- Switzerland

- /

- Pharma

- /

- SWX:ROG

Roche (SWX:ROG) Valuation in Focus After Vabysmo’s Four-Year Efficacy Data Revealed

Reviewed by Simply Wall St

Roche Holding (SWX:ROG) just made headlines with fresh clinical data at the Euretina Congress in Paris. The company presented four-year results from its AVONELLE-X and SALWEEN studies, putting the spotlight on Vabysmo’s performance in treating vision-threatening retinal diseases. For investors, these findings offer a direct window into Roche’s future in the fast-growing ophthalmology market, especially since the studies demonstrate not only strong disease control over time but also a real benefit for patients who have historically been tough to treat.

The news comes at a time when Roche has been quietly regaining momentum. After drifting in recent years, Roche shares have advanced 6% over the past year, with gains picking up in the past month. While the long-term track record has been mixed, a combination of steady revenue growth and this new validation for Vabysmo sets up a key moment for shareholder confidence as we head into the final quarter of the year.

With clinical successes accumulating and renewed strength in the share price, the question for investors is whether Roche Holding is currently undervalued, or if the market has already reflected future growth and upside in its valuation.

Most Popular Narrative: 9.2% Undervalued

The prevailing narrative points to Roche Holding being undervalued by nearly 10%, highlighting strong core business growth, cautious forecasts, and significant opportunities from clinical milestones.

"Roche has proven that, after the decline caused by the pandemic effect, it can grow again. Despite some setbacks, the company remains well positioned to expand steadily in the coming years."

Where does this optimism come from? There is a compelling mix driving this valuation: projected profit expansion, robust revenue estimates, and a key future multiple that sets Roche apart from its rivals. Are you intrigued by which data point tips the scale? The full narrative reveals the core financial assumptions and the boldest forecast yet.

Result: Fair Value of $302.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, setbacks in late-stage clinical trials or intensifying competition from obesity drug rivals could quickly shift sentiment on Roche’s current valuation.

Find out about the key risks to this Roche Holding narrative.Another View: Comparing a Key Valuation Ratio

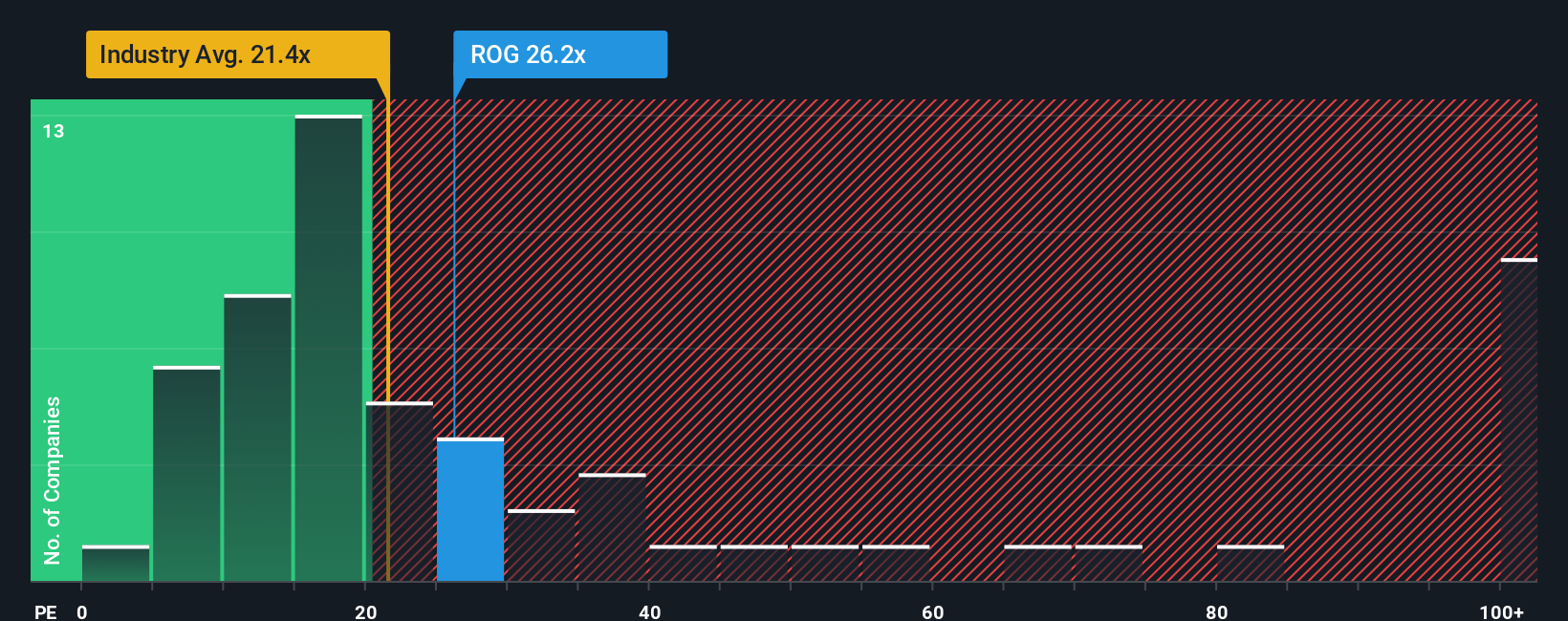

While the user narrative highlights upside, our valuation based on a key earnings ratio relative to the European industry average tells a different story. This approach suggests that Roche shares are currently more expensive than their peers. Does this priciness signal overlooked risks or simply reflect the company’s quality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Roche Holding Narrative

If you see things differently or want to dive into the details yourself, you can develop your own perspective in just a few minutes. Do it your way.

A great starting point for your Roche Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Missing out on big winners is never fun. Uncover stock opportunities tailored to your goals and interests with these handpicked ideas trusted by seasoned investors:

- Explore income opportunities as you uncover dividend stocks with yields > 3% and secure reliable returns with stocks featuring yields over 3%.

- Drive your portfolio’s growth by targeting emerging trends in medicine and technology with healthcare AI stocks, where healthcare and artificial intelligence intersect.

- Enhance your upside with undervalued stocks based on cash flows, highlighting companies trading below their cash flow potential before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SWX:ROG

Roche Holding

Engages in the pharmaceuticals and diagnostics businesses in Europe, North America, Latin America, Asia, Africa, Australia, and New Zealand.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives