As of October 2025, the European markets have shown mixed performance with the pan-European STOXX Europe 600 Index inching higher amid dovish signals from U.S. Fed Chair Jerome Powell and easing trade tensions between the U.S. and China. Despite challenges such as a cooling UK labor market and contracting industrial production in the Eurozone, these conditions create a backdrop where discerning investors can identify potential opportunities among small-cap stocks that demonstrate resilience and adaptability. In this environment, identifying promising stocks involves looking for companies with strong fundamentals that can navigate economic fluctuations effectively while capitalizing on emerging trends within their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

EPC Groupe (ENXTPA:EXPL)

Simply Wall St Value Rating: ★★★★★★

Overview: EPC Groupe is involved in the manufacture, storage, and distribution of explosives across Europe, Africa, Asia Pacific, and the Americas with a market capitalization of €424.53 million.

Operations: EPC Groupe generates revenue primarily from its Specialty Chemicals segment, which contributed €513.62 million. The company's market capitalization stands at €424.53 million.

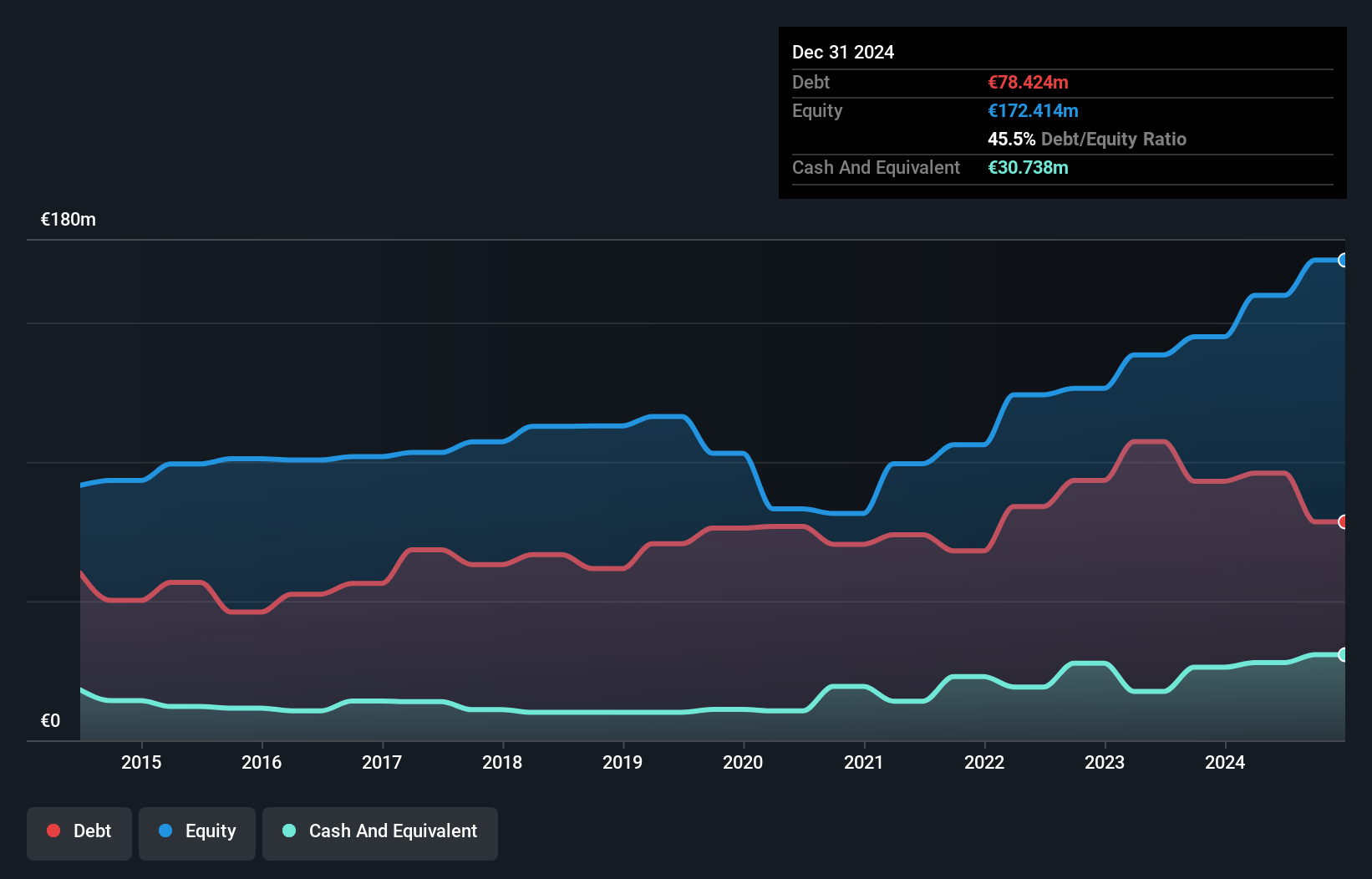

EPC Groupe, a notable player in the chemicals sector, has shown robust performance with earnings growth of 15.5% over the past year, outpacing the industry's 12.8%. Their net debt to equity ratio stands at a satisfactory 39.8%, and interest payments are well covered by EBIT at 4.3 times coverage. Recently added to both the CAC Small Index and CAC All-Tradable Index, EPC reported half-year sales of €260.65 million and net income of €13.77 million, reflecting steady growth from last year's figures of €242.42 million in sales and €12.52 million in net income.

- Get an in-depth perspective on EPC Groupe's performance by reading our health report here.

Explore historical data to track EPC Groupe's performance over time in our Past section.

SpareBank 1 Østfold Akershus (OB:SOAG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: SpareBank 1 Østfold Akershus operates as a savings bank offering a range of banking products and services in Norway, with a market cap of NOK5.51 billion.

Operations: The bank generates revenue primarily through interest income and fees from its banking services. Operating expenses are a significant cost factor, impacting profitability. Net profit margin trends have shown variability over recent periods, reflecting changes in cost management and revenue generation efficiency.

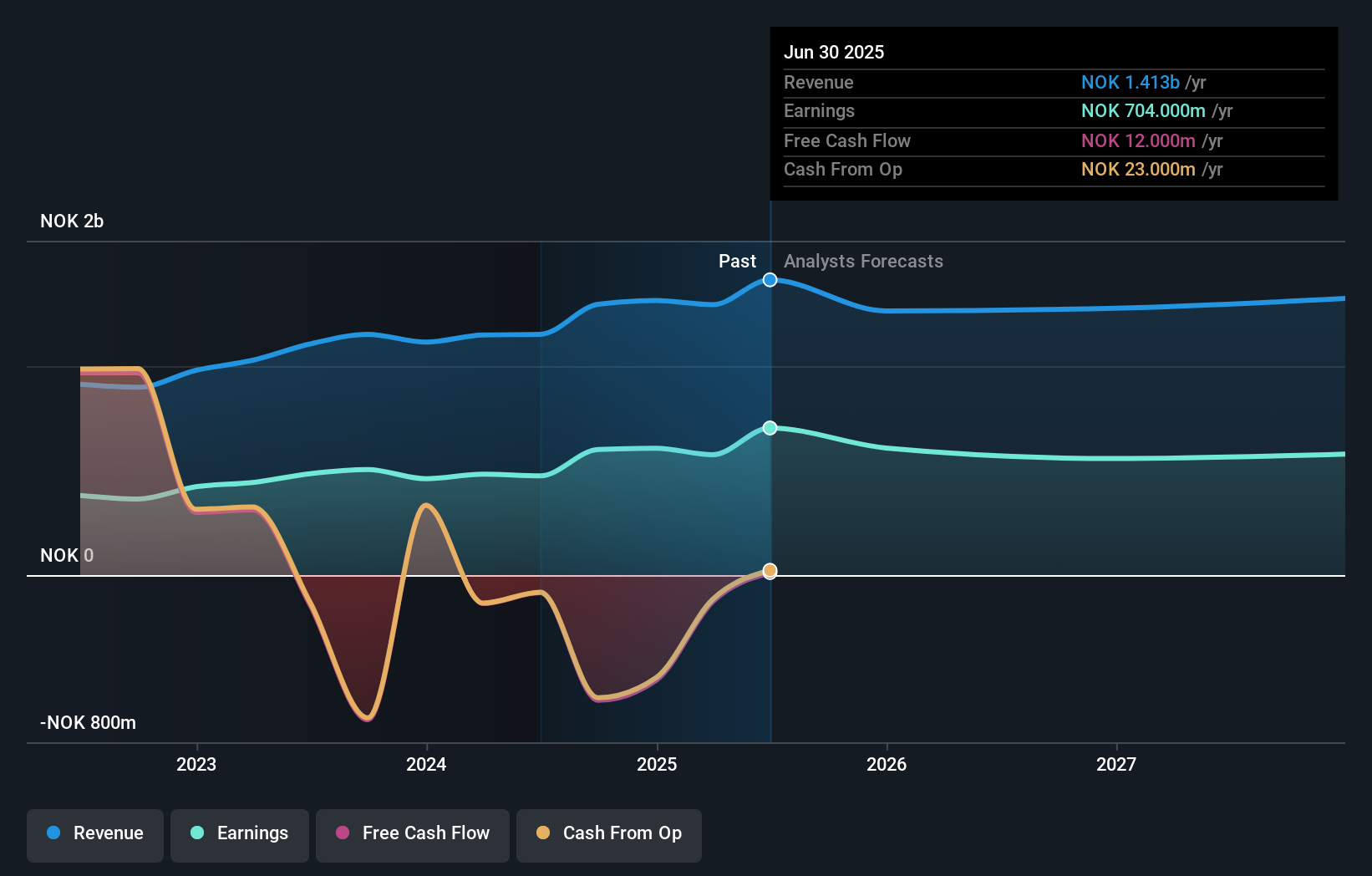

SpareBank 1 Østfold Akershus, a smaller player in the banking sector, shows promising growth with its earnings surging by 48% over the past year, significantly outpacing the industry average of 13%. The bank's net income for Q2 2025 was NOK243 million, up from NOK131 million last year. With total assets at NOK31.9 billion and equity at NOK5.1 billion, it trades at nearly 45% below fair value estimates. Primarily funded through low-risk customer deposits (80% of liabilities), it offers high-quality earnings despite forecasts indicating a potential annual decline in earnings by about 5% over the next three years.

Newron Pharmaceuticals (SWX:NWRN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Newron Pharmaceuticals S.p.A. is a biopharmaceutical company focused on discovering and developing novel therapies for central and peripheral nervous system diseases in Italy and the United States, with a market cap of CHF283.05 million.

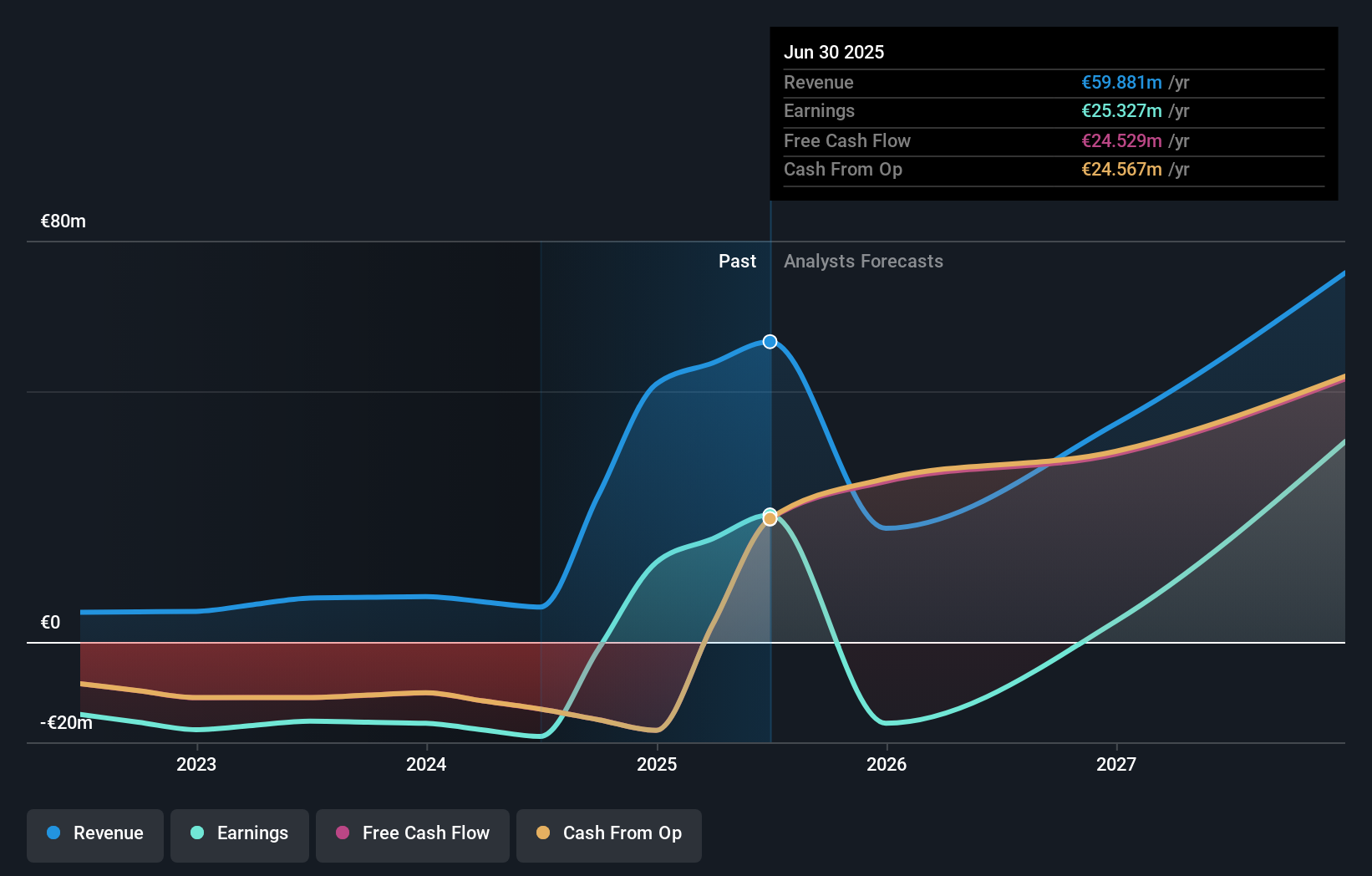

Operations: Newron Pharmaceuticals generates its revenue primarily from the research and development of pharmaceutical drugs, amounting to €59.88 million. The company's financial performance is influenced by its investment in developing therapies for nervous system diseases.

Newron Pharmaceuticals, a small player in the biopharma space, has recently turned profitable with earnings showing significant improvement. The company's net loss narrowed to EUR 0.073 million from EUR 9.56 million last year, while revenue jumped to EUR 11.9 million from EUR 3.41 million previously. Despite a hefty debt-to-equity ratio of 3276%, Newron's interest payments are well-covered by EBIT at an impressive 8.8 times coverage, indicating solid financial management amidst high leverage. Trading at nearly 91% below its estimated fair value and boasting high-quality earnings, Newron presents a compelling case for potential investors seeking growth opportunities in Europe’s pharmaceutical sector.

Taking Advantage

- Click here to access our complete index of 328 European Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EPC Groupe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXPL

EPC Groupe

Engages in the manufacture, storage, and distribution of explosives in Europe, Africa, Asia Pacific, and the Americas.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives