- Switzerland

- /

- Chemicals

- /

- SWX:CLN

3 Swiss Stocks On The SIX Swiss Exchange Trading Up To 40.6% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

The Swiss market ended weak on Monday, constrained by global concerns and rising geopolitical tensions, with the SMI closing down 0.53% at 12,168.87. Despite this bearish mood, a favorable outlook from the KOF Swiss Economic Institute suggests potential recovery in sectors like manufacturing and financial services. In such a climate, identifying undervalued stocks becomes crucial for investors seeking opportunities amidst market uncertainties. Here are three stocks on the SIX Swiss Exchange trading up to 40.6% below intrinsic value estimates that may warrant closer attention.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Swissquote Group Holding (SWX:SQN) | CHF304.40 | CHF565.96 | 46.2% |

| LEM Holding (SWX:LEHN) | CHF1374.00 | CHF1828.40 | 24.9% |

| ALSO Holding (SWX:ALSN) | CHF271.00 | CHF365.80 | 25.9% |

| Georg Fischer (SWX:GF) | CHF63.85 | CHF112.33 | 43.2% |

| lastminute.com (SWX:LMN) | CHF18.00 | CHF29.59 | 39.2% |

| Clariant (SWX:CLN) | CHF12.80 | CHF21.54 | 40.6% |

| Barry Callebaut (SWX:BARN) | CHF1566.00 | CHF2287.69 | 31.5% |

| Comet Holding (SWX:COTN) | CHF333.50 | CHF529.18 | 37% |

| Dätwyler Holding (SWX:DAE) | CHF172.60 | CHF241.68 | 28.6% |

| SGS (SWX:SGSN) | CHF94.34 | CHF150.08 | 37.1% |

Here we highlight a subset of our preferred stocks from the screener.

Clariant (SWX:CLN)

Overview: Clariant AG develops, manufactures, distributes, and sells specialty chemicals globally with a market cap of CHF4.21 billion.

Operations: The company's revenue segments include Catalysis (CHF927 million), Care Chemicals (CHF2.22 billion), and Adsorbents & Additives (CHF1.02 billion).

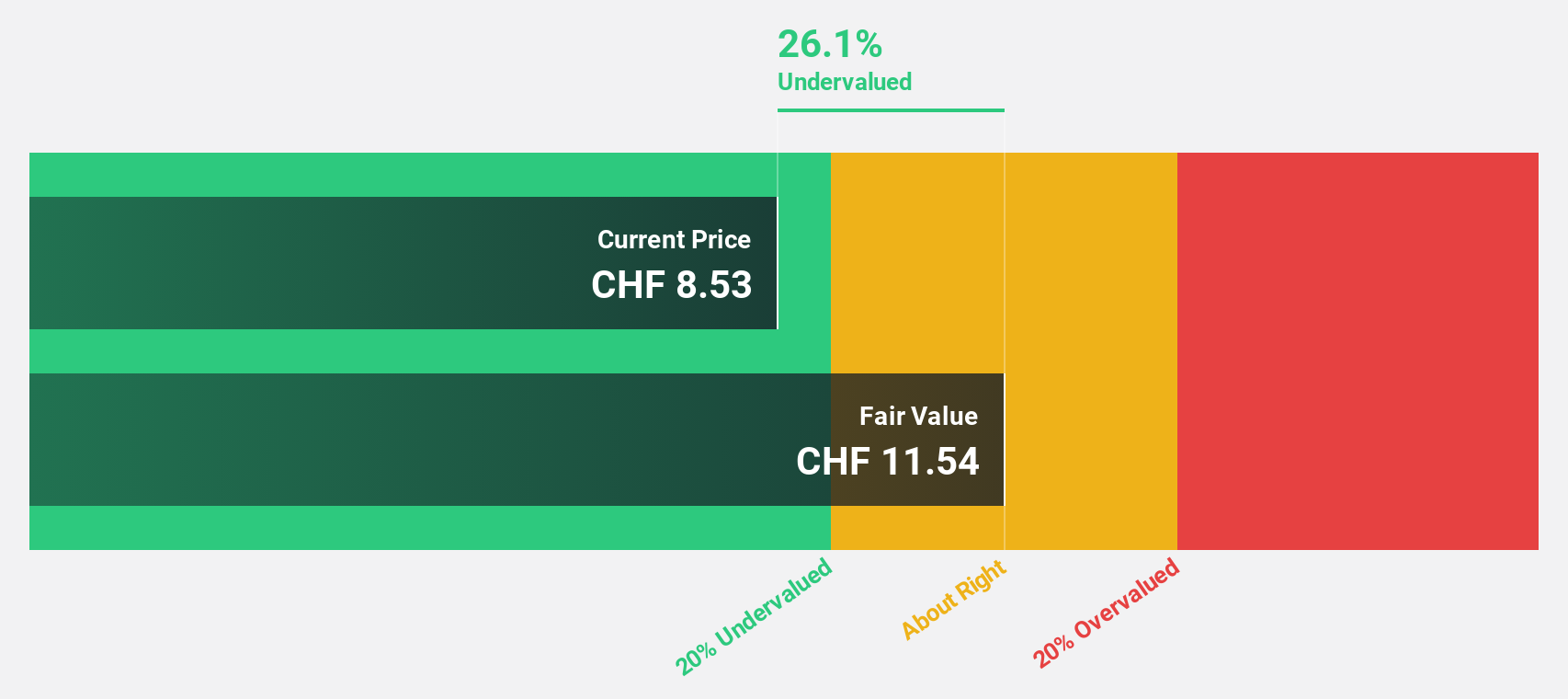

Estimated Discount To Fair Value: 40.6%

Clariant AG is trading at 40.6% below its estimated fair value of CHF21.54, indicating it may be undervalued based on cash flows. Despite a high level of debt and a dividend yield of 3.28% that isn't well covered by earnings, the company's earnings are forecast to grow significantly at 30.26% per year, outpacing the Swiss market's growth rate. Recent half-year results showed decreased sales (CHF2.07 billion) and net income (CHF157 million), but analysts expect a 23.5% rise in stock price.

- In light of our recent growth report, it seems possible that Clariant's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Clariant.

u-blox Holding (SWX:UBXN)

Overview: u-blox Holding AG develops, manufactures, and markets GPS/GNSS satellite positioning systems for various sectors globally and has a market cap of CHF573.22 million.

Operations: Revenue from wireless communications equipment totals CHF365.79 million.

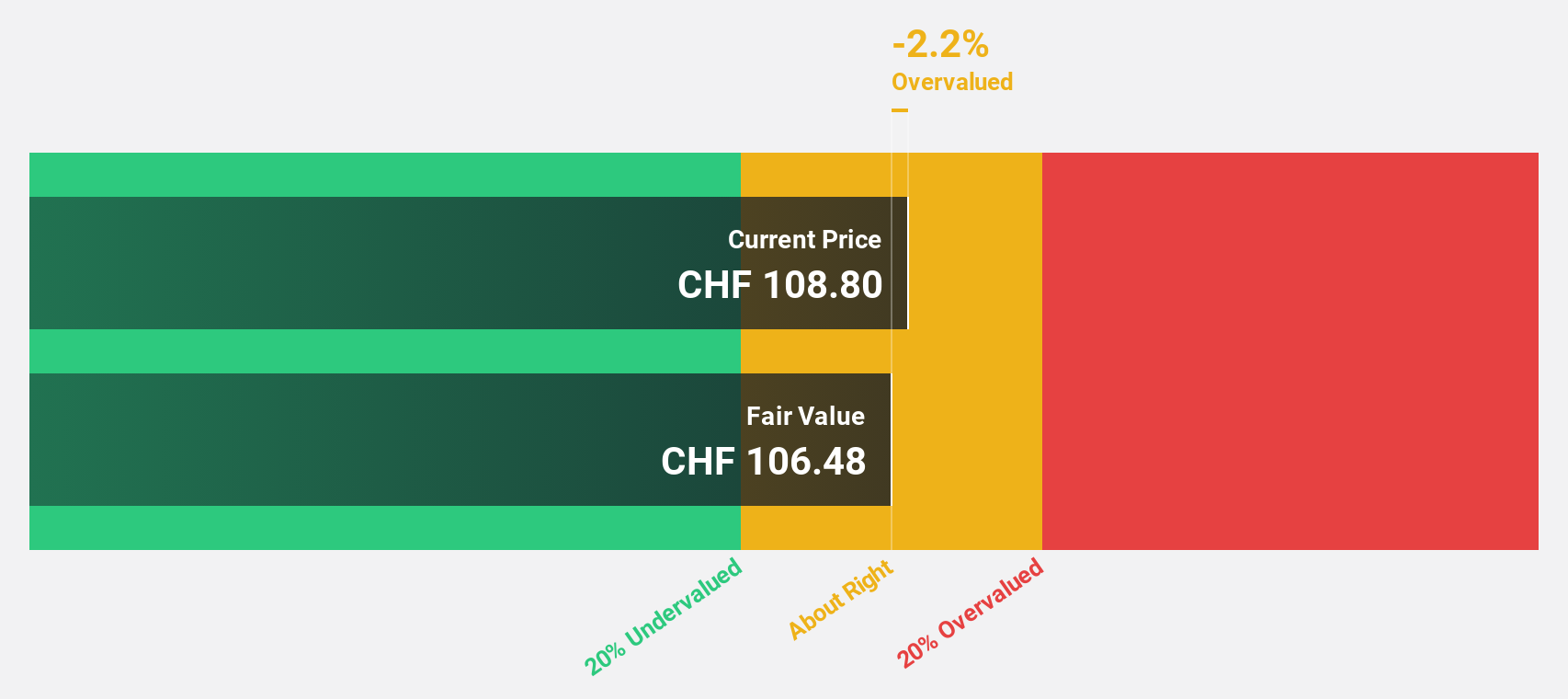

Estimated Discount To Fair Value: 20.3%

u-blox Holding AG is trading 20.3% below its estimated fair value of CHF97.57, suggesting it could be undervalued based on cash flows. Despite recent financial challenges, including a net loss of CHF25.79 million for H1 2024, the company is expected to become profitable within three years with earnings forecasted to grow at over 100% annually. Recent product launches like the X20 GNSS platform and SARA-S528NM10 IoT module highlight its commitment to innovation and potential for future revenue growth in high-precision positioning and IoT markets.

- Upon reviewing our latest growth report, u-blox Holding's projected financial performance appears quite optimistic.

- Navigate through the intricacies of u-blox Holding with our comprehensive financial health report here.

VAT Group (SWX:VACN)

Overview: VAT Group AG, with a market cap of CHF12.92 billion, develops, manufactures, and supplies vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows across Switzerland, Europe, the United States, Japan, Korea, Singapore, China and other international markets.

Operations: The company's revenue segments are composed of CHF783.51 million from Valves and CHF163.83 million from Global Service.

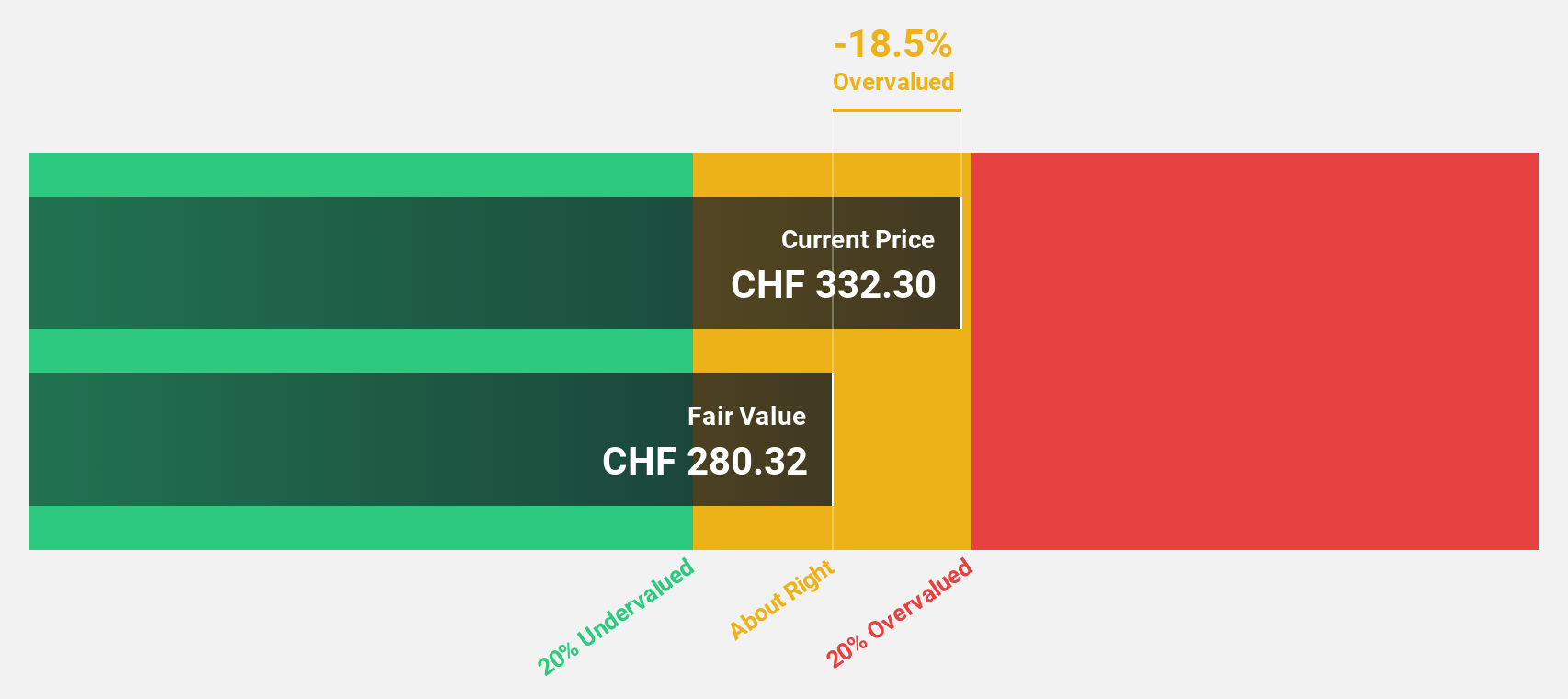

Estimated Discount To Fair Value: 22.6%

VAT Group AG is trading 22.6% below its estimated fair value of CHF556.38, indicating potential undervaluation based on cash flows. Despite a highly volatile share price over the past three months, VAT Group reported strong financials for H1 2024, with net income rising to CHF94 million from CHF84.2 million a year ago. Earnings are forecasted to grow significantly at 22.5% annually, outpacing the Swiss market's average growth rate and reflecting robust future profitability prospects.

- Our growth report here indicates VAT Group may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of VAT Group stock in this financial health report.

Next Steps

- Click through to start exploring the rest of the 11 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CLN

Clariant

Develops, manufactures, distributes, and sells specialty chemicals in Switzerland, Europe, the Middle East, Africa, the United States, and the Asia Pacific.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives