- Switzerland

- /

- Pharma

- /

- SWX:SDZ

How Investors Are Reacting To Sandoz Group (SWX:SDZ) US Launch of Generic Iron Sucrose Injection

Reviewed by Sasha Jovanovic

- Sandoz has announced the US launch of its FDA-approved generic iron sucrose injection, now available nationwide for the treatment of iron deficiency anemia, including use in patients with chronic kidney disease.

- This new entry further expands the Sandoz US iron therapy portfolio, aiming to address the needs of the approximately five million Americans affected by iron deficiency anemia.

- We'll examine how the expansion of Sandoz's iron therapy portfolio shapes its long-term investment narrative and future prospects.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Sandoz Group Investment Narrative Recap

The central appeal of Sandoz Group for shareholders hinges on its ability to drive consistent growth through expanding its biosimilars and generics portfolio in global chronic disease markets. The recent US launch of its FDA-approved generic iron sucrose injection strengthens Sandoz’s iron therapy lineup, but this move is unlikely to serve as the most important short-term catalyst compared to faster-growing biosimilar launches; the main risk continues to be price erosion and competition in both generics and biosimilars, which may keep pressuring profit margins in the near term.

Among recent announcements, the launch of Wyost and Jubbonti, first interchangeable FDA-approved denosumab biosimilars in the US, remains more impactful for Sandoz’s short-term momentum, as these biosimilars target larger patient populations and higher-margin opportunities. While broadening the iron therapy portfolio supports Sandoz’s overall positioning, ongoing competition in key US markets and the need to defend pricing power remain at the forefront of investor concerns.

However, it is important to be aware that intensifying competition from lower-cost manufacturers could...

Read the full narrative on Sandoz Group (it's free!)

Sandoz Group is projected to achieve $12.7 billion in revenue and $1.7 billion in earnings by 2028. This outcome assumes an annual revenue growth rate of 6.3% and a significant increase in earnings of $1.47 billion from current earnings of $227.0 million.

Uncover how Sandoz Group's forecasts yield a CHF49.39 fair value, a 8% upside to its current price.

Exploring Other Perspectives

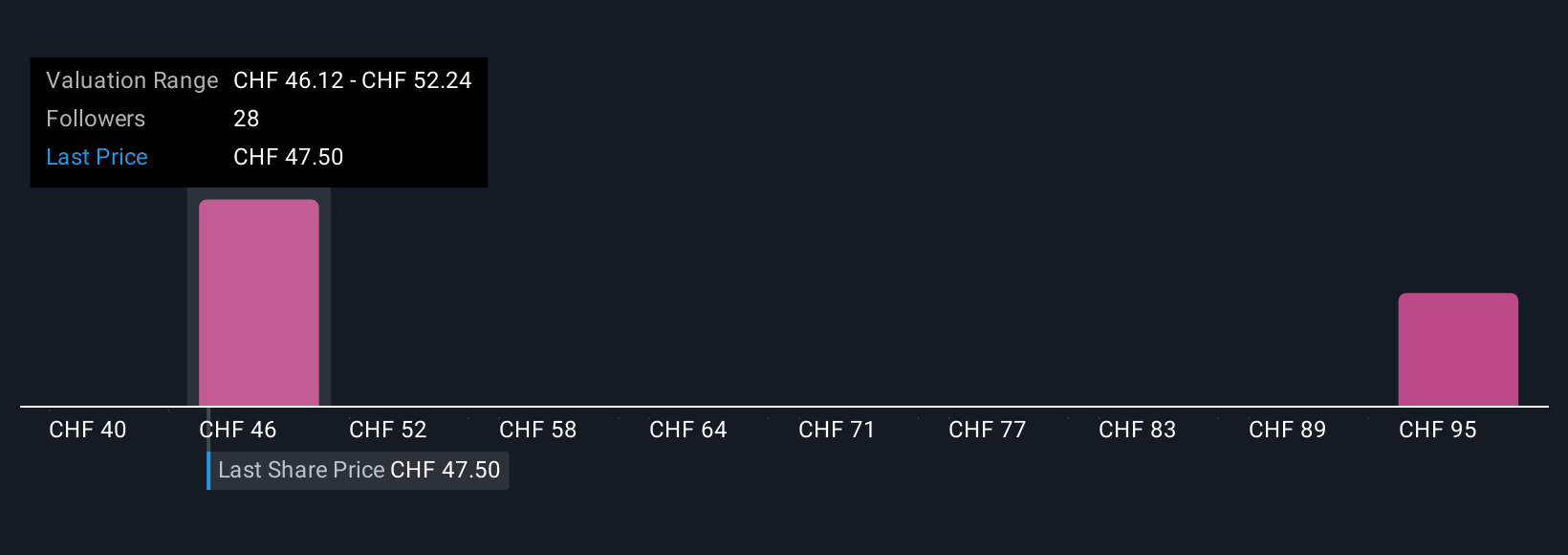

Three individual fair value estimates from the Simply Wall St Community span a wide US$40 to US$101.04 range. As many weigh Sandoz’s evolving product mix, competitive pricing and profit margin pressures continue to loom large for future results.

Explore 3 other fair value estimates on Sandoz Group - why the stock might be worth 13% less than the current price!

Build Your Own Sandoz Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sandoz Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sandoz Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sandoz Group's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SDZ

Sandoz Group

Develops, manufactures, and markets generic pharmaceuticals and biosimilars worldwide.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives