- Switzerland

- /

- Chemicals

- /

- SWX:CLN

August 2024's Intriguing Value Stocks On The SIX Swiss Exchange

Reviewed by Simply Wall St

The Switzerland market ended marginally down on Wednesday as investors refrained from making significant moves, awaiting more clarity on the Federal Reserve's anticipated interest rate cut. Amidst this cautious atmosphere, identifying undervalued stocks becomes crucial for investors looking to capitalize on potential growth opportunities while mitigating risks.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LEM Holding (SWX:LEHN) | CHF1230.00 | CHF1814.76 | 32.2% |

| Swissquote Group Holding (SWX:SQN) | CHF306.40 | CHF567.82 | 46% |

| Georg Fischer (SWX:GF) | CHF65.15 | CHF112.56 | 42.1% |

| Clariant (SWX:CLN) | CHF13.26 | CHF21.78 | 39.1% |

| lastminute.com (SWX:LMN) | CHF19.84 | CHF29.92 | 33.7% |

| Comet Holding (SWX:COTN) | CHF344.50 | CHF663.14 | 48% |

| Emmi (SWX:EMMN) | CHF886.00 | CHF1606.37 | 44.8% |

| SoftwareONE Holding (SWX:SWON) | CHF15.94 | CHF21.47 | 25.8% |

| SGS (SWX:SGSN) | CHF94.28 | CHF145.94 | 35.4% |

| Dätwyler Holding (SWX:DAE) | CHF172.80 | CHF251.42 | 31.3% |

Underneath we present a selection of stocks filtered out by our screen.

Clariant (SWX:CLN)

Overview: Clariant AG is a global company involved in the development, manufacture, distribution, and sale of specialty chemicals with a market cap of CHF4.36 billion.

Operations: The company's revenue segments include Catalysis (CHF927 million), Care Chemicals (CHF2.22 billion), and Adsorbents & Additives (CHF1.02 billion).

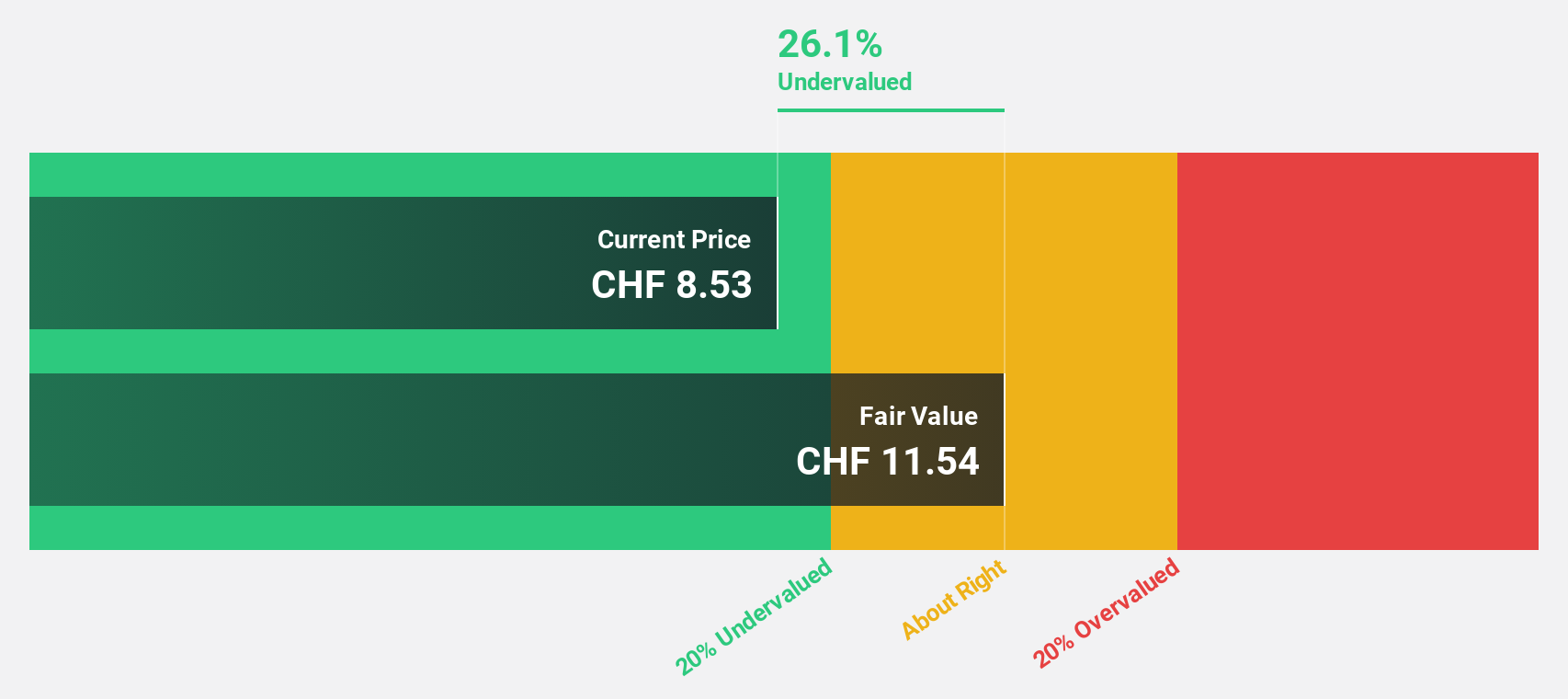

Estimated Discount To Fair Value: 39.1%

Clariant AG's recent earnings report showed a decline in both sales and net income, with CHF 2.07 billion in sales and CHF 157 million in net income for the first half of 2024. Despite this, the stock appears significantly undervalued, trading at CHF 13.26 compared to an estimated fair value of CHF 21.78. Analysts forecast robust annual profit growth of over 30%, well above the Swiss market average, although high debt levels remain a concern.

- Upon reviewing our latest growth report, Clariant's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Clariant's balance sheet by reading our health report here.

Georg Fischer (SWX:GF)

Overview: Georg Fischer AG provides piping systems, casting, and machining solutions globally with a market cap of CHF5.34 billion.

Operations: Georg Fischer AG's revenue segments include CHF1.99 billion from piping systems, CHF901 million from casting solutions, and CHF853 million from machining solutions.

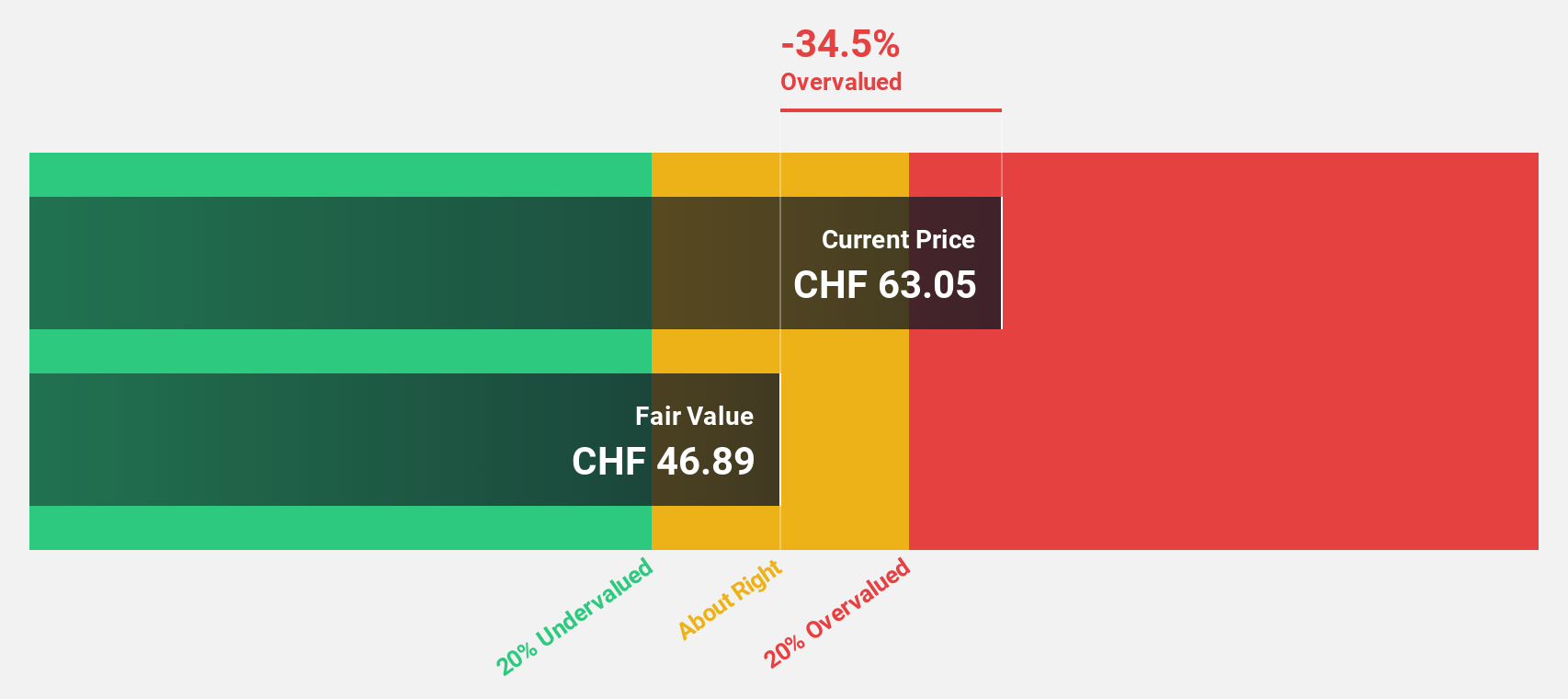

Estimated Discount To Fair Value: 42.1%

Georg Fischer AG reported half-year sales of CHF 2.41 billion, up from CHF 1.96 billion a year ago, with net income dropping to CHF 97 million from CHF 123 million. Trading at CHF 65.15, it is significantly undervalued compared to the estimated fair value of CHF 112.56. Despite lower profit margins and unstable dividends, earnings are projected to grow at an impressive annual rate of over 23%, outpacing the Swiss market's growth forecast.

- The growth report we've compiled suggests that Georg Fischer's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Georg Fischer stock in this financial health report.

VAT Group (SWX:VACN)

Overview: VAT Group AG, with a market cap of CHF13.06 billion, develops, manufactures, and supplies vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows across Switzerland, Europe, the United States, Japan, Korea, Singapore, China and other international markets.

Operations: The company's revenue segments include Valves (CHF783.51 million) and Global Service (CHF163.83 million).

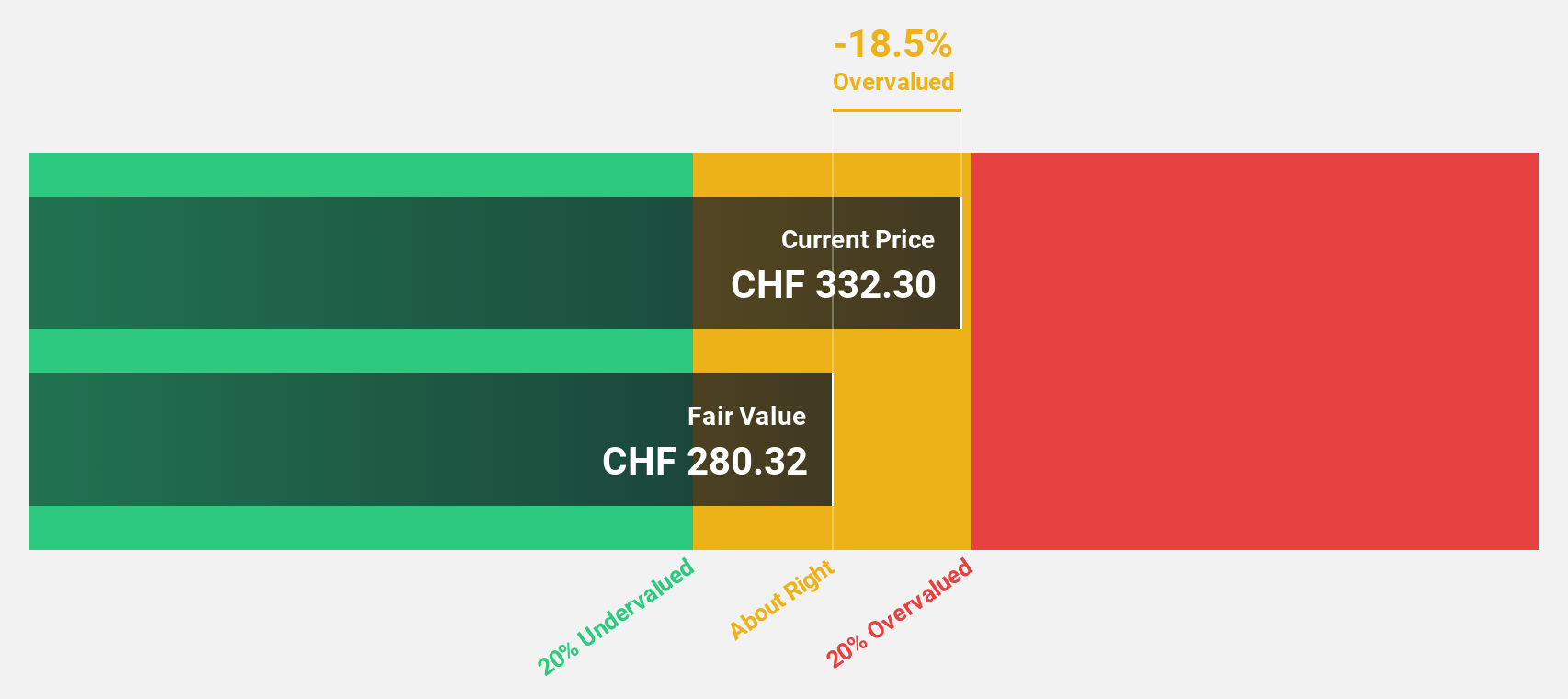

Estimated Discount To Fair Value: 21.5%

VAT Group AG is trading at CHF 435.5, which is 21.5% below its estimated fair value of CHF 555.12, indicating it may be undervalued based on cash flows. The company's earnings are forecast to grow significantly at 22.48% per year over the next three years, outpacing the Swiss market's growth rate of 11.9%. Recent half-year results show net income increased to CHF 94 million from CHF 84.2 million a year ago, despite slightly lower sales.

- Insights from our recent growth report point to a promising forecast for VAT Group's business outlook.

- Click to explore a detailed breakdown of our findings in VAT Group's balance sheet health report.

Summing It All Up

- Dive into all 15 of the Undervalued SIX Swiss Exchange Stocks Based On Cash Flows we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CLN

Clariant

Engages in the development, manufacture, distribution, and sale of specialty chemicals worldwide.

Reasonable growth potential with adequate balance sheet.