- Switzerland

- /

- Pharma

- /

- SWX:GALD

Galderma (SWX:GALD): Evaluating Valuation in Light of New Sensitive Skin Research and Upcoming EADV Data Presentations

Reviewed by Simply Wall St

Most Popular Narrative: 3.2% Overvalued

The dominant narrative puts Galderma Group's fair value just below its current trading price, suggesting shares are modestly ahead of fundamentals after recent outperformance.

“A sustained shift in product mix toward premium, high-margin innovations (e.g., biostimulators, neuromodulators, new fillers, and prescription biologics) supports both revenue resilience and long-term net margin improvement. These products are less exposed to commoditization and price pressure compared to traditional fillers.”

Curious how analysts justify this high price tag for Galderma? The latest valuation assumes a future profit profile on par with some of the most resilient growth stories in healthcare. Are you ready to discover the bold financial projections and pivotal assumptions driving this fair value? Dive deeper to see what might be underpinning these remarkable forecasts.

Result: Fair Value of $140.69 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including potential softness in global demand for injectables and reliance on a handful of blockbuster innovations. These factors could challenge future momentum.

Find out about the key risks to this Galderma Group narrative.Another View: What Does Our DCF Model Say?

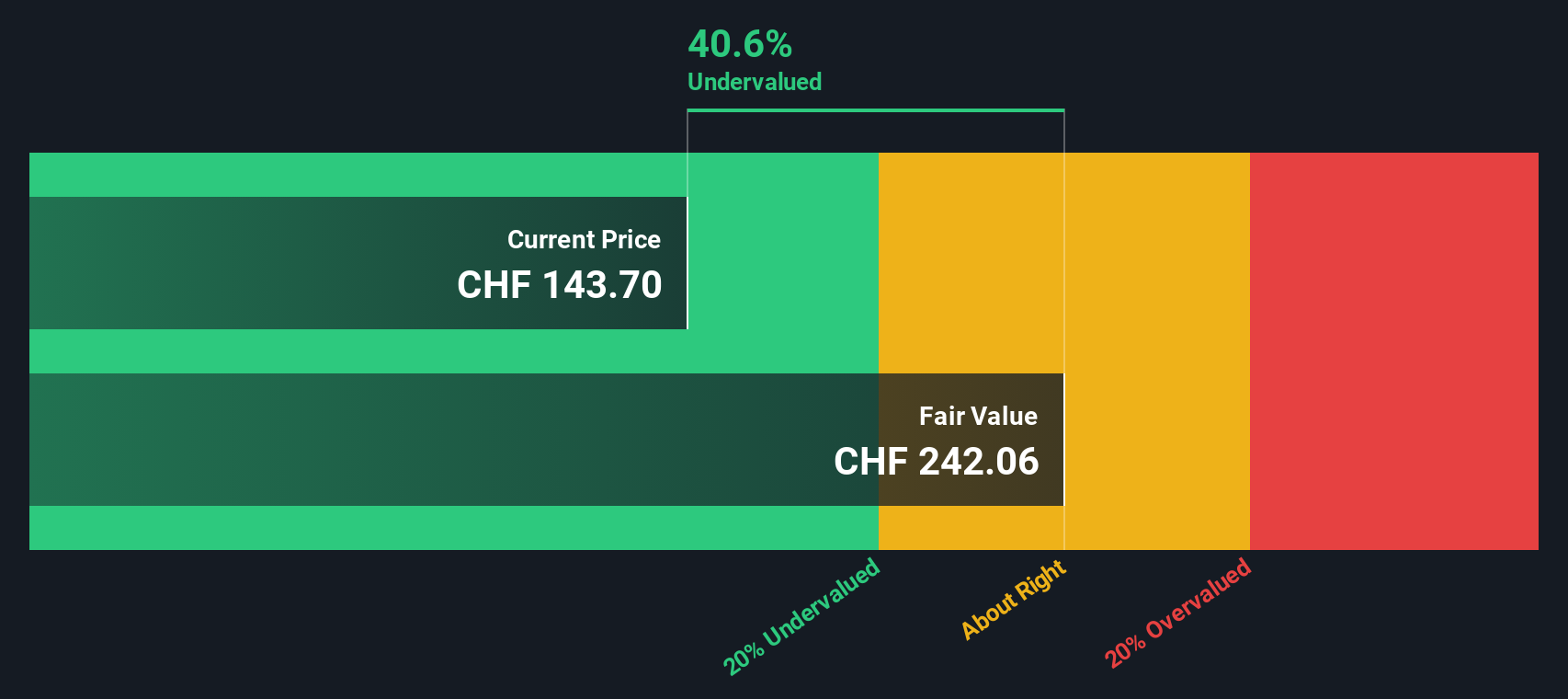

While the market's focus is on multiples, our SWS DCF model takes a different approach and suggests a far more optimistic picture for Galderma. Which method tells the real story about value here?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Galderma Group Narrative

If the current analysis does not quite capture your viewpoint, or you would rather craft your own perspective, the process is fast and straightforward. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Galderma Group.

Looking for More Smart Investment Opportunities?

Sharpen your portfolio strategy by jumping into fresh ideas beyond Galderma. The right screener opens doors you might never have considered. Don’t let great chances slip by.

- Unlock steady income by tapping into dividend stocks with yields > 3% with above-average yields from companies delivering consistent payouts and financial strength.

- Spot early movers in artificial intelligence by checking out AI penny stocks which are redefining everything from automation to next-gen data insights.

- Accelerate growth potential with undervalued stocks based on cash flows, where overlooked stocks are trading below their intrinsic cash flow value and may be positioned for a rebound.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:GALD

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives