- Switzerland

- /

- Pharma

- /

- SWX:ROG

Why Roche Holding (SWX:ROG) Is Up 9.3% After Positive MS Trial Results for Fenebrutinib

Reviewed by Sasha Jovanovic

- In early November 2025, Roche announced positive outcomes from late-stage clinical studies of its investigational BTK inhibitor fenebrutinib in both relapsing and primary progressive multiple sclerosis, meeting key primary endpoints in pivotal trials compared to established treatments.

- This progress highlights Roche’s expanding leadership in neuroimmunology and could introduce a new treatment option for primary progressive multiple sclerosis, for which there are currently limited approved therapies.

- We’ll explore how these successful late-stage results for fenebrutinib could influence Roche’s investment narrative and long-term growth potential in neurological diseases.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Roche Holding Investment Narrative Recap

Shareholders in Roche are generally buying into the company's ability to convert its robust research pipeline and leadership in targeted therapies into sustainable growth, offsetting expected revenue headwinds from biosimilar competition and pricing reforms. The recent positive Phase III results for fenebrutinib in both relapsing and primary progressive multiple sclerosis reinforce near-term pipeline momentum but are unlikely to immediately counter the medium-term risk from major patent expirations and price pressure in key markets.

Of the recent announcements, Roche’s approval of OCREVUS for subcutaneous use in MS is particularly relevant, as it strengthens the company’s position in neuroimmunology and illustrates ongoing innovation in a therapeutic area also targeted by fenebrutinib. This could help Roche defend its share against biosimilar erosion, representing a positive catalyst for the neurology portfolio amid broader portfolio challenges.

However, investors should also be aware that, despite pipeline successes, the scale and timing of biosimilar pressures after 2026...

Read the full narrative on Roche Holding (it's free!)

Roche Holding's narrative projects CHF67.3 billion in revenue and CHF16.8 billion in earnings by 2028. This requires 1.9% yearly revenue growth and a CHF7.4 billion earnings increase from current earnings of CHF9.4 billion.

Uncover how Roche Holding's forecasts yield a CHF298.64 fair value, a 3% upside to its current price.

Exploring Other Perspectives

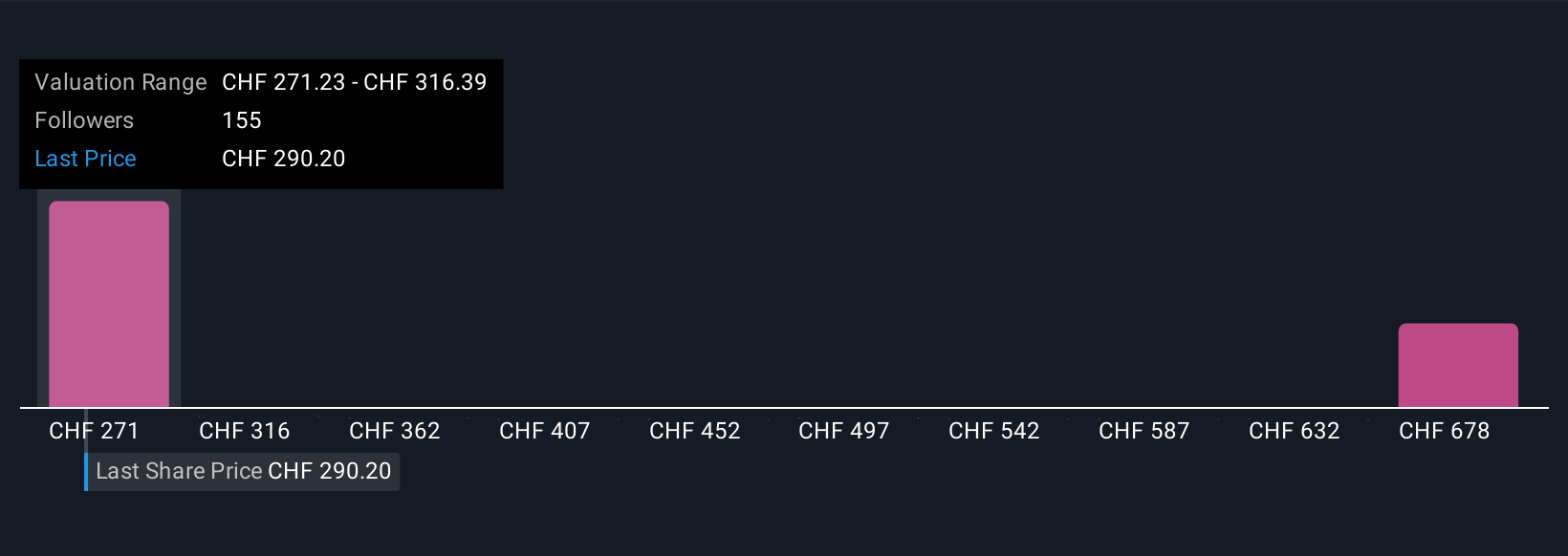

Seven members of the Simply Wall St Community estimate Roche’s fair value from CHF298.64 up to CHF705.80 per share. While patent expirations threaten future sales, opinion remains split on just how much this risk will shape long-term returns.

Explore 7 other fair value estimates on Roche Holding - why the stock might be worth just CHF298.64!

Build Your Own Roche Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Roche Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Roche Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Roche Holding's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ROG

Roche Holding

Engages in the pharmaceuticals and diagnostics businesses in Europe, North America, Latin America, Asia, Africa, Australia, and New Zealand.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives