One of the best investments we can make is in our own knowledge and skill set. With that in mind, this article will work through how we can use Return On Equity (ROE) to better understand a business. By way of learning-by-doing, we'll look at ROE to gain a better understanding of Givaudan SA (VTX:GIVN).

Over the last twelve months Givaudan has recorded a ROE of 20%. One way to conceptualize this, is that for each CHF1 of shareholders' equity it has, the company made CHF0.20 in profit.

View our latest analysis for Givaudan

How Do I Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit ÷ Shareholders' Equity

Or for Givaudan:

20% = CHF672m ÷ CHF3.4b (Based on the trailing twelve months to June 2019.)

It's easy to understand the 'net profit' part of that equation, but 'shareholders' equity' requires further explanation. It is all the money paid into the company from shareholders, plus any earnings retained. The easiest way to calculate shareholders' equity is to subtract the company's total liabilities from the total assets.

What Does ROE Signify?

ROE looks at the amount a company earns relative to the money it has kept within the business. The 'return' is the amount earned after tax over the last twelve months. That means that the higher the ROE, the more profitable the company is. So, all else equal, investors should like a high ROE. That means it can be interesting to compare the ROE of different companies.

Does Givaudan Have A Good Return On Equity?

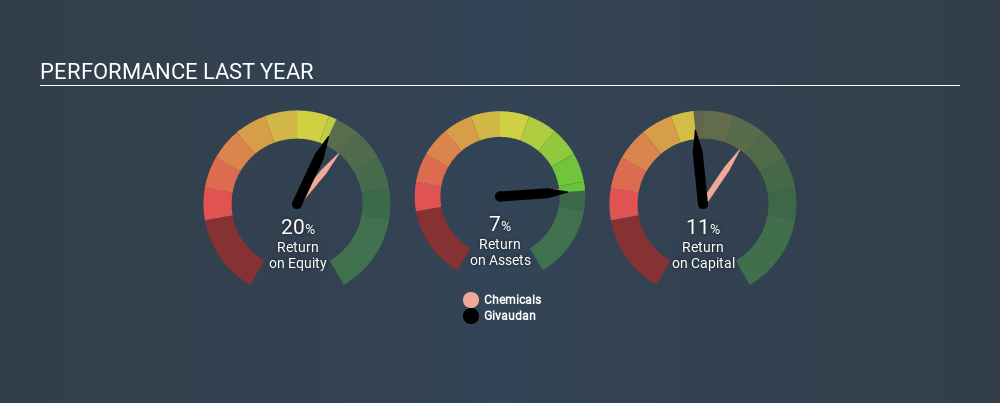

By comparing a company's ROE with its industry average, we can get a quick measure of how good it is. The limitation of this approach is that some companies are quite different from others, even within the same industry classification. The image below shows that Givaudan has an ROE that is roughly in line with the Chemicals industry average (22%).

That's neither particularly good, nor bad. ROE can give us a view about company quality, but many investors also look to other factors, such as whether there are insiders buying shares. I will like Givaudan better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

How Does Debt Impact ROE?

Virtually all companies need money to invest in the business, to grow profits. The cash for investment can come from prior year profits (retained earnings), issuing new shares, or borrowing. In the first and second cases, the ROE will reflect this use of cash for investment in the business. In the latter case, the debt required for growth will boost returns, but will not impact the shareholders' equity. Thus the use of debt can improve ROE, albeit along with extra risk in the case of stormy weather, metaphorically speaking.

Combining Givaudan's Debt And Its 20% Return On Equity

Givaudan does use a significant amount of debt to increase returns. It has a debt to equity ratio of 1.06. I think the ROE is impressive, but it would have been assisted by the use of debt. Debt increases risk and reduces options for the company in the future, so you generally want to see some good returns from using it.

The Bottom Line On ROE

Return on equity is a useful indicator of the ability of a business to generate profits and return them to shareholders. In my book the highest quality companies have high return on equity, despite low debt. If two companies have around the same level of debt to equity, and one has a higher ROE, I'd generally prefer the one with higher ROE.

Having said that, while ROE is a useful indicator of business quality, you'll have to look at a whole range of factors to determine the right price to buy a stock. It is important to consider other factors, such as future profit growth -- and how much investment is required going forward. So you might want to check this FREE visualization of analyst forecasts for the company.

If you would prefer check out another company -- one with potentially superior financials -- then do not miss thisfree list of interesting companies, that have HIGH return on equity and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SWX:GIVN

Givaudan

Manufactures, supplies, and sells fragrance, beauty, taste, and wellbeing products to the consumer goods industry.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)