- France

- /

- Aerospace & Defense

- /

- ENXTPA:FII

European Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

As European markets remain relatively stable, with the pan-European STOXX Europe 600 Index ending unchanged amid investor assessments of interest rate policies and trade concerns, there is a growing interest in identifying stocks that may be trading below their intrinsic value. In such an environment, a good stock is often characterized by strong fundamentals and potential for growth despite broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SBO (WBAG:SBO) | €27.15 | €53.18 | 48.9% |

| QPR Software Oyj (HLSE:QPR1V) | €0.602 | €1.17 | 48.5% |

| Profoto Holding (OM:PRFO) | SEK17.70 | SEK34.83 | 49.2% |

| Millenium Hospitality Real Estate SOCIMI (BME:YMHRE) | €2.04 | €4.05 | 49.7% |

| Lingotes Especiales (BME:LGT) | €5.80 | €11.22 | 48.3% |

| Kuros Biosciences (SWX:KURN) | CHF27.74 | CHF54.38 | 49% |

| Industrie Chimiche Forestali (BIT:ICF) | €6.46 | €12.64 | 48.9% |

| Dynavox Group (OM:DYVOX) | SEK107.20 | SEK212.68 | 49.6% |

| Circle (BIT:CIRC) | €8.20 | €16.32 | 49.8% |

| Atea (OB:ATEA) | NOK142.20 | NOK280.79 | 49.4% |

We'll examine a selection from our screener results.

Lisi (ENXTPA:FII)

Overview: Lisi S.A. designs and produces assembly and component solutions for the aerospace, automotive, and medical sectors in France and internationally, with a market cap of €2.20 billion.

Operations: The company's revenue segments are comprised of €1.13 billion from LISI Aerospace, €561.21 million from LISI Automotive, and €183.94 million from LISI Medical.

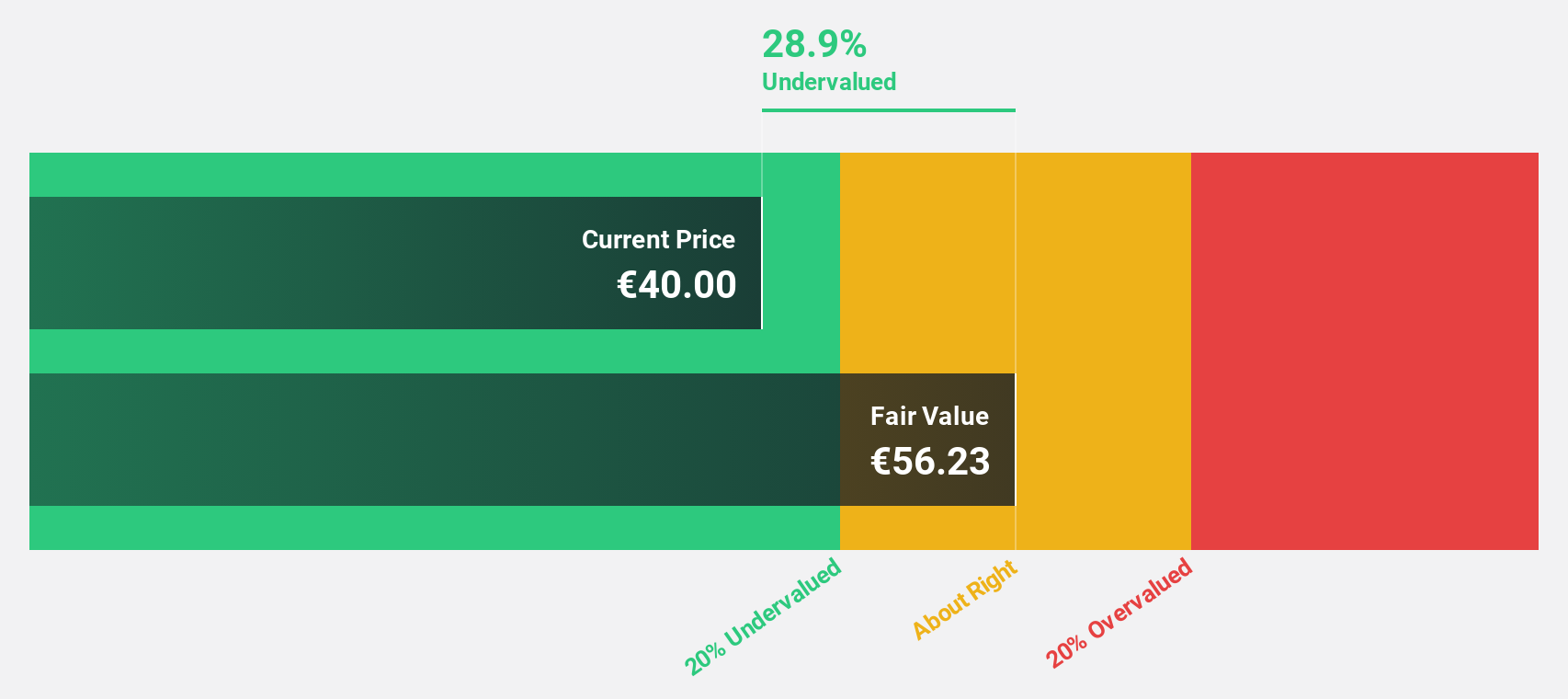

Estimated Discount To Fair Value: 16.3%

Lisi S.A. appears undervalued based on cash flows, trading at €48.2 against a fair value estimate of €57.56. Despite high debt levels and low forecasted return on equity, the company shows strong potential with earnings expected to grow significantly above the French market average at 31.2% annually over the next three years. Recent earnings reports indicate robust growth, with revenue reaching €1.03 billion and net income increasing to €38.51 million for H1 2025 compared to last year.

- According our earnings growth report, there's an indication that Lisi might be ready to expand.

- Click here to discover the nuances of Lisi with our detailed financial health report.

Galderma Group (SWX:GALD)

Overview: Galderma Group AG is a global dermatology company with a market cap of CHF32.74 billion.

Operations: The company generates revenue primarily through its dermatology segment, amounting to $4.69 billion.

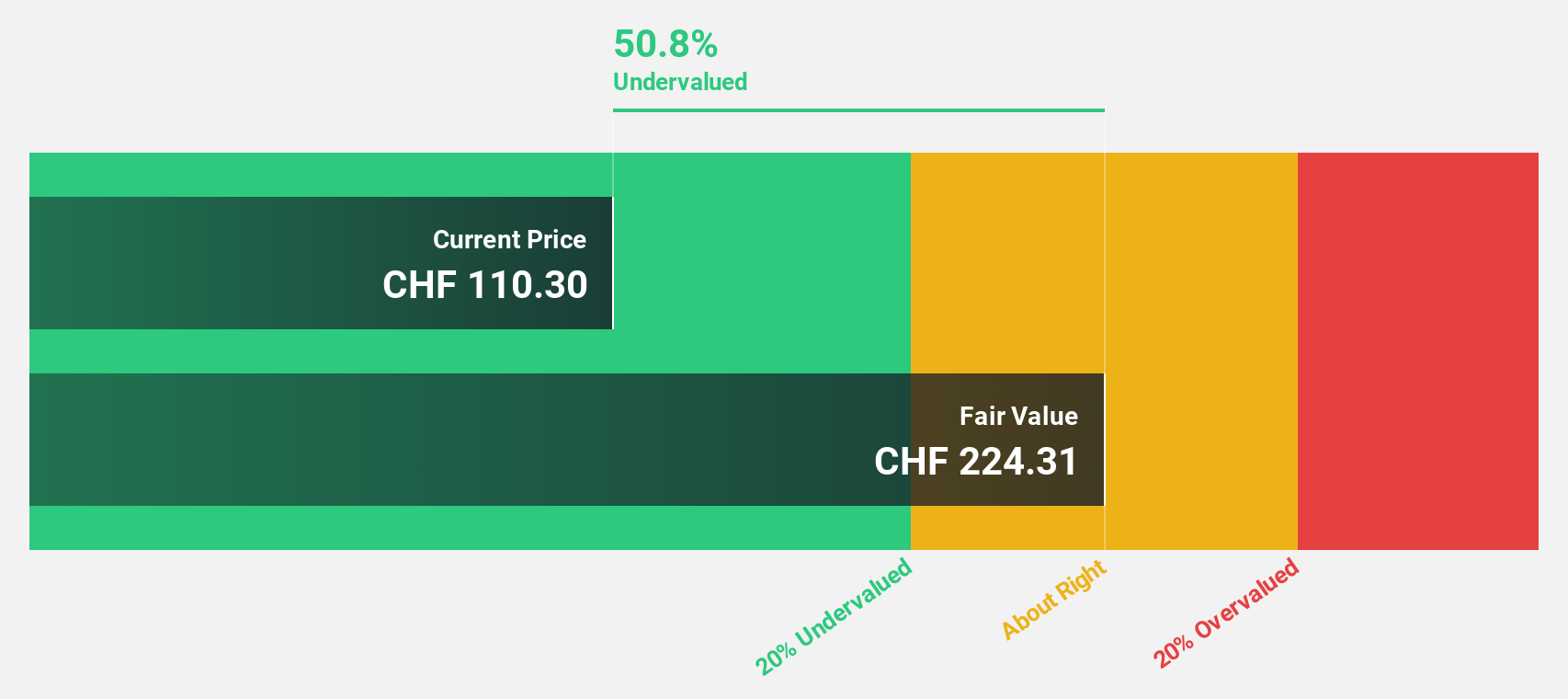

Estimated Discount To Fair Value: 42.6%

Galderma Group is trading at CHF137.9, significantly below its estimated fair value of CHF240.04, suggesting it may be undervalued based on cash flows. The company has become profitable this year and forecasts indicate earnings growth of 31.93% annually over the next three years, outpacing the Swiss market average. Recent product launches and expansions into new markets like China bolster its dermatological skincare segment, despite a lower forecasted return on equity of 13.1%.

- Upon reviewing our latest growth report, Galderma Group's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Galderma Group stock in this financial health report.

Kuros Biosciences (SWX:KURN)

Overview: Kuros Biosciences AG focuses on the commercialization and development of biologic technologies for musculoskeletal care across the USA, EU, and internationally, with a market cap of CHF1.07 billion.

Operations: The company's revenue segment consists of CHF103.35 million from its medical devices for musculoskeletal care.

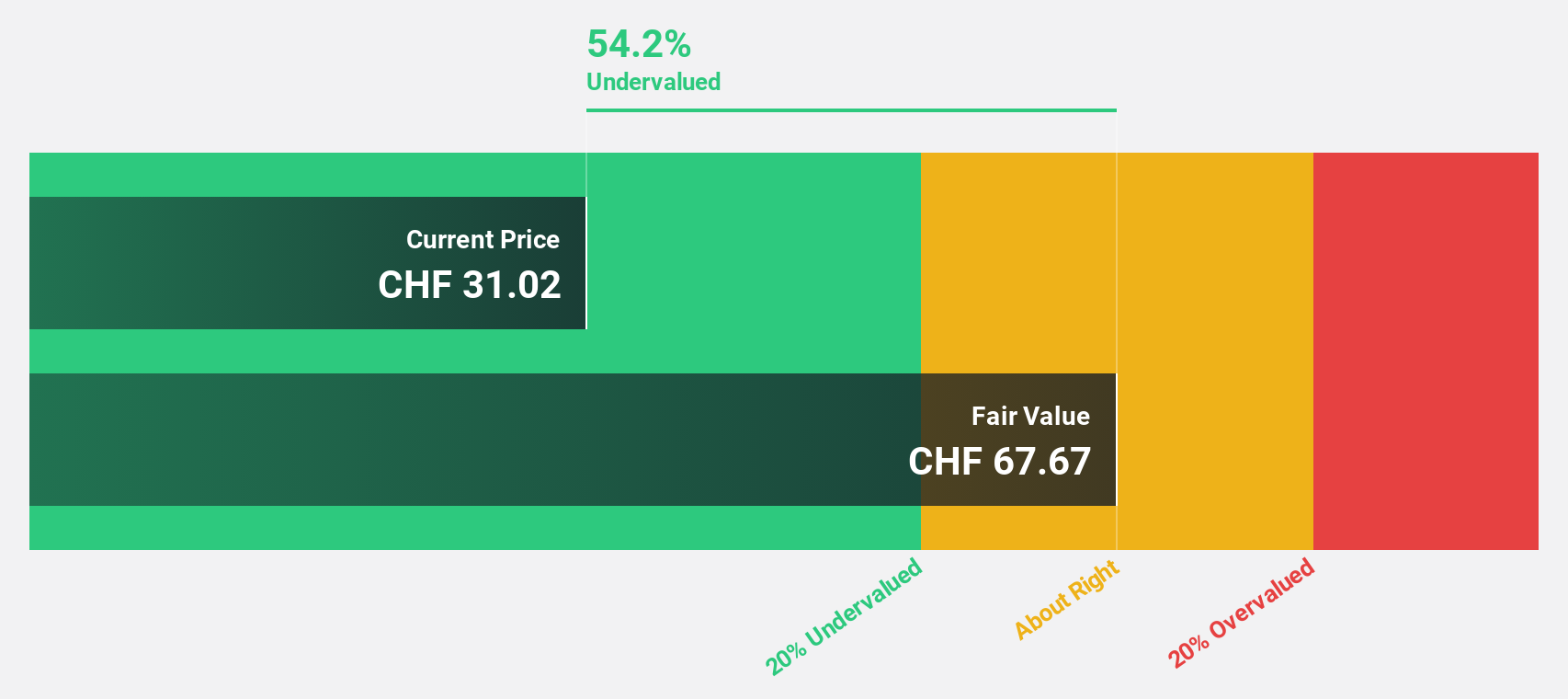

Estimated Discount To Fair Value: 49%

Kuros Biosciences is trading at CHF27.74, well below its estimated fair value of CHF54.38, indicating potential undervaluation based on cash flows. Despite a volatile share price recently, the company is on track to achieve profitability within three years and anticipates robust revenue growth of 21.5% annually, outpacing the Swiss market average. Recent advancements in their MagnetOs product line and strategic expansions into new markets further support long-term growth prospects despite current net losses.

- Our expertly prepared growth report on Kuros Biosciences implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Kuros Biosciences' balance sheet health report.

Where To Now?

- Investigate our full lineup of 206 Undervalued European Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FII

Lisi

Designs and produces assembly and component solutions for the aerospace, automotive, and medical sectors in France and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success