- Switzerland

- /

- Pharma

- /

- SWX:ROG

Roche Stock Surges 12.6% as Swiss Leaders Address US Pharma Tariff Concerns

Reviewed by Bailey Pemberton

Trying to decide what to do with Roche Holding stock right now? You're not alone. The last several weeks have seen Roche make some impressive moves, with shares up 12.6% in just the past seven days and 14.5% over the year. It's a bounce that has certainly caught the market's attention, especially when you compare it to the roughly flat performance over the last three years. There is clearly a new sense of optimism, or perhaps just a major shift in how investors are weighing the risks and potential rewards.

Part of what's driving this renewed energy is the broader backdrop for drugmakers like Roche. Ongoing debates in the U.S. over Medicare drug price negotiations and potential new tariffs have created volatility across the sector. News of Swiss leaders stepping in to discuss the tariff situation with Roche highlights just how pivotal politics and policy are for this company’s outlook. For some investors, this sort of regulatory attention would be a reason to get cautious. For others, it is the kind of uncertainty that creates opportunity.

But before you make any decisions, let’s talk numbers. Roche scores a 4 out of 6 on key valuation checks, implying the stock is undervalued in two-thirds of the metrics we use to screen for opportunities. That is a pretty compelling foundation, but which valuation methods really deserve your attention? Up next, I will walk you through the approaches analysts rely on most, and hint at a perspective that may go even deeper into what Roche shares are truly worth.

Why Roche Holding is lagging behind its peers

Approach 1: Roche Holding Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by forecasting its future free cash flows and discounting them back to their present value. This method aims to reflect what those future cash streams are worth today, using reasonable assumptions about growth and risk.

For Roche Holding, the DCF analysis starts with CHF 14.1 billion in free cash flow over the last twelve months. Analyst estimates look for steady cash flow growth, projecting Roche's free cash flow to reach CHF 19.3 billion by 2029. While detailed analyst forecasts cover only the next five years, projections up to 2035 are extrapolated to provide a full picture. These projections are all expressed in Swiss francs (CHF), matching the company's reporting currency.

According to this model, the estimated intrinsic value of Roche shares is CHF 723.37. This suggests the stock is currently 60.1% undervalued compared to its market price. This significant discount could imply meaningful upside for value-focused investors. Based on these cash flow projections and the implied margin of safety, Roche stands out as being deeply undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Roche Holding is undervalued by 60.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Roche Holding Price vs Earnings

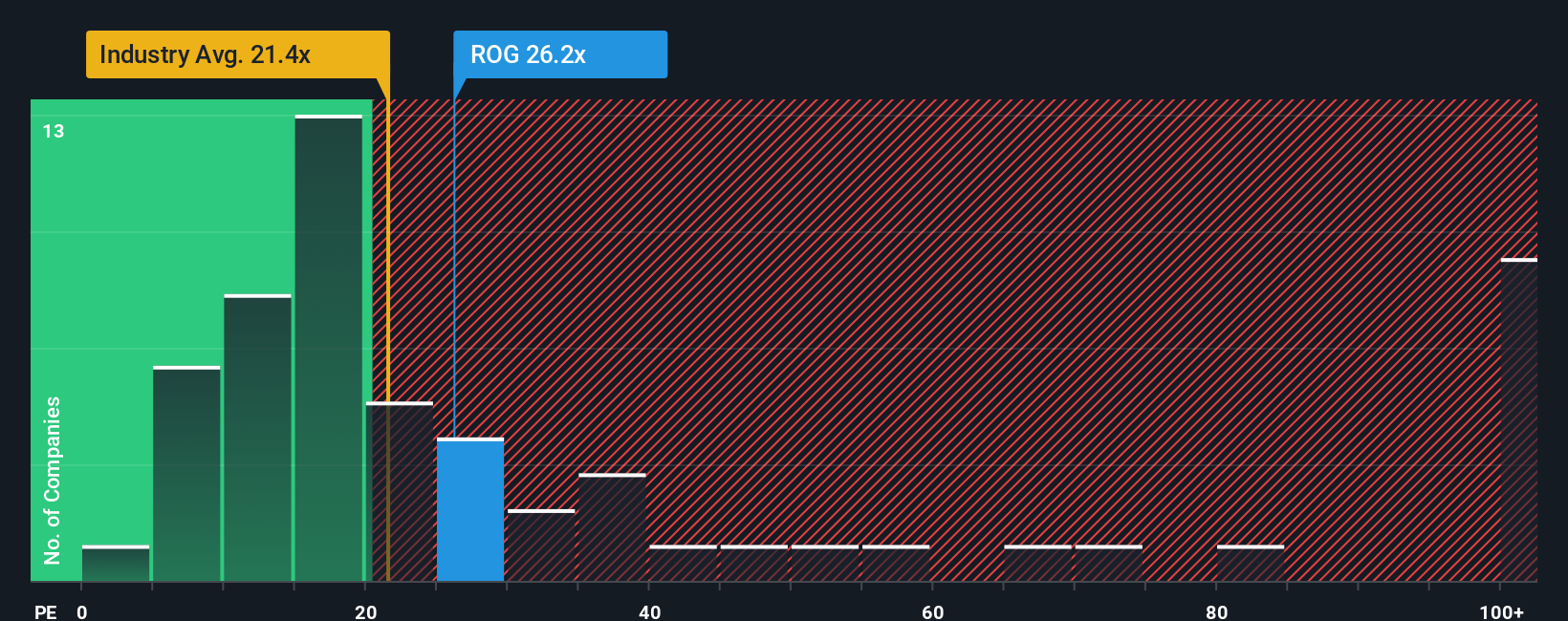

For profitable companies like Roche Holding, the Price-to-Earnings (PE) ratio is a tried-and-true valuation tool. It tells you how much investors are willing to pay today for a franc of future earnings, making it especially relevant when profits are stable and predictable.

The “right” PE ratio for any stock depends not just on profits, but also on expectations around future growth and how much risk investors are willing to bear. Faster-growing or less risky companies typically deserve a higher PE, while slower growers tend to command more conservative multiples.

Currently, Roche trades at a PE ratio of 26x. That is just above the Pharmaceuticals industry average of 24.7x, but well below the peer group average of 71.8x. However, comparing with these raw benchmarks can be misleading because they do not account for Roche’s specific margins, growth outlook, or business risks. This is where Simply Wall St's proprietary “Fair Ratio” is considered. It suggests that, after balancing Roche’s growth trajectory, strong profitability, risk factors, industry characteristics, and its large market cap, a PE of 33.7x would be appropriate. This is a more holistic benchmark, tailored to Roche’s unique situation and not just generic industry peers.

Given that Roche’s current PE of 26x is below its Fair Ratio of 33.7x, it implies the stock may be undervalued by this metric and could have room to catch up if expectations improve.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Roche Holding Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Instead of relying solely on ratios or discounted cash flows, Narratives let you build or select a "story" for Roche Holding—your own perspective on how its business will evolve, complete with your fair value, growth estimates, and margin forecasts.

A Narrative connects the company’s story to realistic financial forecasts and then to a fair value, bridging the gap between raw numbers and real-world context. These Narratives are easy to find and use right on Simply Wall St's Community page, where millions of investors post, discuss, and update their theories.

With Narratives, you can make smarter buy or sell decisions by checking if your (or the community's) Fair Value lines up with the current share price. Best of all, Narratives are updated dynamically. Whenever major news or fresh earnings appear, the forecasts and fair values automatically refresh, giving you real-time insight.

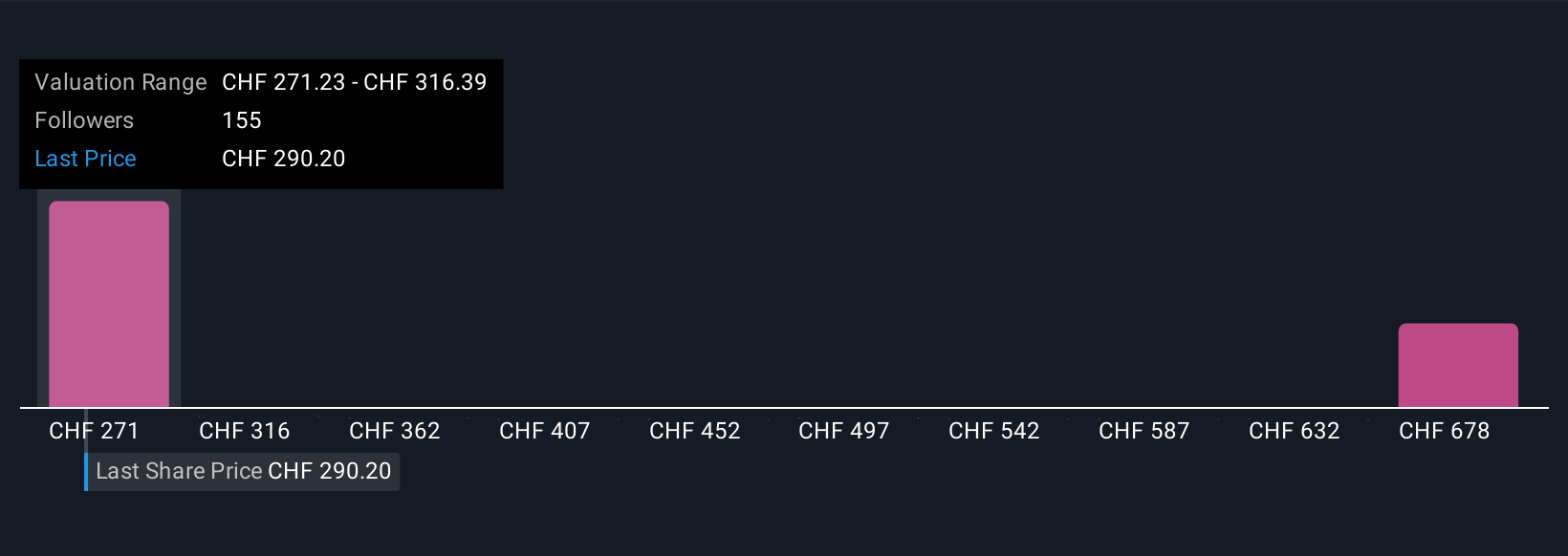

For Roche Holding, you will see a range of Narratives: one bullish investor might forecast a fair value as high as CHF 438.00 based on ambitious new drug launches, while a more cautious peer may see only CHF 230.00 due to patent risks and margin concerns.

Do you think there's more to the story for Roche Holding? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ROG

Roche Holding

Engages in the pharmaceuticals and diagnostics businesses in Europe, North America, Latin America, Asia, Africa, Australia, and New Zealand.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives