- Switzerland

- /

- Pharma

- /

- SWX:NOVN

How Investors May Respond To Novartis (SWX:NOVN) Positive Phase III Malaria Treatment Results Amid Rising Drug Resistance

Reviewed by Sasha Jovanovic

- Novartis recently announced positive Phase III results for its new malaria treatment KLU156 (GanLum), developed in collaboration with MMV and presented at the 2025 American Society of Tropical Medicine and Hygiene meeting.

- This milestone comes as drug resistance in Africa presents growing challenges, highlighting GanLum's potential to address an urgent unmet medical need on a global scale.

- We'll explore how the success of GanLum in late-stage trials could influence Novartis's long-term growth outlook and portfolio strength.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Novartis Investment Narrative Recap

For investors in Novartis, the big picture revolves around the company’s ability to offset upcoming losses in exclusivity for key drugs with growth from new therapies and pipeline assets. The positive Phase III results for GanLum, while promising, are not likely to meaningfully affect the most important short-term revenue catalysts, which are still tied to sustained sales growth of established brands and the looming risk from generic competition affecting blockbuster products.

The recent announcement most relevant to GanLum’s progress is Novartis’ disclosure of strong Q3 2025 results, with sales rising to US$13,909 million and net income at US$3,928 million. This earnings momentum, driven by core portfolio brands, provides some buffer as the company invests in breakthrough candidates like GanLum and continues to face pressures from pricing, competition, and exclusivity loss across mature products.

In contrast to revenue gains, investors should be aware of the risks from rapid loss of exclusivity and accelerating generic entries…

Read the full narrative on Novartis (it's free!)

Novartis' outlook indicates $59.1 billion in revenue and $17.3 billion in earnings by 2028. This reflects a 2.3% annual revenue growth rate and a $3.6 billion increase in earnings from the current $13.7 billion.

Uncover how Novartis' forecasts yield a CHF102.12 fair value, in line with its current price.

Exploring Other Perspectives

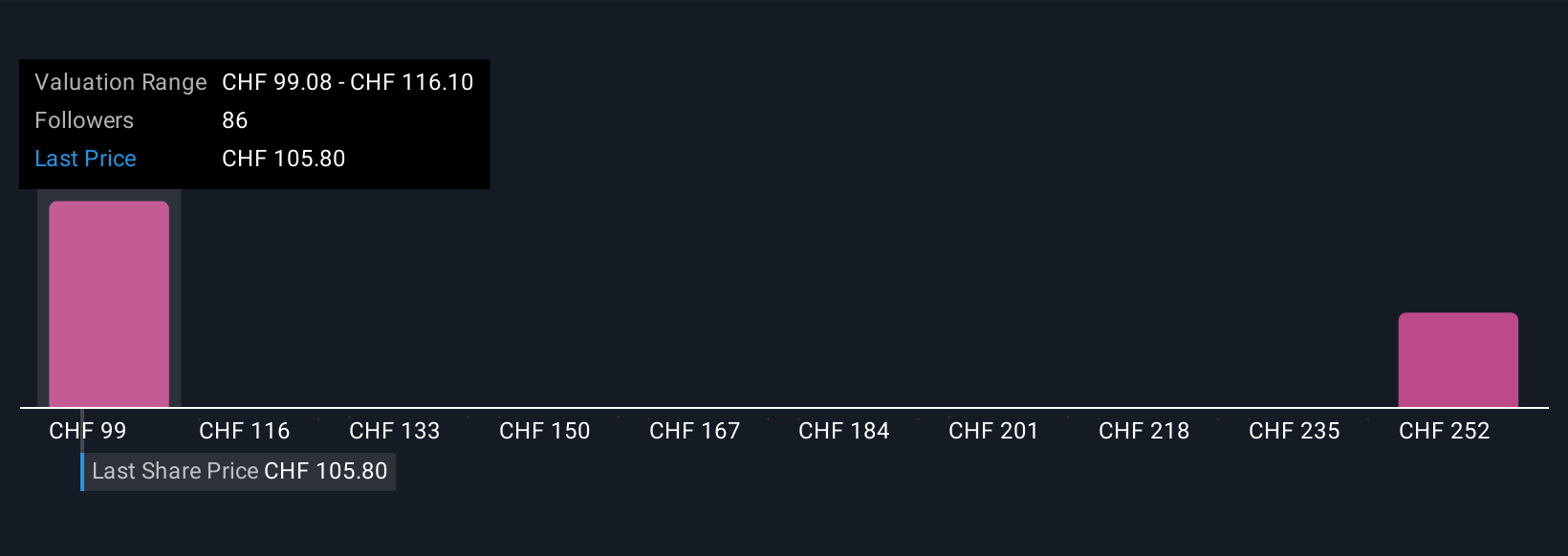

Four private investors in the Simply Wall St Community set Novartis’ fair value estimates between CHF102 and CHF270 per share. Even as potential for generic competition weighs on near-term earnings, these differing outlooks highlight the varied ways investors assess future performance and value drivers.

Explore 4 other fair value estimates on Novartis - why the stock might be worth over 2x more than the current price!

Build Your Own Novartis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Novartis research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Novartis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Novartis' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novartis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NOVN

Novartis

Researches, develops, manufactures, distributes, markets, and sells pharmaceutical medicines in Switzerland and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives