- Switzerland

- /

- Pharma

- /

- SWX:NOVN

Novartis (SWX:NOVN): Exploring Valuation as Shares Hover Near Recent Highs

Reviewed by Simply Wall St

Novartis (SWX:NOVN) shares have seen a mild pullback over the past day, despite steady gains for the month and year. Investors seem to be weighing recent momentum in revenue and earnings while considering broader sector trends.

See our latest analysis for Novartis.

Novartis has been quietly building positive momentum, notching a 12.6% share price return over the last quarter and a total shareholder return of 10.2% for the past year. Growth in underlying earnings and steady sector-wide optimism appear to be fueling renewed interest in the stock. Longer-term holders have enjoyed a substantial 88% total return over five years, although recent sessions brought a slight pause.

Looking for more promising opportunities in healthcare? Check out the full list of industry peers and innovators via our See the full list for free..

With shares near their recent highs and solid fundamentals under the hood, the real question for investors is whether Novartis is still trading below its true value or if the market has already priced in its future growth potential.

Most Popular Narrative: 6% Overvalued

Novartis shares recently closed at CHF104.52 while the most followed narrative consensus fair value lands at CHF98.60. This implies the latest price sits slightly above analyst expectations. The gap is small, but the fair value debate comes down to key industry drivers and future profitability assumptions.

Novartis' robust pipeline and rapid regulatory progress in advanced therapies (including biologics, gene, and cell therapies) positions the company to benefit from emerging healthcare technologies. This could potentially accelerate future earnings and margin growth as new high-value products launch. Expansion in emerging markets, particularly China (with Leqvio's strong out-of-pocket uptake and continued ex-U.S. growth in priority brands), increases Novartis' overall addressable market. This helps mitigate saturation in developed geographies and may drive future sales and cash flow.

What bold moves will define Novartis’ next chapter? The narrative relies on razor-sharp margin growth and ambitious market expansion bets, but what exactly powers that price target? Uncover the forecasts that could swing the stock in either direction.

Result: Fair Value of CHF98.60 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks like generic competition for key drugs or tighter global pricing controls could quickly challenge Novartis' bullish outlook and reset market expectations.

Find out about the key risks to this Novartis narrative.

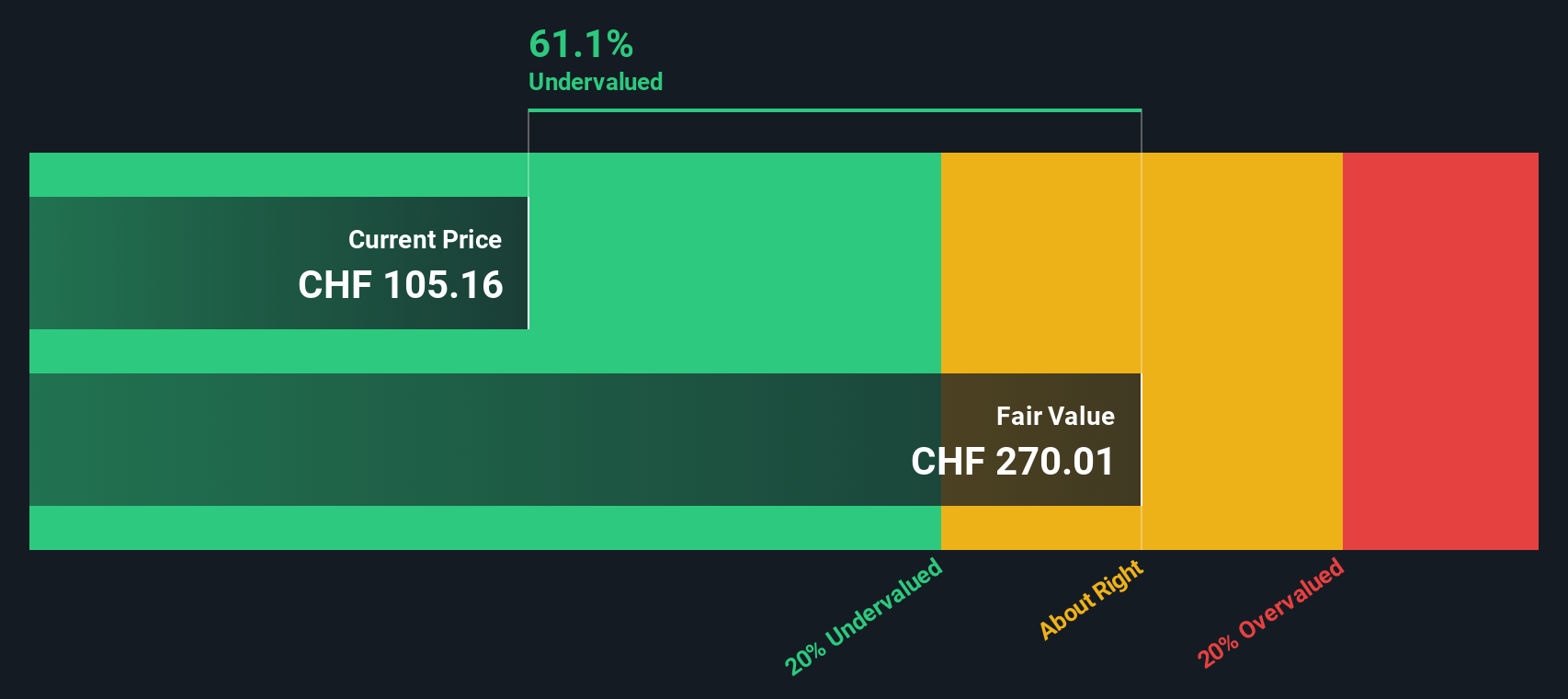

Another View: Discounted Cash Flow Model Points Higher

While analyst price targets suggest Novartis is currently overvalued, our DCF model offers a different perspective. By projecting future cash flows, the SWS DCF model estimates a fair value of CHF269.37 per share, which is significantly above today’s price. Does this indicate the market is underestimating long-term potential, or could there be other factors influencing investor sentiment?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Novartis Narrative

Prefer to dig into the numbers yourself or chart your own path? In just a few minutes, you can easily shape your own perspective and narrative. Do it your way.

A great starting point for your Novartis research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Catch tomorrow’s winners today by uncovering new opportunities through our handpicked screeners. Your next smart investment may be just a click away. Don’t let it slip by.

- Boost your portfolio with income potential. See which companies currently offer attractive yields via these 17 dividend stocks with yields > 3%.

- Capitalize on the AI revolution by checking out these 27 AI penny stocks that are driving innovation and reshaping industries.

- Position yourself for outsized returns by finding these 876 undervalued stocks based on cash flows poised for a potential rebound.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novartis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NOVN

Novartis

Researches, develops, manufactures, distributes, markets, and sells pharmaceutical medicines in Switzerland and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives