- Switzerland

- /

- Insurance

- /

- SWX:HELN

Top Dividend Stocks On SIX Swiss Exchange To Consider

Reviewed by Simply Wall St

The Switzerland market ended modestly higher on Friday after a somewhat choppy session, with investors largely reacting to earnings updates and improved consumer sentiment. Given the current economic landscape, selecting dividend stocks that offer stability and consistent returns can be a prudent strategy for investors looking to navigate these fluctuating conditions.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.25% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.41% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.64% | ★★★★★★ |

| LEM Holding (SWX:LEHN) | 4.36% | ★★★★★☆ |

| EFG International (SWX:EFGN) | 4.73% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 5.50% | ★★★★★☆ |

| Helvetia Holding (SWX:HELN) | 4.94% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 3.66% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.40% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.68% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

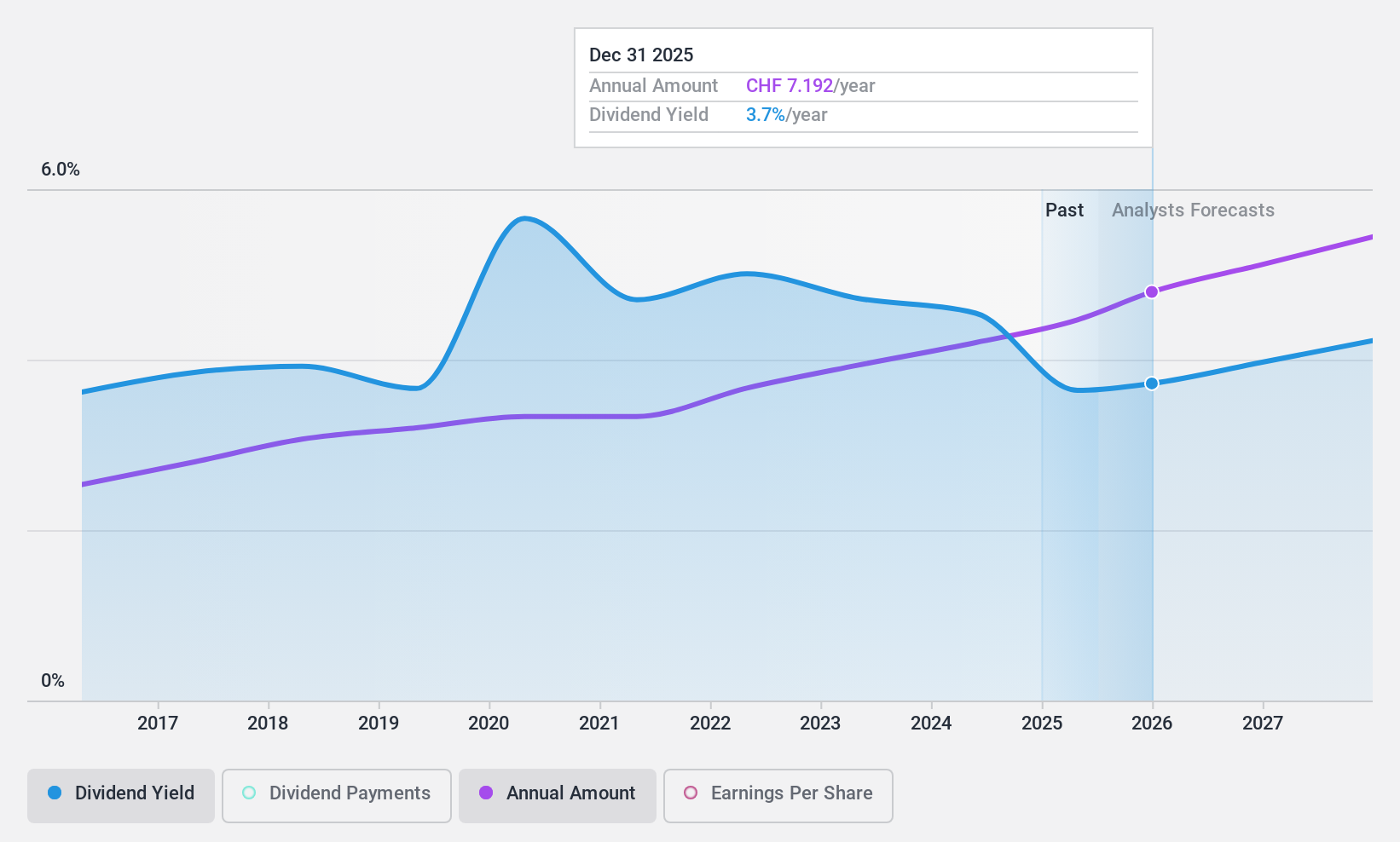

Helvetia Holding (SWX:HELN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Helvetia Holding AG operates in life and non-life insurance, as well as reinsurance, across Switzerland, Germany, Austria, Spain, Italy, France and internationally with a market cap of CHF6.74 billion.

Operations: Helvetia Holding AG's revenue segments include CHF1.81 billion from life insurance and CHF7.09 billion from non-life insurance.

Dividend Yield: 4.9%

Helvetia Holding has demonstrated reliable and stable dividend payments over the past decade, with dividends growing consistently. Despite a high payout ratio of 120.3%, indicating dividends are not well covered by earnings, the cash payout ratio stands at a manageable 36.5%, suggesting adequate coverage by cash flows. The current dividend yield of 4.94% places it in the top quartile among Swiss dividend payers, though profit margins have declined from 5.1% to 3%.

- Unlock comprehensive insights into our analysis of Helvetia Holding stock in this dividend report.

- Our valuation report here indicates Helvetia Holding may be overvalued.

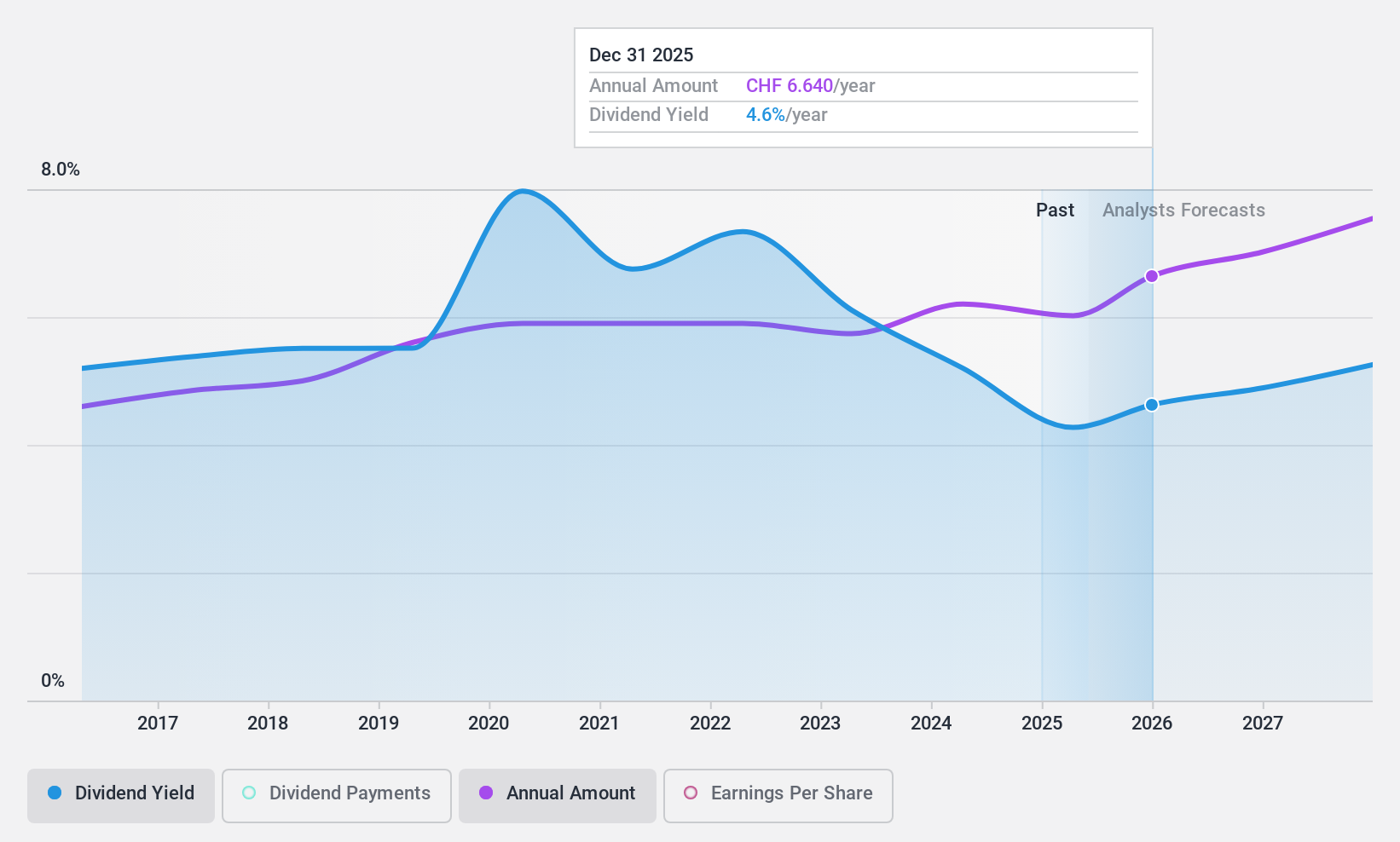

Swiss Re (SWX:SREN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swiss Re AG, with a market cap of CHF30.17 billion, operates globally offering wholesale reinsurance, insurance, risk transfer solutions, and other insurance-related services.

Operations: Swiss Re AG generates revenue from three primary segments: Property & Casualty Reinsurance ($23.74 billion), Life & Health Reinsurance ($18.09 billion), and Corporate Solutions ($6.06 billion).

Dividend Yield: 5.7%

Swiss Re's dividend payments have been volatile over the past decade, with dividends falling during this period. However, the company's dividends are well covered by earnings and cash flows, with payout ratios of 53.9% and 48.3%, respectively. Recent executive changes include a new CFO starting in April 2025 and a new CEO for Corporate Solutions from July 2024. Swiss Re's net income for Q1 2024 was US$1.09 billion, reflecting strong financial performance amidst these transitions.

- Click to explore a detailed breakdown of our findings in Swiss Re's dividend report.

- Upon reviewing our latest valuation report, Swiss Re's share price might be too pessimistic.

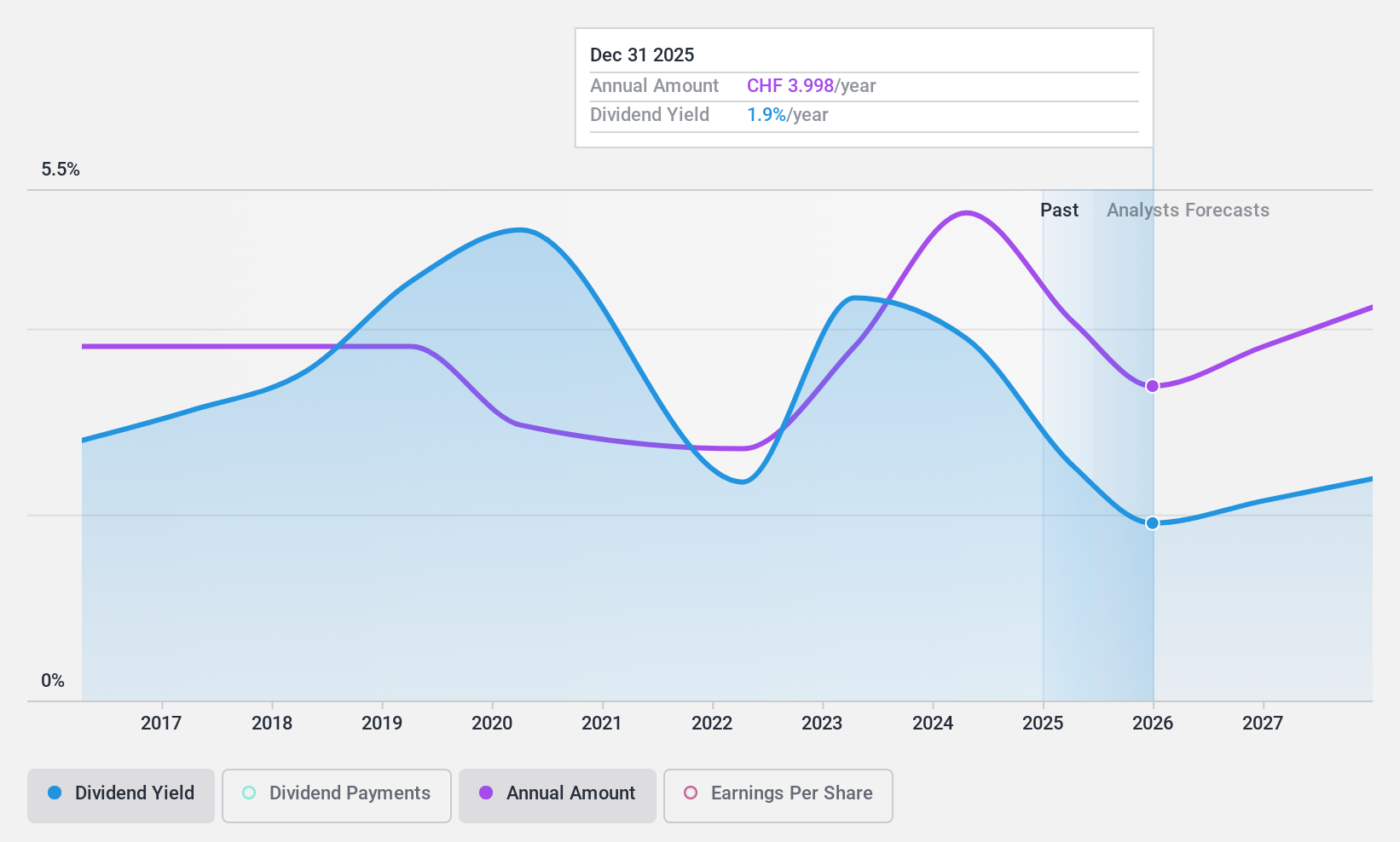

TX Group (SWX:TXGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TX Group AG operates a network of platforms and participations that offers information, orientation, entertainment, and support services in Switzerland, with a market cap of CHF1.67 billion.

Operations: TX Group AG's revenue segments in millions of CHF are: Tamedia at 446.40, Goldbach at 274.70, 20 Minutes at 118.40, TX Markets at 133.80, and Groups & Ventures at 159.40.

Dividend Yield: 3.9%

TX Group's dividend payments have been volatile and unreliable over the past decade, though they have increased during this period. The current payout ratio of 86.9% indicates dividends are covered by earnings, while a cash payout ratio of 42.1% shows strong coverage by free cash flow. Despite trading at 71% below estimated fair value, TX Group's dividend yield (3.93%) is lower than the top quartile in Switzerland (4.26%). Earnings are expected to grow annually by 21.22%.

- Click here and access our complete dividend analysis report to understand the dynamics of TX Group.

- Our valuation report unveils the possibility TX Group's shares may be trading at a premium.

Make It Happen

- Investigate our full lineup of 25 Top SIX Swiss Exchange Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helvetia Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:HELN

Helvetia Holding

Engages in life and non-life insurance, and reinsurance business in Switzerland, Germany, Austria, Spain, Italy, France, and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives