- Switzerland

- /

- Insurance

- /

- SWX:ZURN

Zurich Insurance Group (SWX:ZURN): Assessing Valuation as Strategy Targets Boost Growth and Retail Profitability Prospects

Reviewed by Simply Wall St

Zurich Insurance Group (SWX:ZURN) is gaining attention as it pushes forward with its 2025 to 2027 strategy, citing disciplined execution and improvements in its retail business profitability. The company is also ramping up growth efforts across segments.

See our latest analysis for Zurich Insurance Group.

The recent wave of strategic initiatives, including the appointment of a new Asia-Pacific chief claims officer and a focus on Zurich Insurance Group’s specialty unit, appears to have renewed investor confidence. While the share price has gained 3.5% year-to-date, it is Zurich’s 7.3% total shareholder return over the past year and nearly doubling of value over five years that stand out. This highlights steady, long-term momentum even as shorter-term price swings remain modest.

If Zurich’s disciplined strategy piques your interest, now is a great time to see what else is out there and discover fast growing stocks with high insider ownership

With performance steadily climbing and ambitious targets in sight, investors now face a crucial question: Is Zurich Insurance still undervalued, or is its future growth already priced into today’s share price?

Most Popular Narrative: 2% Overvalued

Zurich Insurance Group’s last close of CHF563.80 sits slightly above the most widely followed narrative’s fair value estimate of CHF552.80, suggesting limited upside according to these projections. The landscape appears finely balanced. Here is what is shaping the current valuation.

“Zurich is strategically pivoting its P&C business toward specialties and mid-market segments while reducing exposure to large corporate and liability lines, capitalizing on increased demand for complex risk management solutions and better pricing discipline, supporting both sustained revenue growth and improved net margins.”

Want to know why these strategic shifts have analysts calling the stock close to fully priced? The answer lies in how Zurich’s revenue mix and fresh efficiency targets lay the groundwork for a future earnings profile that sets the market’s current expectations. Ready to discover what key assumptions power this valuation call? The full narrative has the details hidden in plain sight.

Result: Fair Value of $552.80 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps in new markets or persistent cost pressures could undermine Zurich’s growth narrative and challenge today’s positive valuation outlook.

Find out about the key risks to this Zurich Insurance Group narrative.

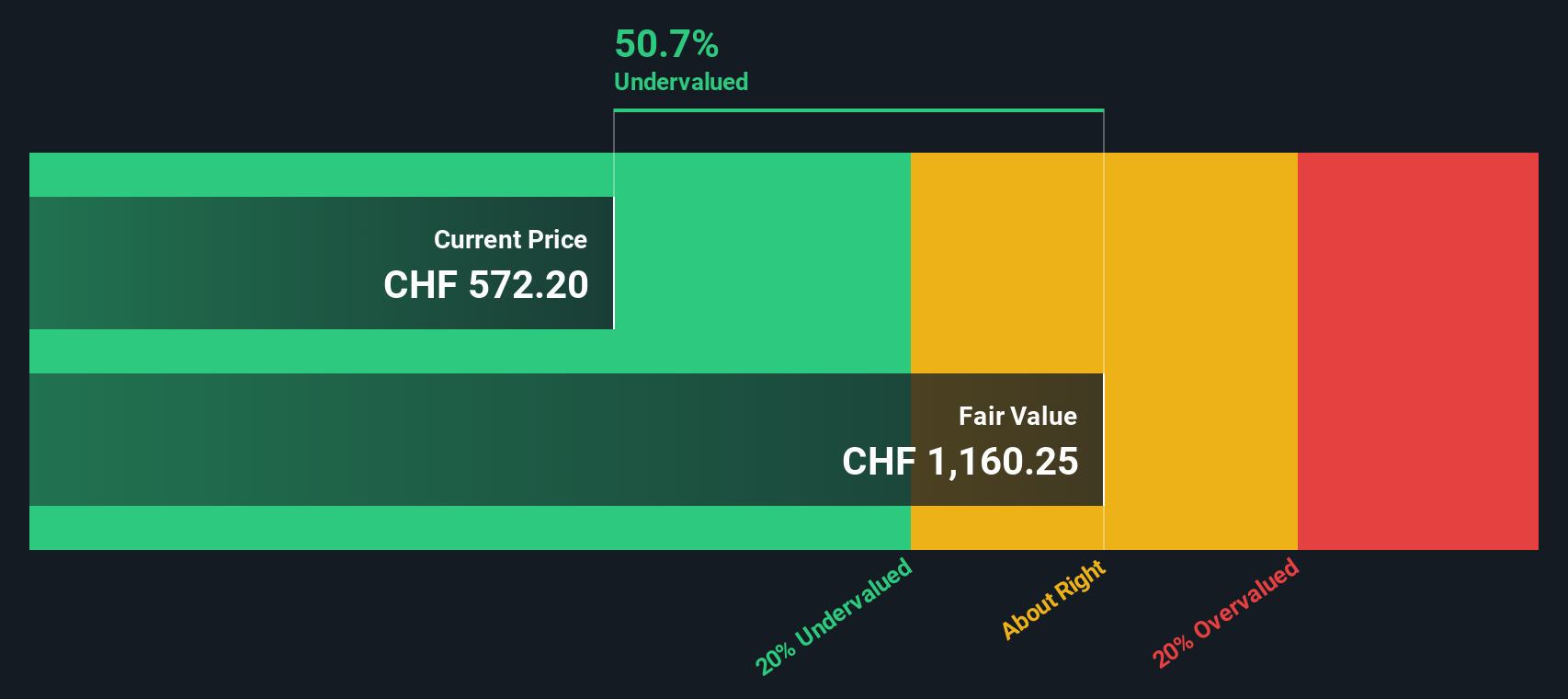

Another View: Our SWS DCF Model Sees Deep Undervaluation

While the consensus narrative argues Zurich Insurance Group is nearly fully priced, our SWS DCF model paints a sharply different picture and estimates fair value at CHF1,162.04, more than double the current share price. Could the market be overlooking Zurich’s longer-term cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Zurich Insurance Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Zurich Insurance Group Narrative

If you see things differently or want to dig into the data yourself, you can craft a personalized Zurich Insurance Group story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Zurich Insurance Group.

Looking for More Winning Investment Ideas?

Your next smart move could be just a click away. Stay ahead of the curve by checking out unique opportunities that others might miss if they hesitate.

- Capture income potential and steady yields by browsing these 17 dividend stocks with yields > 3% delivering payouts above 3% to strengthen your portfolio’s resilience.

- Ride the next big tech wave by targeting future-focused businesses through these 25 AI penny stocks redefining artificial intelligence breakthroughs.

- Tap into undervalued gems hidden in plain sight by filtering for new opportunities among these 917 undervalued stocks based on cash flows and position yourself for growth others overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zurich Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ZURN

Zurich Insurance Group

Provides insurance products and related services in Europe, the Middle East, Africa, North America, Latin America, and the Asia Pacific.

6 star dividend payer with solid track record.

Similar Companies

Market Insights

Community Narratives