- Switzerland

- /

- Biotech

- /

- SWX:SANN

Santhera Pharmaceuticals Holding AG (VTX:SANN) Held Back By Insufficient Growth Even After Shares Climb 27%

Santhera Pharmaceuticals Holding AG (VTX:SANN) shares have continued their recent momentum with a 27% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 55% in the last year.

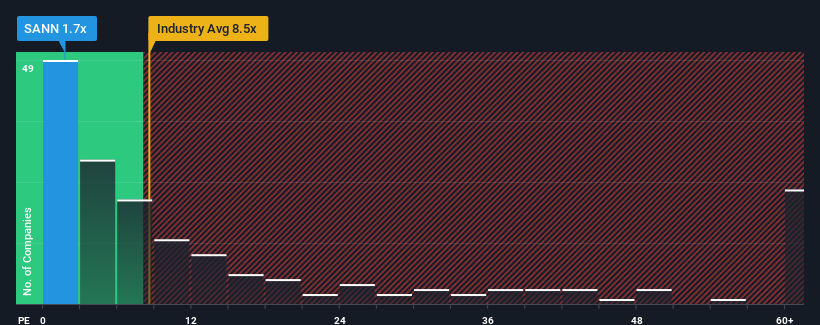

Although its price has surged higher, Santhera Pharmaceuticals Holding's price-to-sales (or "P/S") ratio of 1.7x might still make it look like a strong buy right now compared to the wider Biotechs industry in Switzerland, where around half of the companies have P/S ratios above 4.1x and even P/S above 14x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Santhera Pharmaceuticals Holding

What Does Santhera Pharmaceuticals Holding's Recent Performance Look Like?

Recent times have been advantageous for Santhera Pharmaceuticals Holding as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Santhera Pharmaceuticals Holding will help you uncover what's on the horizon.How Is Santhera Pharmaceuticals Holding's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Santhera Pharmaceuticals Holding's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an explosive gain to the company's top line. The amazing performance means it was also able to deliver huge revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the one analyst covering the company suggest revenue growth is heading into negative territory, declining 73% over the next year. Meanwhile, the broader industry is forecast to expand by 218%, which paints a poor picture.

In light of this, it's understandable that Santhera Pharmaceuticals Holding's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Even after such a strong price move, Santhera Pharmaceuticals Holding's P/S still trails the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's clear to see that Santhera Pharmaceuticals Holding maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Santhera Pharmaceuticals Holding (at least 2 which are a bit concerning), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:SANN

Santhera Pharmaceuticals Holding

A specialty pharmaceutical company, together with its subsidiaries, develops and commercializes medicines for rare neuromuscular and pulmonary diseases with high unmet medical need in the Europe, North America, and Asia.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives