- Switzerland

- /

- Pharma

- /

- SWX:SDZ

Assessing Sandoz Group (SWX:SDZ) Valuation After Delivering a 33% Total Return Over the Past Year

Reviewed by Kshitija Bhandaru

Sandoz Group (SWX:SDZ) has attracted investor attention recently, delivering steady total returns of 33% in the past year. The stock’s performance stands out in a challenging environment and prompts a closer look at what’s driving sentiment.

See our latest analysis for Sandoz Group.

Sandoz Group’s share price has advanced steadily this year, with positive momentum building on the back of a strong 1-year total shareholder return of 33%. Recent, smaller share price moves have been relatively muted, but overall performance points to renewed investor confidence and optimism about the company’s growth potential.

If you’re interested in uncovering more opportunities in healthcare innovation, consider checking out the latest from the space via our curated See the full list for free..

With Sandoz Group posting notable gains and recent earnings on the rise, the question remains: is the company’s stock still trading below its true value, or has the market already factored in its future growth trajectory?

Most Popular Narrative: 5.8% Undervalued

With Sandoz Group's fair value pegged slightly above the latest closing price, investor attention is turning to the drivers behind this modest valuation gap and whether the current market has fully accounted for future growth catalysts.

Accelerating biosimilar launches in large chronic disease indications (e.g., autoimmunity, osteoporosis) position Sandoz to capitalize on sustained global demand for affordable biologics and a growing aging population. This supports robust long-term revenue growth.

Want to see the math behind the story? This narrative teases a potent mix of high-margin launches, fresh markets and a bold profit surge. Find out what future profit scenario powers that fair value—it may surprise you. Dive in now to see the bold assumptions shaping this price target.

Result: Fair Value of $49.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing price erosion in biosimilars and reliance on non-US markets could pressure margins and threaten Sandoz’s ability to sustain its projected growth.

Find out about the key risks to this Sandoz Group narrative.

Another View: High Multiples Raise Questions

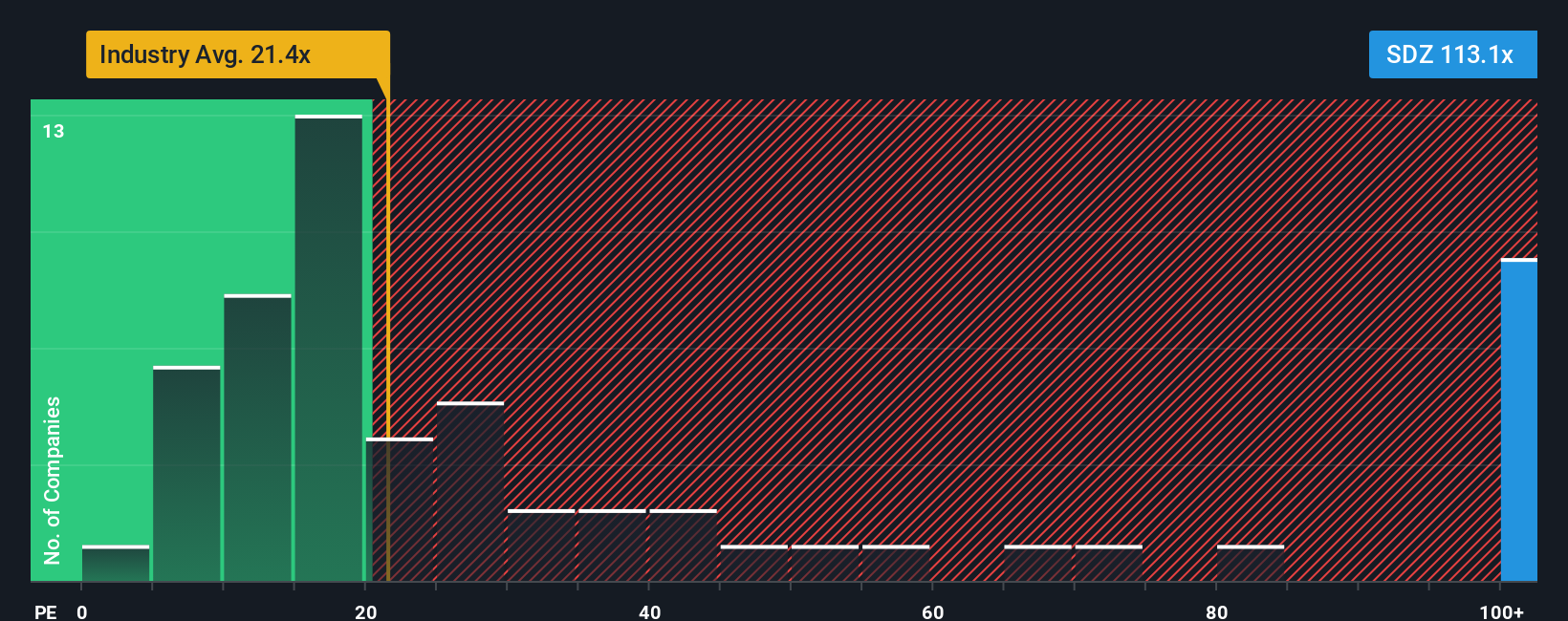

While a fair value approach suggests Sandoz is undervalued, looking at its price-to-earnings ratio paints a more cautionary picture. The stock trades at 111x earnings, significantly higher than peers at 49.1x and the European industry at 21.3x. The fair ratio sits at just 30.8x, which hints at potential valuation risk if sentiment cools. Is the market too optimistic, or is there growth yet to be unlocked?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sandoz Group Narrative

If you’re eager to challenge these perspectives or want your own take on Sandoz Group, our platform gives you everything you need to build a personal view in just a few minutes. Do it your way.

A great starting point for your Sandoz Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your opportunities to just one stock. Expand your search and get ahead of the crowd with curated picks matched to your strategy.

- Maximize yield potential and add steady income by assessing these 19 dividend stocks with yields > 3%, which boasts attractive dividend payouts above 3% annual returns.

- Uncover tomorrow’s technological disruptors and tap into the excitement around these 24 AI penny stocks, which are reshaping industries from healthcare to finance with next-level artificial intelligence.

- Capitalize on breakthrough science as you pinpoint these 26 quantum computing stocks, fueling advances in quantum technology with ambitions to redefine computing power worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SDZ

Sandoz Group

Develops, manufactures, and markets generic pharmaceuticals and biosimilars worldwide.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives