- Switzerland

- /

- Basic Materials

- /

- SWX:HOLN

Holcim (SWX:HOLN) Valuation Check After New European Circular Construction Recycling Acquisitions

Reviewed by Simply Wall St

Holcim (SWX:HOLN) just doubled down on circular construction by completing two acquisitions and agreeing a third in demolition materials recycling across the UK, Germany, and France, adding meaningful processing capacity to its ECOCycle ecosystem.

See our latest analysis for Holcim.

Those circular moves come as Holcim’s shares trade around CHF 75.20, with a solid 3 month share price return of 12.47% and an impressive 1 year total shareholder return of 67.09%, suggesting momentum is still firmly with long term holders.

If Holcim’s shift toward circular construction has your attention, it could be worth exploring fast growing stocks with high insider ownership as another way to spot ambitious companies where management has serious skin in the game.

Yet with revenue and earnings slipping, the stock trading slightly above analyst targets, and a negative intrinsic value signal, investors must ask whether Holcim is still a bargain or if future growth is already priced in.

Most Popular Narrative: 2.7% Overvalued

With Holcim’s last close at CHF 75.20 versus a narrative fair value of CHF 73.20, the prevailing view bakes in only a slim premium.

The analysts have a consensus price target of CHF66.956 for Holcim based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF79.3 and the most bearish reporting a price target of CHF51.0.

Curious how shrinking revenues can still support rising margins and a richer earnings multiple by 2028? The narrative leans on bold mix shifts and valuation upgrades. Want to see exactly which assumptions make that tight upside case hold together?

Result: Fair Value of $73.20 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, faster scaling of high margin sustainable products and successful bolt on acquisitions could support stronger earnings and justify today’s richer valuation.

Find out about the key risks to this Holcim narrative.

Another Take: Multiples Point to Value

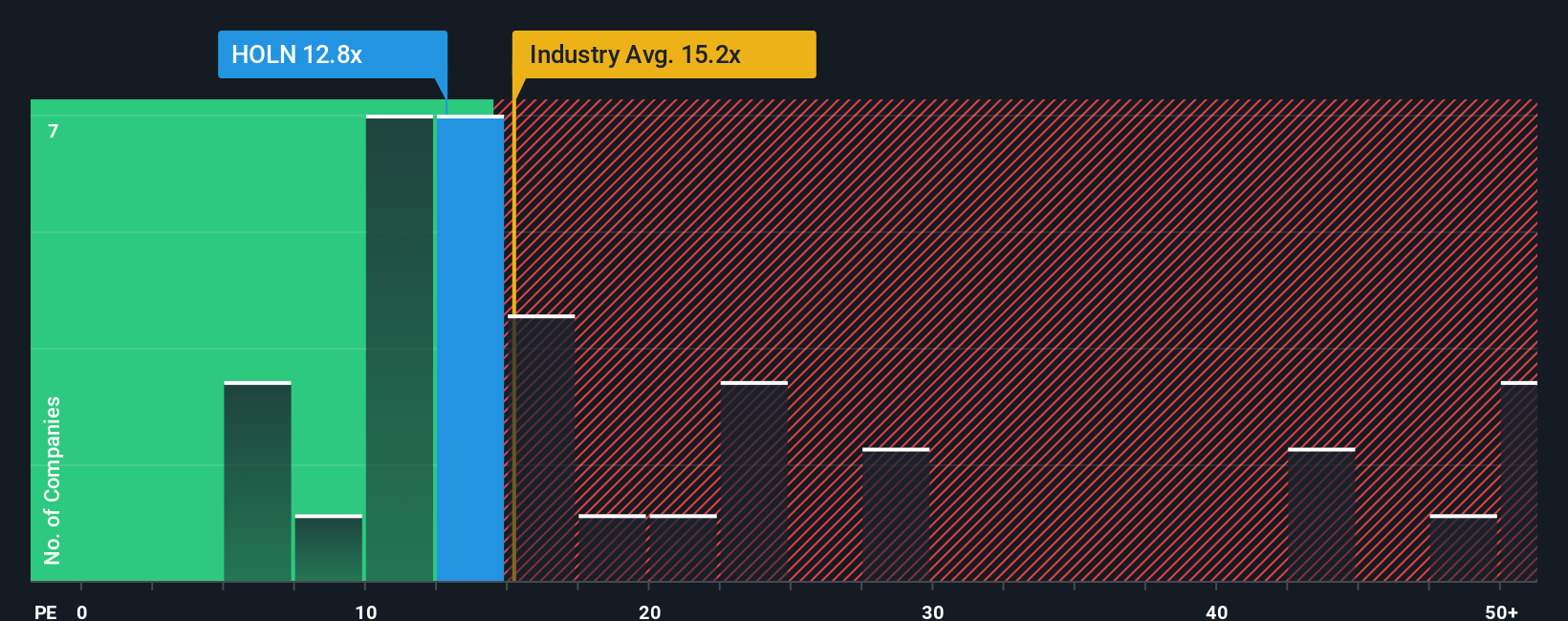

While the narrative fair value suggests Holcim is slightly overvalued, its 12.8x price to earnings sits well below both the European Basic Materials average of 15.6x and a fair ratio of 17.3x, which may hint at upside if sentiment shifts, or a value trap if earnings shrink faster than expected?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Holcim Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can craft a personalised view in just minutes: Do it your way.

A great starting point for your Holcim research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Do not stop at one opportunity. Use the Simply Wall St Screener to uncover fresh ideas that match your strategy before the market catches on.

- Capture income potential by scanning these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow while others focus only on headline growth stories.

- Spot tomorrow’s innovators early by reviewing these 26 AI penny stocks, where emerging leaders push the frontier of automation, data, and machine learning.

- Tilt the odds in your favor by targeting these 908 undervalued stocks based on cash flows, letting you focus on companies where the cash flow story still outpaces the current price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Holcim might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:HOLN

Outstanding track record 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026