- Switzerland

- /

- Media

- /

- SWX:TXGN

Swiss Hidden Treasures naturenergie holding and 2 Promising Small Caps

Reviewed by Simply Wall St

Over the last 7 days, the Swiss market has remained flat, yet it boasts an impressive 16% increase over the past year with earnings forecasted to grow by 12% annually. In this promising environment, identifying stocks that combine growth potential with solid fundamentals can uncover hidden treasures like naturenergie holding and other promising small caps.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| IVF Hartmann Holding | NA | 0.24% | 0.63% | ★★★★★★ |

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| TX Group | 0.93% | -1.67% | 7.21% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Elma Electronic | 36.60% | 3.13% | 3.10% | ★★★★★★ |

| Compagnie Financière Tradition | 47.15% | 1.91% | 11.44% | ★★★★★☆ |

| Vaudoise Assurances Holding | NA | 1.52% | 1.85% | ★★★★★☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 1.66% | -1.82% | 12.78% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| lastminute.com | 42.65% | 4.93% | 3.11% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

naturenergie holding (SWX:NEAG)

Simply Wall St Value Rating: ★★★★★★

Overview: Naturenergie Holding AG, with a market cap of CHF1.25 billion, operates through its subsidiaries in the production, distribution, and sale of electricity under the naturenergie brand both in Switzerland and internationally.

Operations: Naturenergie Holding AG generates revenue primarily from Customer-Oriented Energy Solutions (€1.15 billion) and Renewable Generation Infrastructure (€1.09 billion). The company's net profit margin reflects its financial efficiency in managing costs relative to its revenue streams.

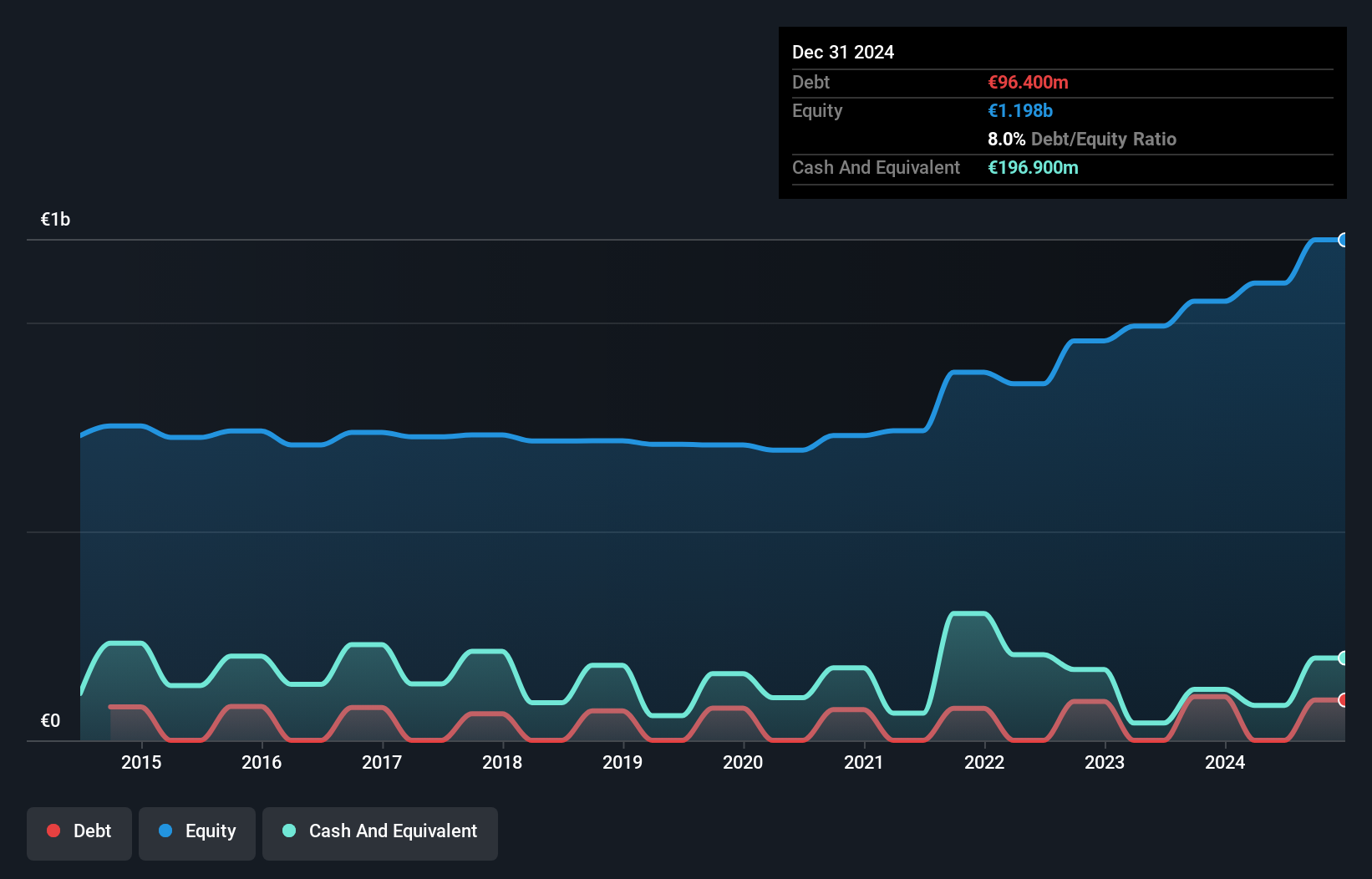

Naturenergie Holding, a small player in the Swiss energy sector, shows impressive earnings growth of 40.5% over the past year, outpacing the Electric Utilities industry. With a price-to-earnings ratio of 11.5x below the Swiss market average of 21.5x, it seems undervalued relative to peers. The company is debt-free and boasts high-quality earnings, suggesting financial stability and no concerns about interest payments coverage. Recent results reveal net income rose to €77 million from €68 million last year despite sales dipping to €868 million from €973 million, hinting at effective cost management or operational efficiency improvements amidst revenue challenges.

TX Group (SWX:TXGN)

Simply Wall St Value Rating: ★★★★★★

Overview: TX Group AG operates a network of platforms and participations offering information, orientation, entertainment, and support services in Switzerland, with a market cap of CHF1.55 billion.

Operations: TX Group AG generates revenue through segments such as Tamedia (CHF 427 million), Goldbach (CHF 299.10 million), and others, with a total revenue of CHF 983.90 million after accounting for eliminations and reconciliation IAS 19. The net profit margin trend is noteworthy, reflecting the company's ability to manage costs relative to its revenues effectively.

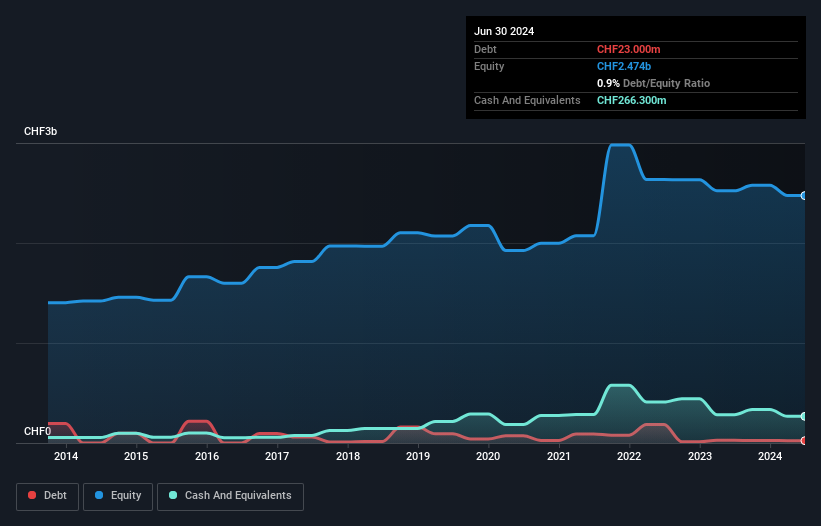

TX Group, a small Swiss media player, has shown promising financial resilience. Its recent inclusion in the S&P Global BMI Index underscores its growing prominence. Over the past five years, TXGN's debt to equity ratio impressively fell from 4.4% to 0.9%, reflecting prudent financial management. The company reported a net income of CHF 9.6 million for the half year ending June 2024, reversing a previous loss of CHF 1.4 million, and earnings per share climbed to CHF 0.9 from a loss of CHF 0.13 last year. Trading at nearly two-thirds below its estimated fair value suggests potential upside for investors seeking undervalued opportunities in Switzerland's media landscape.

- Unlock comprehensive insights into our analysis of TX Group stock in this health report.

Review our historical performance report to gain insights into TX Group's's past performance.

IVF Hartmann Holding (SWX:VBSN)

Simply Wall St Value Rating: ★★★★★★

Overview: IVF Hartmann Holding AG operates in the medical consumer goods sector, serving markets both in Switzerland and internationally, with a market capitalization of CHF335.81 million.

Operations: IVF Hartmann Holding AG generates revenue primarily from wound care (CHF41.97 million), infection management (CHF56.41 million), and incontinence management (CHF33.07 million).

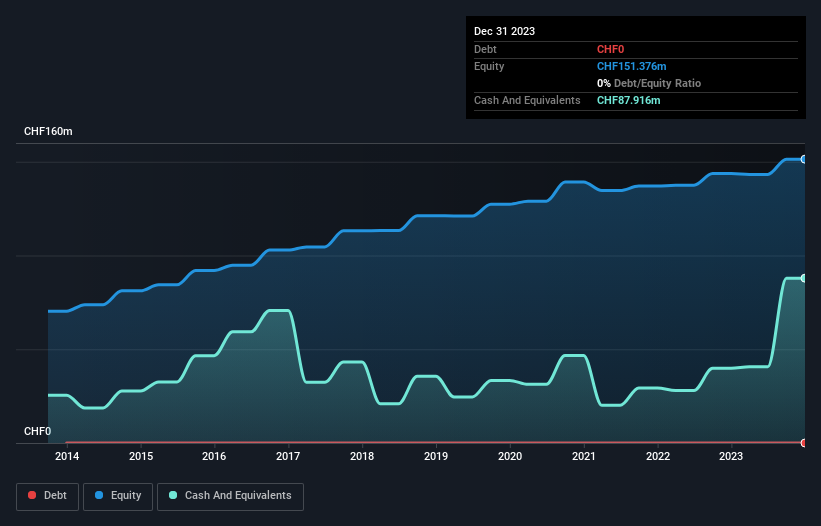

IVF Hartmann, a notable name in Switzerland's medical supplies sector, is showcasing promising growth with recent half-year sales reaching CHF 76.51 million, up from CHF 71.57 million the previous year. Revenue also climbed to CHF 78.7 million from CHF 74.77 million, while net income saw an increase to CHF 9.53 million from CHF 7.04 million last year, highlighting its robust performance amid industry challenges. The company's basic earnings per share rose to CHF 3.97 compared to the prior year's CHF 2.93, indicating strong operational efficiency and profitability that outpaces many peers in the medical equipment field.

Seize The Opportunity

- Click through to start exploring the rest of the 15 SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TX Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:TXGN

TX Group

Operates a network of platforms and participations that provides users with information, orientation, entertainment, and other services in Switzerland.

Excellent balance sheet and fair value.

Market Insights

Community Narratives