- Switzerland

- /

- Food

- /

- SWX:BARN

Exploring Undervalued Stocks on the SIX Swiss Exchange in July 2024

Reviewed by Simply Wall St

The Switzerland market recently showed resilience, closing modestly higher as investors displayed sustained interest in buying, pushing the benchmark SMI to a gain of 45.52 points or 0.38% at 12,051.66. In light of these conditions, identifying undervalued stocks on the SIX Swiss Exchange could offer interesting opportunities for investors seeking value in a market that demonstrates potential for recovery and growth.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sulzer (SWX:SUN) | CHF136.40 | CHF222.79 | 38.8% |

| COLTENE Holding (SWX:CLTN) | CHF48.90 | CHF77.66 | 37% |

| Burckhardt Compression Holding (SWX:BCHN) | CHF606.00 | CHF860.67 | 29.6% |

| Temenos (SWX:TEMN) | CHF64.00 | CHF85.03 | 24.7% |

| Julius Bär Gruppe (SWX:BAER) | CHF51.16 | CHF95.72 | 46.6% |

| Sonova Holding (SWX:SOON) | CHF274.20 | CHF468.57 | 41.5% |

| SGS (SWX:SGSN) | CHF80.86 | CHF125.37 | 35.5% |

| Comet Holding (SWX:COTN) | CHF376.00 | CHF590.35 | 36.3% |

| Medartis Holding (SWX:MED) | CHF69.30 | CHF131.32 | 47.2% |

| Sika (SWX:SIKA) | CHF258.60 | CHF335.75 | 23% |

We're going to check out a few of the best picks from our screener tool

Barry Callebaut (SWX:BARN)

Overview: Barry Callebaut AG operates in the production and sale of chocolate and cocoa products, with a market capitalization of approximately CHF 8.45 billion.

Operations: The company's revenue is divided into segments, with the Global Cocoa segment generating CHF 5.31 billion.

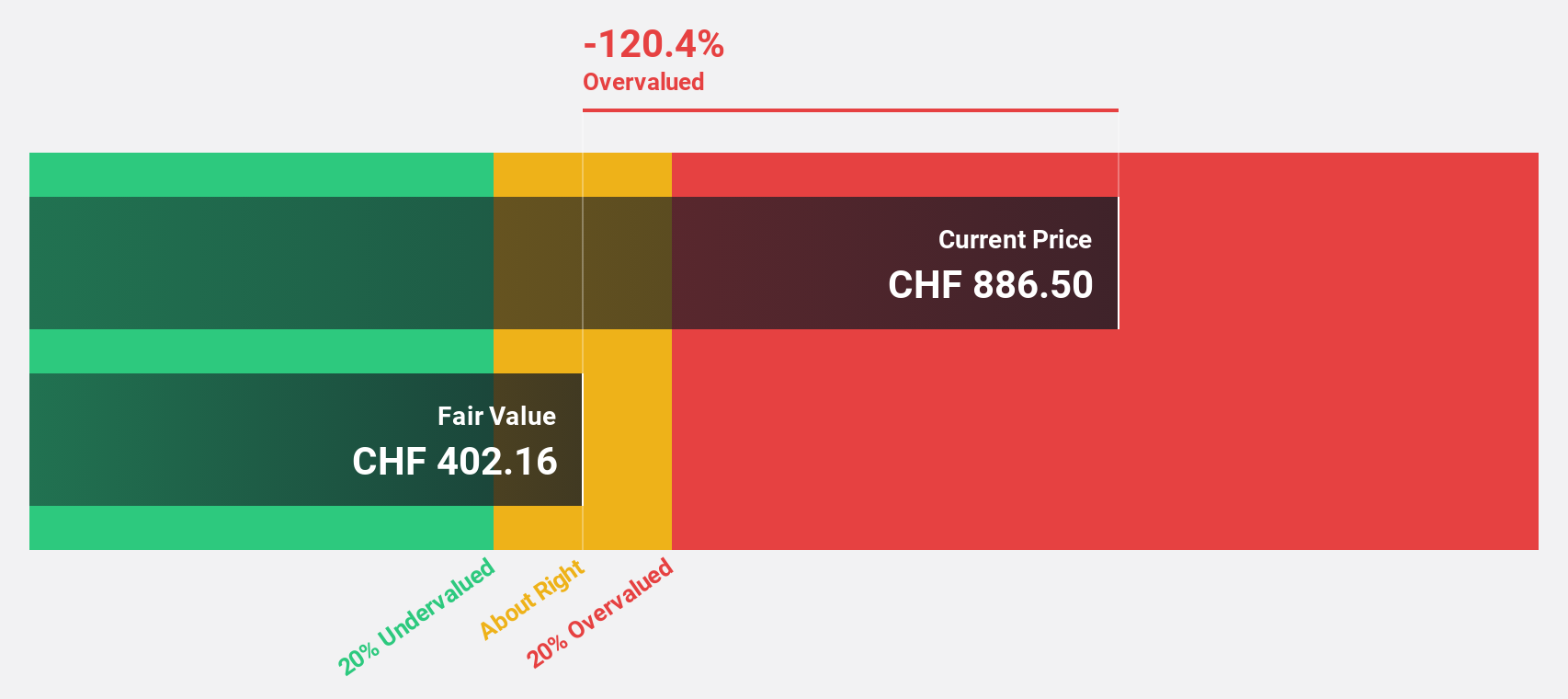

Estimated Discount To Fair Value: 15.5%

Barry Callebaut, trading at CHF 1544, is positioned below our fair value estimate of CHF 1827.66, marking a modest undervaluation. Despite this, the company's debt is poorly covered by operating cash flow and it has experienced significant share price volatility recently. On a positive note, earnings are projected to grow by 25.2% annually over the next three years, outpacing the Swiss market's growth. However, its return on equity is expected to be low at 14.7% in three years' time.

- According our earnings growth report, there's an indication that Barry Callebaut might be ready to expand.

- Navigate through the intricacies of Barry Callebaut with our comprehensive financial health report here.

Sika (SWX:SIKA)

Overview: Sika AG is a specialty chemicals company that offers solutions for bonding, sealing, damping, reinforcing, and protecting in the building and automotive industries globally, with a market capitalization of CHF 41.49 billion.

Operations: The company generates CHF 9.45 billion from its construction industry products and CHF 1.78 billion from industrial manufacturing products.

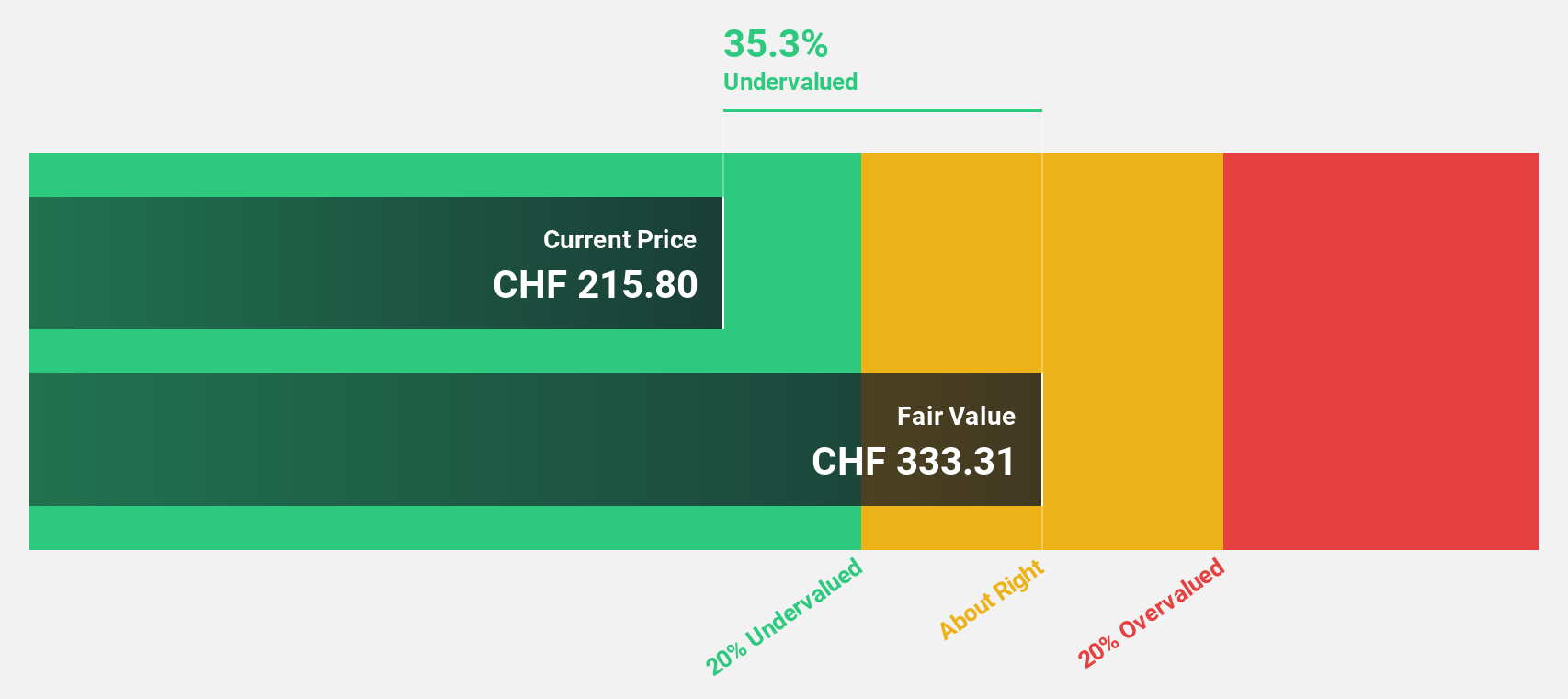

Estimated Discount To Fair Value: 23%

Sika, priced at CHF 258.6, is valued below our fair value estimate of CHF 335.75, indicating a significant undervaluation based on discounted cash flows. Despite a high level of debt, Sika's return on equity is expected to be robust at 20.3% in three years. Earnings are forecasted to grow by 12.7% annually, surpassing the Swiss market's average. Recent expansions in China and Peru underscore its strategic growth initiatives, enhancing its manufacturing capabilities and market reach.

- Our growth report here indicates Sika may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Sika stock in this financial health report.

Sulzer (SWX:SUN)

Overview: Sulzer Ltd is a global company specializing in fluid engineering and chemical processing solutions, with a market capitalization of CHF 4.61 billion.

Operations: The company's revenue is divided into three main segments: Chemtech at CHF 772.50 million, Services at CHF 1.15 billion, and Flow Equipment at CHF 1.35 billion.

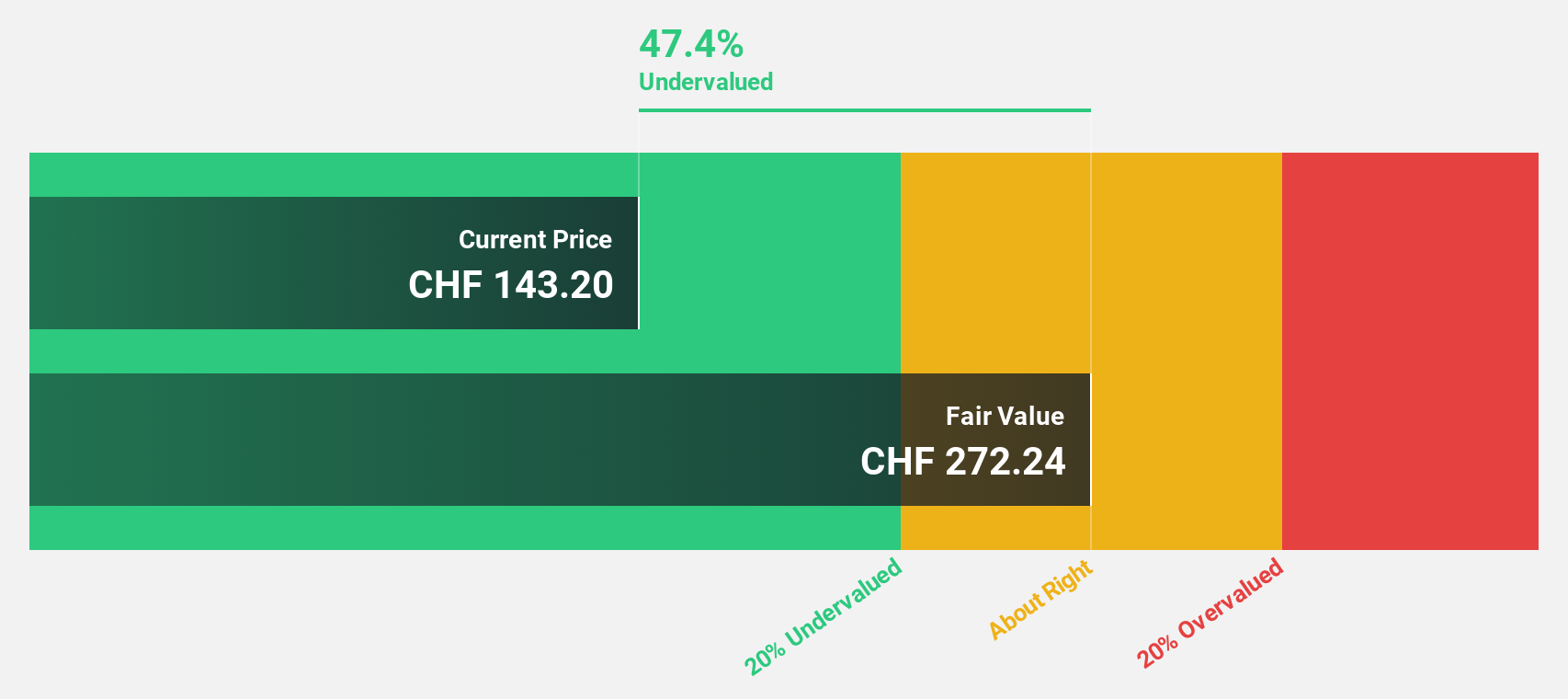

Estimated Discount To Fair Value: 38.8%

Sulzer, with a current price of CHF136.4, is trading at a substantial discount to our fair value estimate of CHF222.79, highlighting its undervaluation based on cash flows. Despite an unstable dividend history, Sulzer's earnings have surged by 701% over the past year and are projected to outpace the Swiss market with an annual growth rate of 9.7%. Recent presentations in Zambia and Germany emphasize its active engagement in industry events, potentially boosting investor confidence.

- Our earnings growth report unveils the potential for significant increases in Sulzer's future results.

- Get an in-depth perspective on Sulzer's balance sheet by reading our health report here.

Make It Happen

- Unlock our comprehensive list of 14 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Barry Callebaut might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BARN

Barry Callebaut

Engages in the manufacture and sale of chocolate and cocoa products in Western Europe, North America, Central and Eastern Europe, Latin America, and internationally.

Moderate risk average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion