- Switzerland

- /

- Hospitality

- /

- SWX:LMN

Three Undiscovered Gems in Switzerland with Promising Potential

Reviewed by Simply Wall St

The Switzerland market ended marginally down on Wednesday, as investors largely refrained from making significant moves, choosing to wait for more clarity about the quantum of interest rate cut by the Federal Reserve. The benchmark SMI ended down 16.45 points or 0.13% at 12,250.11, after moving in a very narrow range between 12,215.53 and 12,274.31. In such cautious market conditions, identifying undiscovered gems with strong fundamentals and growth potential can be particularly rewarding for investors looking to navigate economic uncertainties effectively. Here are three Swiss stocks that stand out as promising opportunities amidst the current landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| APG|SGA | NA | 1.12% | -16.11% | ★★★★★★ |

| TX Group | 0.96% | -2.25% | 15.99% | ★★★★★★ |

| IVF Hartmann Holding | NA | 1.26% | -4.29% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Elma Electronic | 36.60% | 3.13% | 3.10% | ★★★★★★ |

| Compagnie Financière Tradition | 49.32% | 1.35% | 11.45% | ★★★★★☆ |

| Santhera Pharmaceuticals Holding | 34.94% | -14.16% | 5.21% | ★★★★☆☆ |

| lastminute.com | 42.65% | 4.93% | 3.11% | ★★★★☆☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Jungfraubahn Holding (SWX:JFN)

Simply Wall St Value Rating: ★★★★☆☆

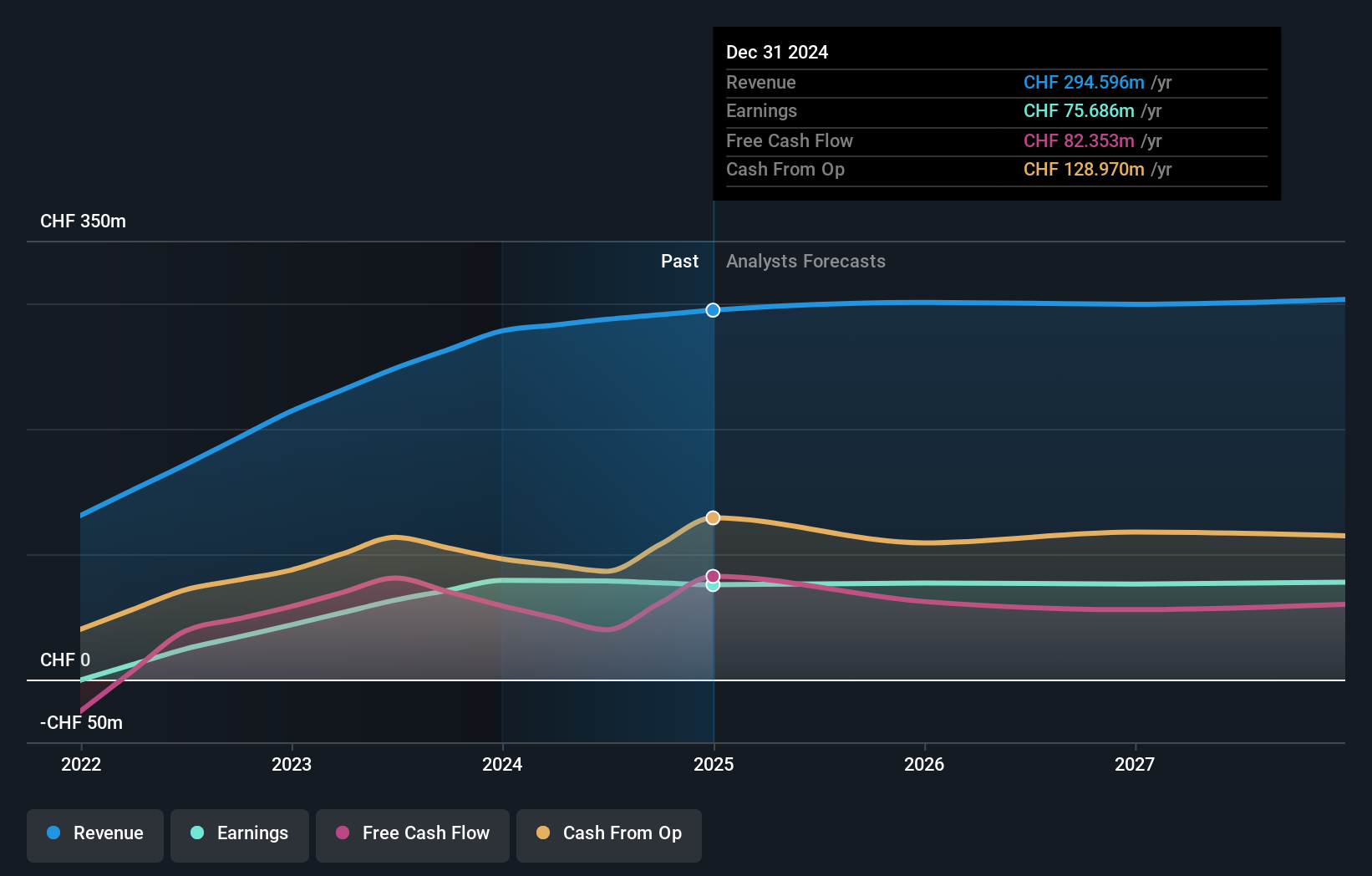

Overview: Jungfraubahn Holding AG, together with its subsidiaries, operates cogwheel railway and winter sports related facilities in the Jungfrau region of Switzerland, with a market capitalization of CHF1.13 billion.

Operations: Revenue primarily comes from the Jungfraujoch - Top of Europe segment (CHF188.24 million), followed by Experience Mountains (CHF45.94 million) and Winter Sports (CHF41.26 million).

Jungfraubahn Holding's earnings surged 81.6% last year, outpacing the Transportation industry’s -8.6%. The company's debt to equity ratio rose from 7.4% to 17.7% over five years, yet its net debt to equity ratio remains satisfactory at 13%. With a price-to-earnings ratio of 14.3x below the Swiss market average of 22x, it seems undervalued. Earnings are forecasted to grow by approximately 2.6% annually, indicating steady future prospects for this small cap stock in Switzerland.

- Click here and access our complete health analysis report to understand the dynamics of Jungfraubahn Holding.

Explore historical data to track Jungfraubahn Holding's performance over time in our Past section.

lastminute.com (SWX:LMN)

Simply Wall St Value Rating: ★★★★☆☆

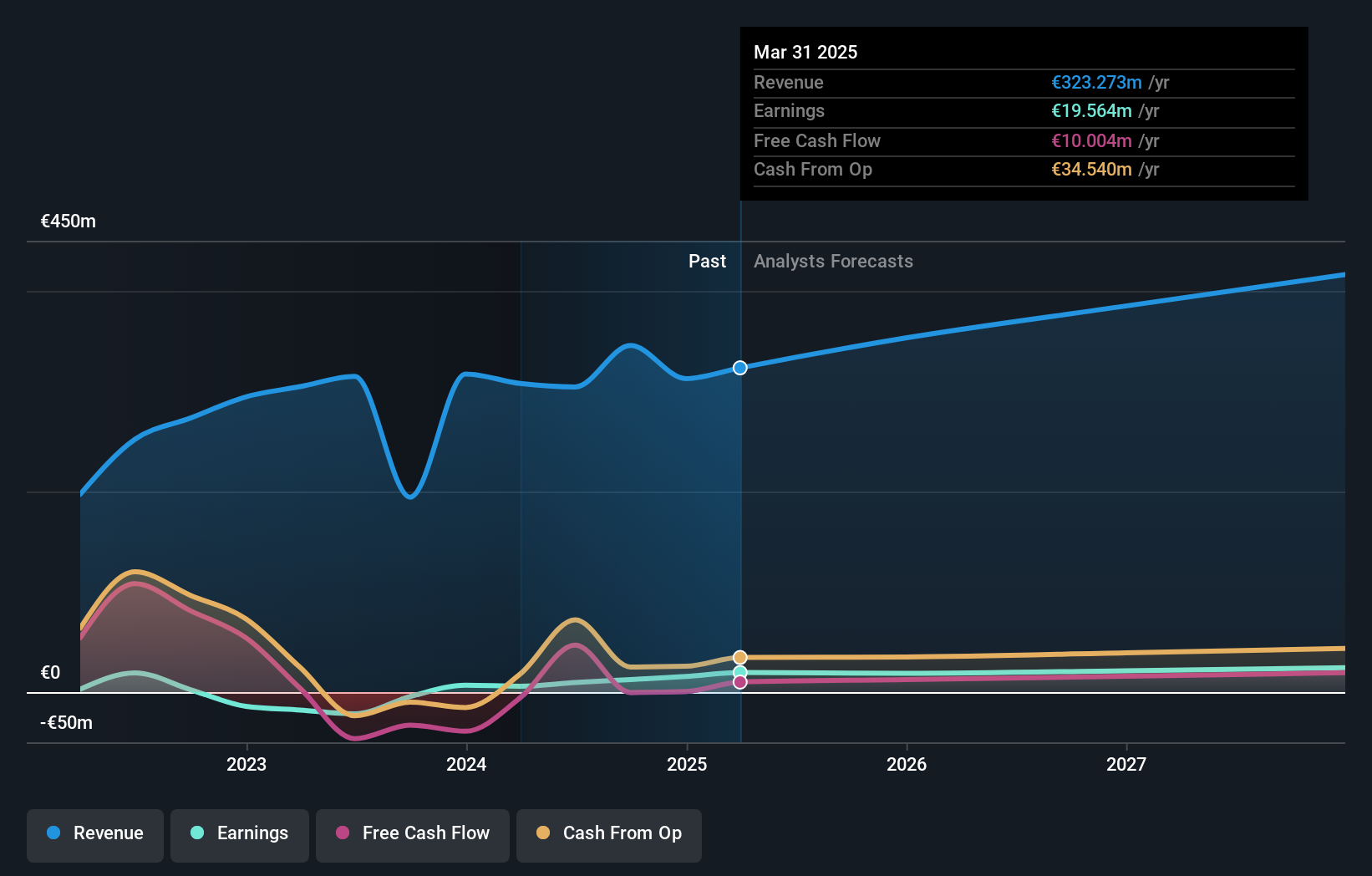

Overview: lastminute.com N.V., along with its subsidiaries, operates in the online travel industry across Italy, Spain, the United Kingdom, France, Germany, and internationally with a market cap of CHF213.67 million.

Operations: lastminute.com N.V. generates revenue primarily from its Business to Consumer (B2C) segment, which accounts for €175.89 million, and its Business to Business (B2B) segment, contributing €128.34 million. The company has a market cap of CHF213.67 million.

LMN has shown a significant turnaround, reporting net income of €9.99M for H1 2024, up from €7.38M last year. The company’s EBIT covers interest payments 6.1 times over, indicating strong financial health. Despite the share price volatility in recent months, LMN's debt-to-equity ratio increased to 42.7% over five years but remains manageable with more cash than total debt and positive free cash flow projections at 30%.

- Delve into the full analysis health report here for a deeper understanding of lastminute.com.

Understand lastminute.com's track record by examining our Past report.

TX Group (SWX:TXGN)

Simply Wall St Value Rating: ★★★★★★

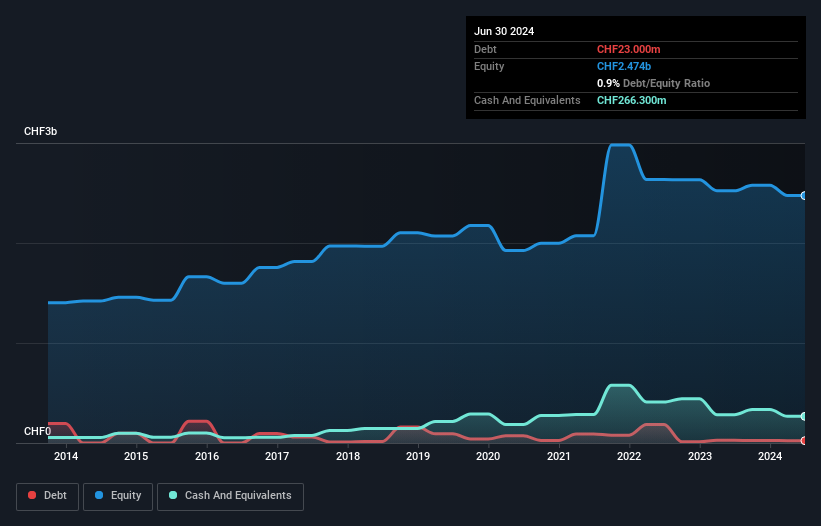

Overview: TX Group AG operates a network of platforms and participations that provides users with information, orientation, entertainment, and support services in Switzerland, with a market cap of CHF1.70 billion.

Operations: Revenue streams for TX Group AG are derived from its segments: Tamedia (CHF446.40 million), Goldbach (CHF274.70 million), 20 Minutes (CHF118.40 million), TX Markets (CHF133.80 million), and Groups & Ventures (CHF159.40 million).

TX Group, a relatively small player in the Swiss media landscape, has recently turned profitable, making it challenging to compare its past year earnings growth to the Media industry's 13%. The company repurchased shares last year and is trading at 70.4% below its estimated fair value. Over the past five years, TX Group's debt-to-equity ratio has impressively decreased from 7.6% to 1%, indicating robust financial management and potential for future stability.

- Get an in-depth perspective on TX Group's performance by reading our health report here.

Gain insights into TX Group's past trends and performance with our Past report.

Turning Ideas Into Actions

- Access the full spectrum of 18 SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if lastminute.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LMN

lastminute.com

Operates in the online travel industry providing dynamic holiday packages in Italy, Spain, the United Kingdom, France, Germany, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives