- Switzerland

- /

- Insurance

- /

- SWX:HELN

Georg Fischer Plus Two More Stocks Estimated To Be Undervalued On SIX Swiss Exchange

Reviewed by Simply Wall St

The Switzerland market recently closed on a strong note, buoyed by positive sentiment across Europe and reactions to political developments in the U.S., as well as anticipation for upcoming economic data and earnings reports. In such a vibrant market environment, identifying undervalued stocks like Georg Fischer can offer investors potential opportunities for growth amidst prevailing trends.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sulzer (SWX:SUN) | CHF136.00 | CHF221.23 | 38.5% |

| COLTENE Holding (SWX:CLTN) | CHF46.70 | CHF74.07 | 37% |

| Burckhardt Compression Holding (SWX:BCHN) | CHF621.00 | CHF856.07 | 27.5% |

| Georg Fischer (SWX:GF) | CHF66.60 | CHF85.64 | 22.2% |

| Swissquote Group Holding (SWX:SQN) | CHF279.60 | CHF359.48 | 22.2% |

| Julius Bär Gruppe (SWX:BAER) | CHF51.80 | CHF93.65 | 44.7% |

| Sonova Holding (SWX:SOON) | CHF266.00 | CHF467.79 | 43.1% |

| Comet Holding (SWX:COTN) | CHF360.00 | CHF589.65 | 38.9% |

| Medartis Holding (SWX:MED) | CHF71.10 | CHF131.41 | 45.9% |

| Sika (SWX:SIKA) | CHF264.30 | CHF342.86 | 22.9% |

Here's a peek at a few of the choices from the screener.

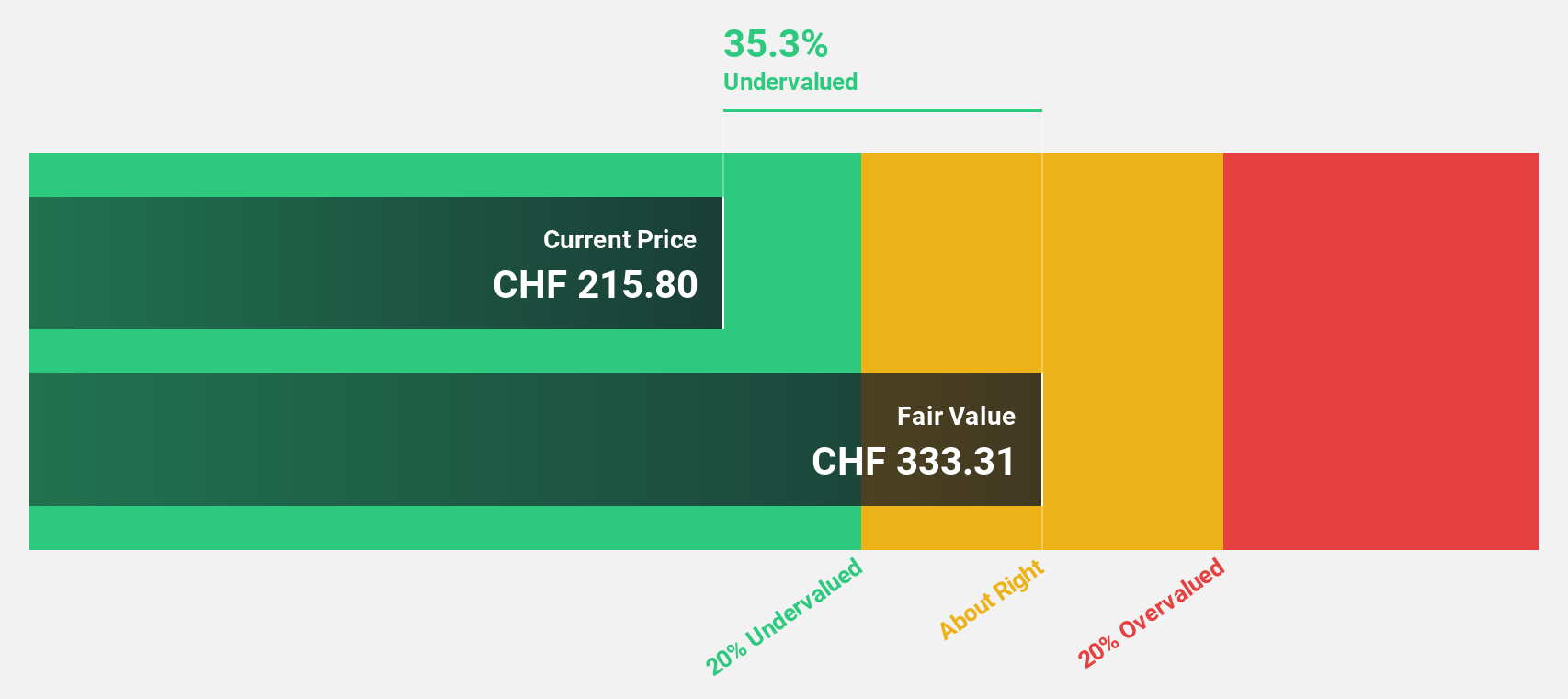

Georg Fischer (SWX:GF)

Overview: Georg Fischer AG operates globally, providing piping systems as well as casting and machining solutions across Europe, the Americas, and Asia, with a market capitalization of approximately CHF 5.45 billion.

Operations: The revenue segments for the company include CHF 1.99 billion from piping systems, CHF 0.90 billion from casting solutions, and CHF 0.85 billion from machining solutions.

Estimated Discount To Fair Value: 22.2%

Georg Fischer, priced at CHF66.6, is undervalued by 22.2%, with a fair value estimated at CHF85.64, reflecting a significant discount. Despite lower profit margins this year (4.6%) compared to last (6.8%), its earnings are expected to grow significantly by 22.3% annually over the next three years, outpacing the Swiss market's 8.3%. However, its debt is poorly covered by operating cash flow, and it has an unstable dividend track record, which might concern risk-averse investors.

- The growth report we've compiled suggests that Georg Fischer's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Georg Fischer.

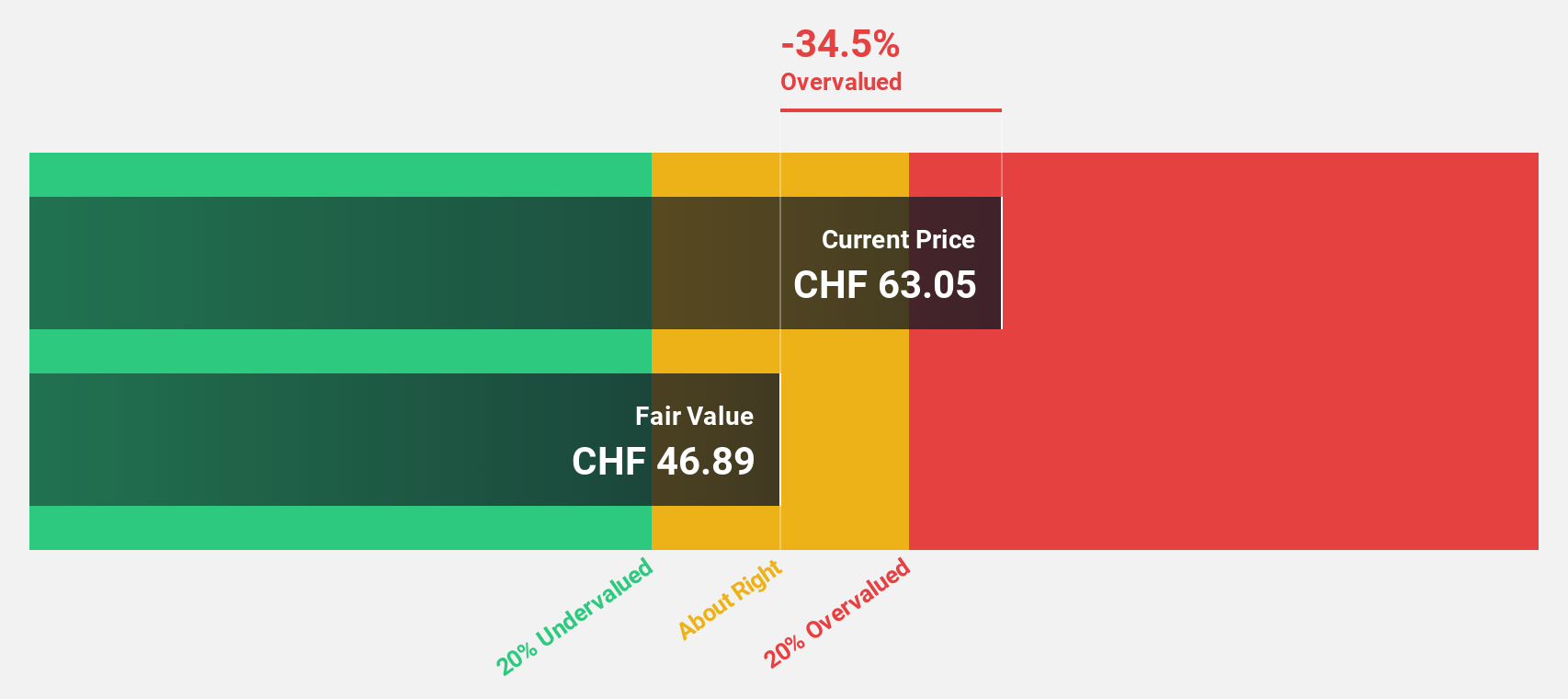

Helvetia Holding (SWX:HELN)

Overview: Helvetia Holding AG operates in the life and non-life insurance and reinsurance sectors across Switzerland, Germany, Austria, Spain, Italy, France, and other international markets with a market capitalization of approximately CHF 6.85 billion.

Operations: Helvetia Holding's revenue is derived primarily from its life insurance segment, which generated CHF 1.81 billion, and its non-life insurance segment, which contributed CHF 7.09 billion.

Estimated Discount To Fair Value: 13.8%

Helvetia Holding, valued at CHF129.6, trades 13.8% below its estimated fair value of CHF150.29, suggesting undervaluation based on cash flows. Despite a dip in net profit margins from last year's 5.1% to 3%, forecasted earnings growth is robust at 22.7% annually, surpassing the Swiss market's 8.3%. However, its dividend coverage by earnings is weak, and the return on equity in three years is projected to be low at 14.3%, which may concern potential investors looking for long-term profitability.

- Upon reviewing our latest growth report, Helvetia Holding's projected financial performance appears quite optimistic.

- Take a closer look at Helvetia Holding's balance sheet health here in our report.

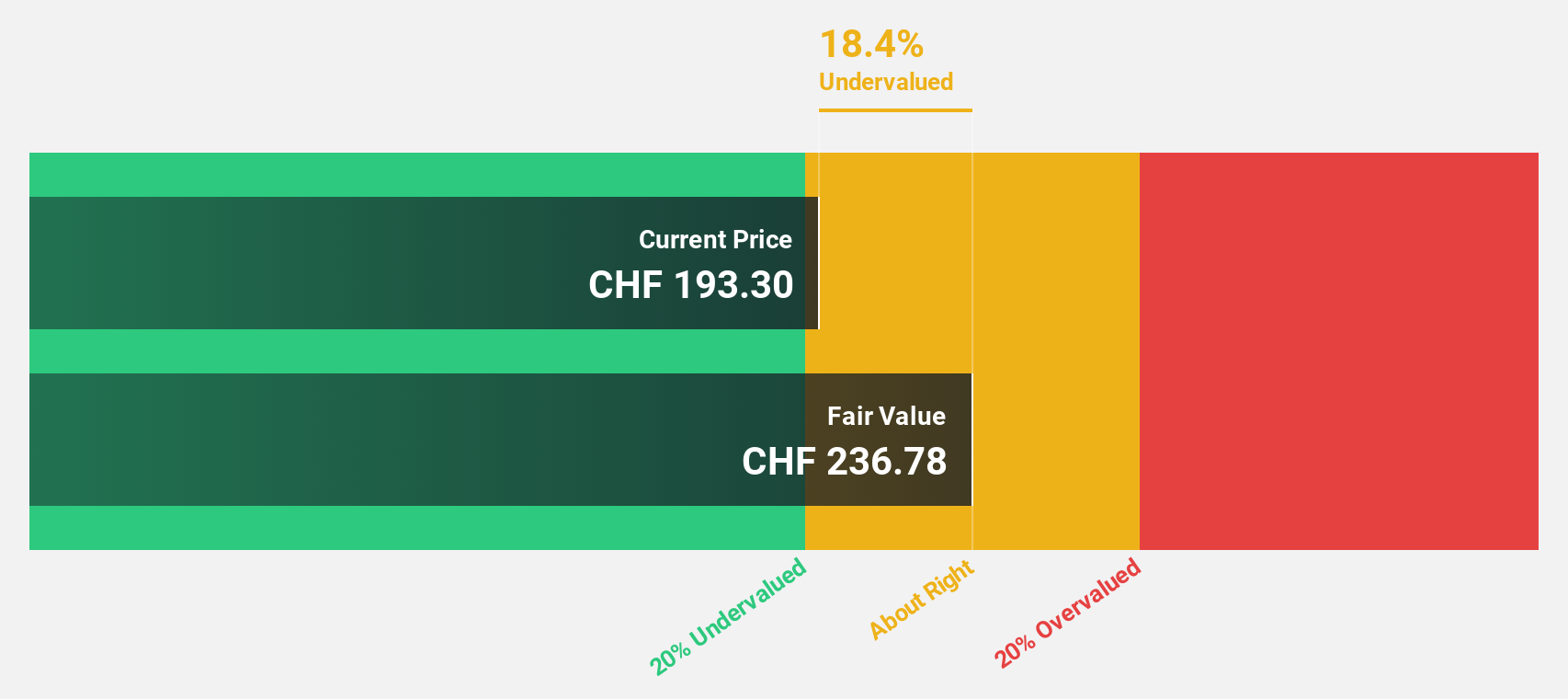

Sika (SWX:SIKA)

Overview: Sika AG is a specialty chemicals company that offers products and systems for bonding, sealing, damping, reinforcing, and protecting in the building and automotive industries globally, with a market capitalization of CHF 42.40 billion.

Operations: The company generates CHF 9.45 billion from construction-related products and CHF 1.78 billion from industrial manufacturing.

Estimated Discount To Fair Value: 22.9%

Sika, priced at CHF264.3, is significantly undervalued with a fair value of CHF342.86, reflecting a 22.9% discount. Expected to outperform the Swiss market, its revenue and earnings are projected to grow by 6.2% and 13.05% annually respectively, compared to market averages of 4.8% and 8.3%. However, it carries a high level of debt which could be a concern despite recent expansions in China enhancing its production capabilities and market reach.

- Our comprehensive growth report raises the possibility that Sika is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Sika stock in this financial health report.

Next Steps

- Navigate through the entire inventory of 15 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helvetia Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:HELN

Helvetia Holding

Engages in life and non-life insurance, and reinsurance business in Switzerland, Germany, Austria, Spain, Italy, France, and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives