- Switzerland

- /

- Basic Materials

- /

- SWX:AMRZ

Assessing Amrize (SWX:AMRZ) Valuation as Shares Hold Steady in a Quiet Market Phase

Reviewed by Kshitija Bhandaru

Amrize (SWX:AMRZ) shares have been moving within a fairly narrow range this month, with the stock fluctuating modestly as investors evaluate recent company performance and broader market sentiment. The current setup offers a useful vantage point for revisiting Amrize's valuation and outlook.

See our latest analysis for Amrize.

Amrize’s share price has edged lower so far this year, reflecting broader market caution even as the company posts steady revenue and earnings growth. Momentum has faded compared to previous periods, which places a spotlight on underlying value and future growth drivers.

If this quieter phase has you curious about other opportunities, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With solid fundamentals and a double-digit discount to analyst price targets, the question now is whether Amrize shares have room to run from here or if the market already anticipates future gains in the current price.

Price-to-Earnings of 22.5x: Is it justified?

Amrize trades at a price-to-earnings ratio of 22.5x, just below the peer average of 22.8x. This suggests its valuation aligns closely with comparable companies in the sector.

The price-to-earnings ratio measures how much investors are willing to pay for each Swiss franc of earnings. It is a widely used gauge of relative value for profitable companies, especially in established sectors like Basic Materials.

Given Amrize’s improving profit margins and accelerating earnings growth, the market appears to be recognizing its solid recent financial performance but remains cautious about paying a premium. Notably, Amrize’s earnings multiple is still substantially above the broader European Basic Materials industry average of 13.6x. This may indicate higher expectations or perceived stability compared to some sector peers.

While the peer comparison shows Amrize is fairly valued within its closest group, its above-industry multiple reflects a market view that its growth and earnings outlook may exceed basic sector trends. Investors should watch for any shift toward the industry average, which could prompt valuation adjustments.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 22.5x (ABOUT RIGHT)

However, persistent market caution or a slowdown in revenue momentum could quickly alter sentiment and put pressure on Amrize’s valuation outlook.

Find out about the key risks to this Amrize narrative.

Another View: Discounted Cash Flow Points to Significant Undervaluation

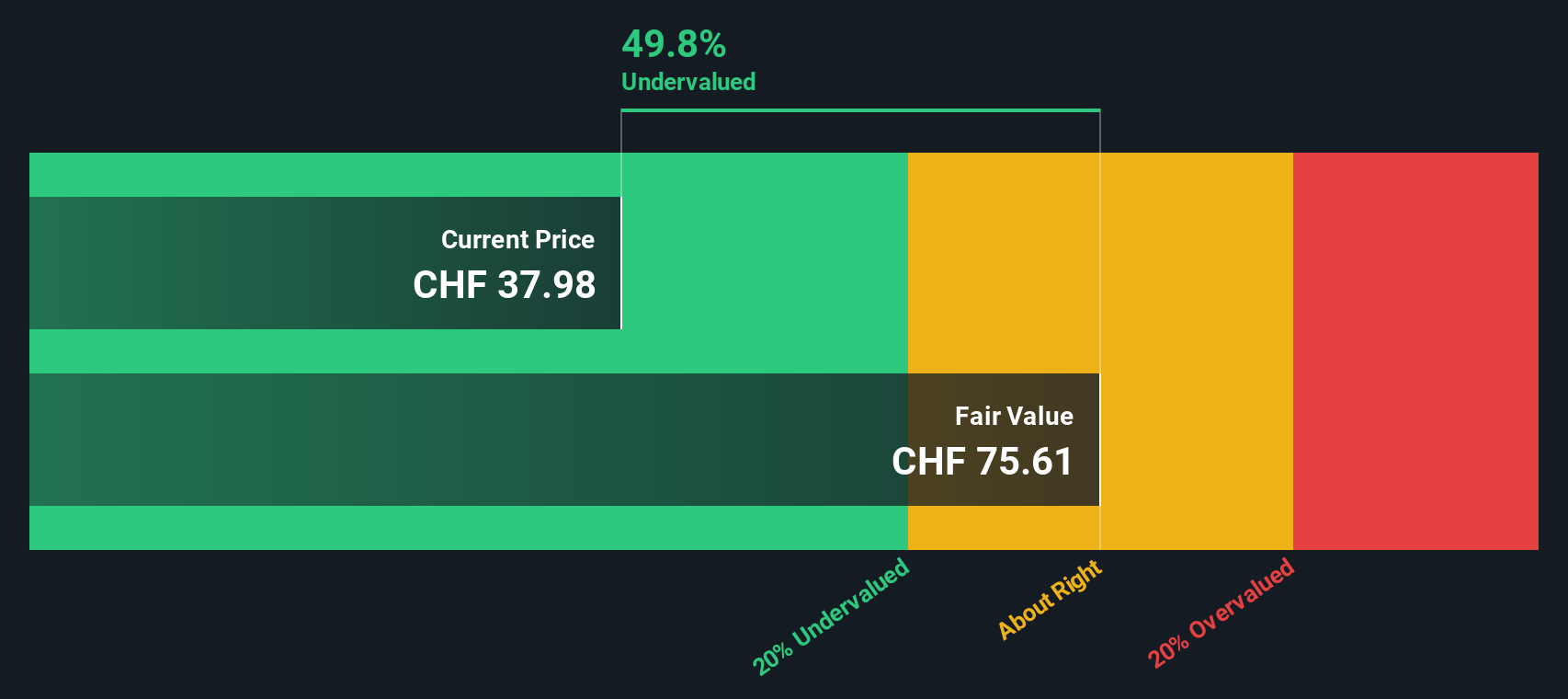

While Amrize looks fairly valued against peers based on earnings, a different picture emerges from our DCF model. This method estimates the company’s intrinsic worth by projecting future cash flows, and it currently suggests Amrize’s shares trade about 49% below fair value.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Amrize for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Amrize Narrative

If you’re keen to dig deeper or come to your own conclusions, you can easily build a personalized narrative using our tools in just minutes. Do it your way.

A great starting point for your Amrize research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

You owe it to yourself to seize the next big opportunity. Start your search with investment ideas tailored to today’s market trends and financial landscape.

- Gain an edge in yield-hunting by checking out these 19 dividend stocks with yields > 3% that offer robust returns above the standard rate.

- Uncover tomorrow’s disruptive technology by browsing these 24 AI penny stocks accelerating breakthroughs in artificial intelligence and software innovation.

- Tap into fast-moving value opportunities by scanning these 904 undervalued stocks based on cash flows trading well below their fair value estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:AMRZ

Solid track record and good value.

Market Insights

Community Narratives