- Switzerland

- /

- Biotech

- /

- SWX:IDIA

Idorsia Ltd (VTX:IDIA) Stock Rockets 26% But Many Are Still Ignoring The Company

Idorsia Ltd (VTX:IDIA) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 68% share price drop in the last twelve months.

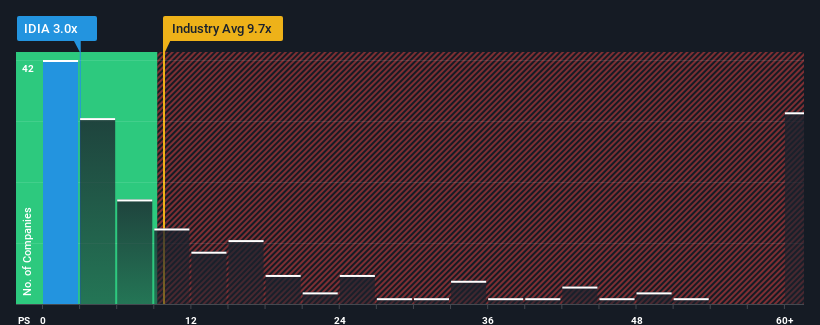

Even after such a large jump in price, there still wouldn't be many who think Idorsia's price-to-sales (or "P/S") ratio of 3x is worth a mention when the median P/S in Switzerland's Biotechs industry is similar at about 3.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Idorsia

How Idorsia Has Been Performing

Idorsia could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Idorsia's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Idorsia's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 25% gain to the company's top line. The latest three year period has also seen an excellent 92% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 46% per annum over the next three years. With the industry only predicted to deliver 34% per year, the company is positioned for a stronger revenue result.

In light of this, it's curious that Idorsia's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Idorsia appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Idorsia currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Idorsia (at least 4 which can't be ignored), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:IDIA

Idorsia

A biopharmaceutical company, engages in the discovery, development, and commercialization of drugs for unmet medical needs in Switzerland, the United States, Japan, Europe, China, and Canada.

Slight risk and slightly overvalued.

Market Insights

Community Narratives