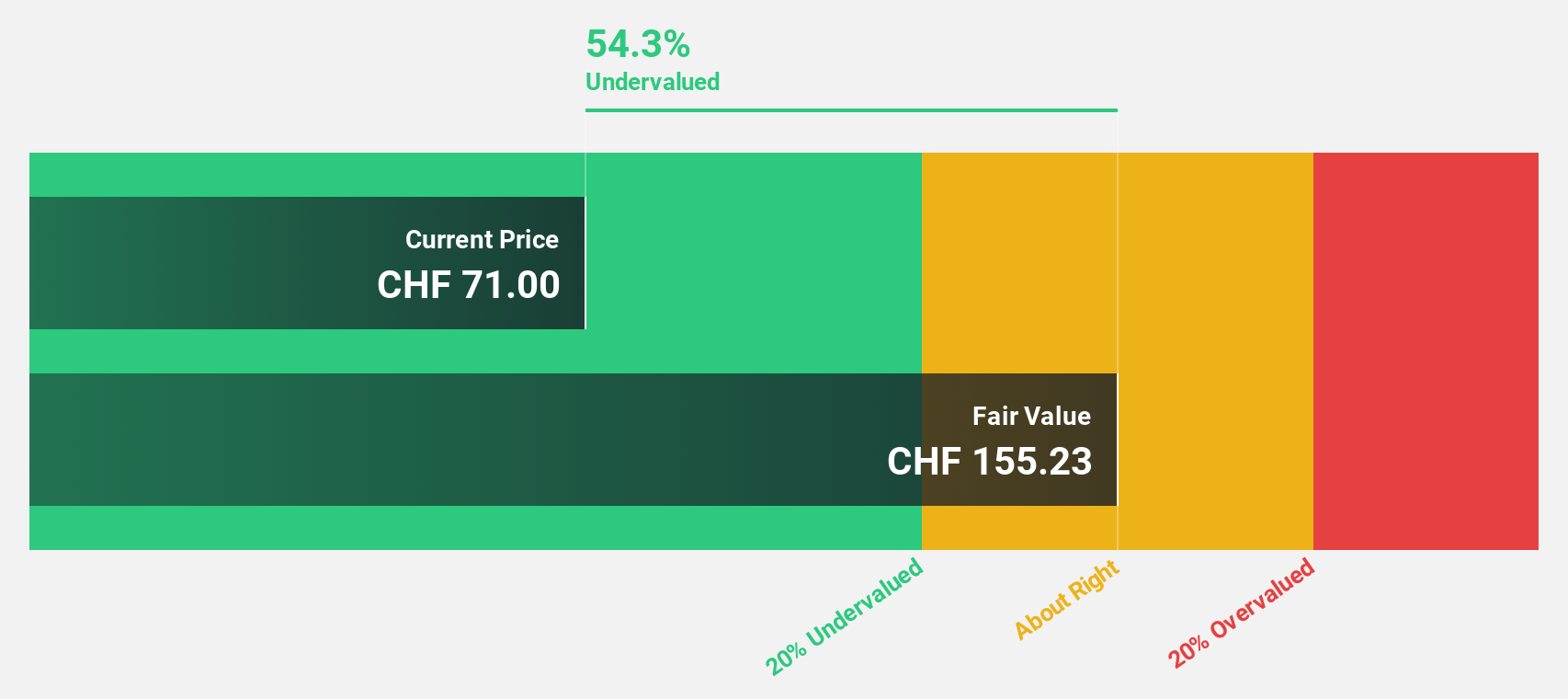

SKAN Group (SWX:SKAN)

Overview: SKAN Group AG, along with its subsidiaries, offers isolators, cleanroom devices, and decontamination processes for the pharmaceutical and chemical industries globally, with a market cap of CHF1.78 billion.

Operations: The company's revenue is primarily derived from its Equipment & Solutions segment, which generates CHF254.17 million, and its Services & Consumables segment, contributing CHF89.84 million.

Estimated Discount To Fair Value: 11.3%

SKAN Group, trading at CHF 79.1, is undervalued compared to its estimated fair value of CHF 89.17. The company forecasts revenue growth of 15.9% annually, surpassing the Swiss market's average growth rate of 4.4%. While earnings are expected to grow by 17.9% per year, outpacing the market's 11.8%, they do not reach significant levels above a benchmark threshold for rapid growth. Recent presentations at major conferences reflect active engagement in industry developments.

- Our comprehensive growth report raises the possibility that SKAN Group is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of SKAN Group.

Summing It All Up

- Investigate our full lineup of 924 Undervalued Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2285

Chervon Holdings

Engages in the research, development, manufacture, testing, sale, and after-sale servicing of power tools, outdoor power equipment, and related products in North America, Europe, China, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success