- Switzerland

- /

- Chemicals

- /

- SWX:CLN

Does Clariant's (SWX:CLN) Cautious 2025 Outlook Reflect a Shift in Its Margin Story?

Reviewed by Sasha Jovanovic

- Clariant AG recently confirmed its earnings guidance for 2025, forecasting local currency sales growth at the lower end of its previously outlined 1% to 3% range.

- This guidance update signals a degree of caution regarding near-term market conditions and could influence how investors view the company's immediate growth prospects.

- We’ll look at how Clariant’s updated sales outlook may affect confidence in its margin-focused investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Clariant Investment Narrative Recap

To be a Clariant shareholder today, you need to believe in the company’s ability to deliver on its margin-focused strategy despite an environment of sluggish industrial demand and rising competition. The recently reaffirmed 2025 sales outlook at the lower end of guidance does not appear to change the immediate catalyst for margin improvement but does reinforce macroeconomic and demand risks as the biggest concerns for the near term.

Of recent developments, Clariant's July guidance revision attributing subdued sales growth to weak industrial production is closely tied to this latest confirmation. It provides direct context for investor caution, especially as volume pressures and cyclical exposure remain at the forefront of risks to both top-line momentum and margin resilience.

Conversely, investors should remain aware of how ongoing exposure to China, amid tariffs, muted demand, and overcapacity, might further impact...

Read the full narrative on Clariant (it's free!)

Clariant's outlook points to CHF4.5 billion in revenue and CHF358.4 million in earnings by 2028. This is based on an expected annual revenue growth rate of 3.3% and a CHF245.4 million increase in earnings from the current CHF113.0 million.

Uncover how Clariant's forecasts yield a CHF9.78 fair value, a 42% upside to its current price.

Exploring Other Perspectives

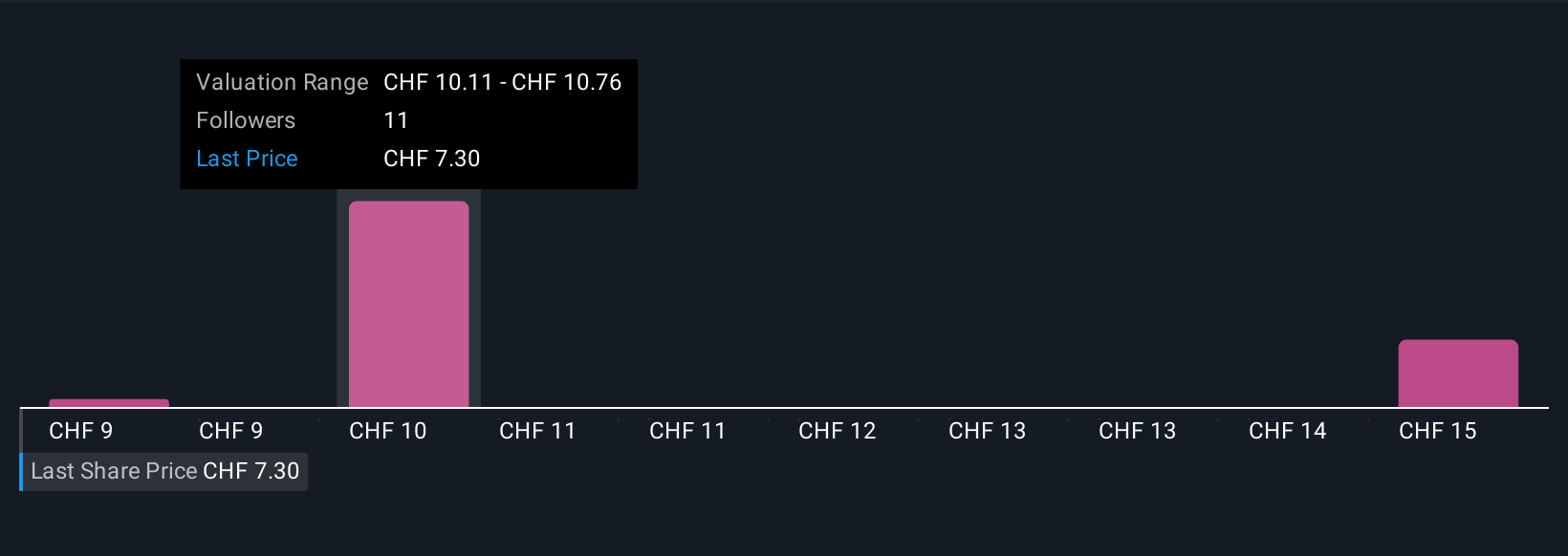

Four Community members assessed Clariant's fair value from CHF8.80 to CHF23.47. With growth expectations challenged by weak industrial production, it’s vital to explore a range of views on the company’s prospects.

Explore 4 other fair value estimates on Clariant - why the stock might be worth over 3x more than the current price!

Build Your Own Clariant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clariant research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Clariant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clariant's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CLN

Clariant

Develops, manufactures, distributes, and sells specialty chemicals in Switzerland, Europe, the Middle East, Africa, the United States, and the Asia Pacific.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives