Stock Analysis

Three Growth Companies On SIX Swiss Exchange With Insider Ownership As High As 30%

Reviewed by Simply Wall St

The Swiss market recently demonstrated resilience, closing on a strong note despite initial setbacks, buoyed by encouraging GDP growth data and robust buying in the latter part of the trading session. This positive economic backdrop sets an interesting stage for exploring growth companies on the SIX Swiss Exchange, particularly those with substantial insider ownership which can be indicative of confidence in the company’s future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 23.4% |

| VAT Group (SWX:VACN) | 10.2% | 21.2% |

| Straumann Holding (SWX:STMN) | 32.7% | 21% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 14.3% |

| Temenos (SWX:TEMN) | 17.4% | 14.7% |

| LEM Holding (SWX:LEHN) | 29.9% | 8.8% |

| Sonova Holding (SWX:SOON) | 17.7% | 10.3% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Sensirion Holding (SWX:SENS) | 20.7% | 78.3% |

| Arbonia (SWX:ARBN) | 28.8% | 100.1% |

Here's a peek at a few of the choices from the screener.

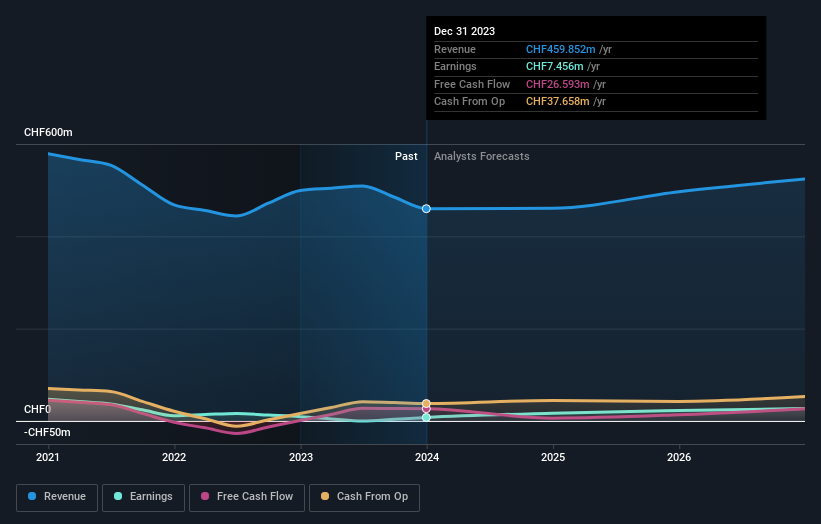

Gurit Holding (SWX:GURN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gurit Holding AG specializes in developing, manufacturing, marketing, and selling advanced composite materials, composite tooling equipment, and kitting services globally with a market capitalization of CHF 274.03 million.

Operations: The company's revenue is primarily derived from three segments: Composite Materials generating CHF 307.09 million, Marine and Industrial at CHF 101.63 million, and Manufacturing Solutions contributing CHF 51.29 million.

Insider Ownership: 30.2%

Gurit Holding is trading at 54.9% below its estimated fair value, suggesting potential undervaluation. Despite its revenue growth forecast being slightly below the Swiss market average at 4% per year, its earnings are expected to surge by 35.08% annually over the next three years, significantly outpacing the broader market's growth. However, it carries a high level of debt and has shown high price volatility recently. Analysts predict a substantial price increase of 44.6%. The company maintains a strong projected Return on Equity at 21.8%.

- Get an in-depth perspective on Gurit Holding's performance by reading our analyst estimates report here.

- The analysis detailed in our Gurit Holding valuation report hints at an deflated share price compared to its estimated value.

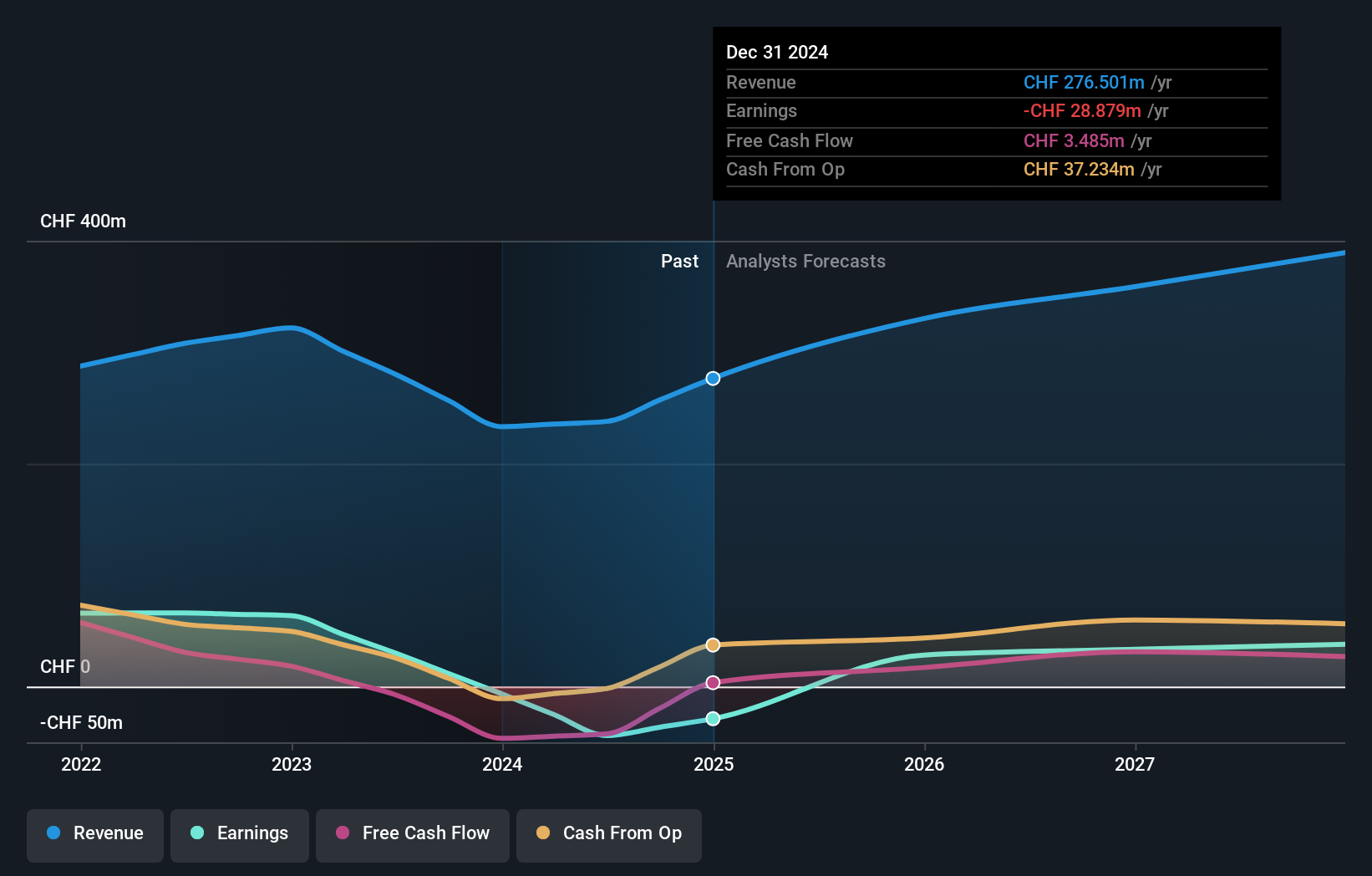

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sensirion Holding AG operates globally, specializing in the development, production, sale, and servicing of sensor systems, modules, and components with a market capitalization of approximately CHF 1.20 billion.

Operations: The company generates CHF 233.17 million from its sensor systems, modules, and components segment.

Insider Ownership: 20.7%

Sensirion Holding, amidst a challenging financial period with a significant sales drop to CHF 233.17 million and a shift to a net loss of CHF 6.58 million in 2023, is refocusing its business strategy on high-potential sectors like methane emission monitoring. Despite the current downturn, Sensirion is expected to recover profitability within three years, with earnings growth predicted at an impressive rate annually. The company's revenue growth is projected to surpass the Swiss market average, although it remains below more aggressive industry benchmarks. This performance coupled with strategic shifts indicates potential for future stabilization and growth in its niche markets.

- Take a closer look at Sensirion Holding's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Sensirion Holding is priced higher than what may be justified by its financials.

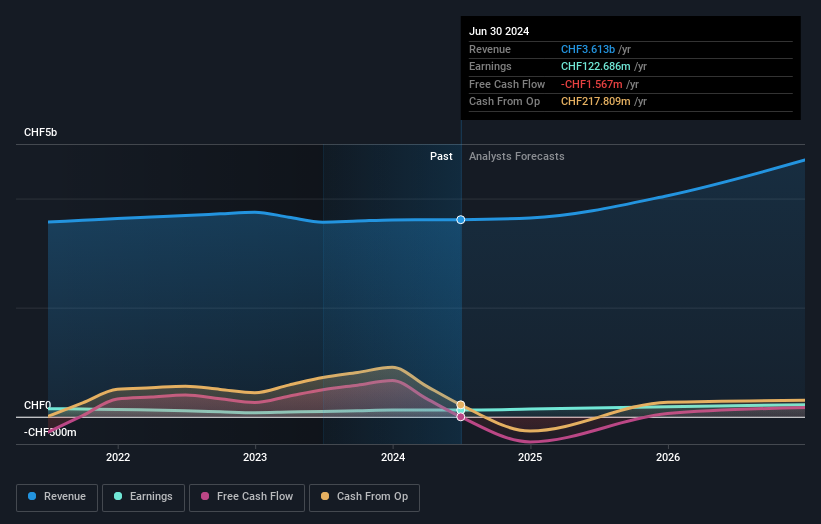

Stadler Rail (SWX:SRAIL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Stadler Rail AG specializes in manufacturing and selling trains across various regions including Switzerland, Germany, Austria, Western and Eastern Europe, the Americas, and the CIS countries with a market capitalization of CHF 2.75 billion.

Operations: Stadler Rail AG generates revenue primarily through three segments: Rolling Stock, which brought in CHF 3.12 billion, Service & Components at CHF 767.55 million, and Signalling with CHF 102.99 million.

Insider Ownership: 14.5%

Stadler Rail AG, a Swiss growth company with high insider ownership, has demonstrated robust financial performance with earnings increasing by 70.5% last year and forecasted to grow at 23.39% annually. Despite an unstable dividend track record, the company's revenue growth is expected to outpace the Swiss market average significantly. Recently reported annual results showed a substantial rise in net income from CHF 72.9 million to CHF 124.32 million, underscoring its strong profit generation capabilities amidst competitive market conditions.

- Dive into the specifics of Stadler Rail here with our thorough growth forecast report.

- Our expertly prepared valuation report Stadler Rail implies its share price may be too high.

Make It Happen

- Investigate our full lineup of 17 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Sensirion Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SENS

Sensirion Holding

Engages in the development, production, sale, and servicing of sensor systems, modules, and components worldwide.

Flawless balance sheet with reasonable growth potential.