- Switzerland

- /

- Insurance

- /

- SWX:BALN

These Analysts Think Baloise Holding AG's (VTX:BALN) Sales Are Under Threat

The analysts covering Baloise Holding AG (VTX:BALN) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Revenue estimates were cut sharply as the analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well. Baloise Holding shares have been sold off recently, so it will be interesting to see if today's downgrade is enough to trigger a full-on rout. The stock price has dropped 5.2% to CHF180 in the past week.

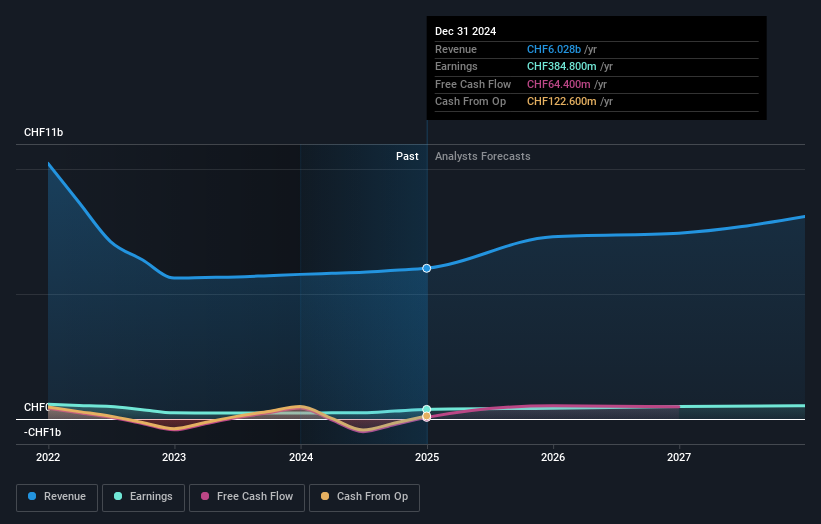

After the downgrade, the five analysts covering Baloise Holding are now predicting revenues of CHF7.3b in 2025. If met, this would reflect a substantial 21% improvement in sales compared to the last 12 months. Per-share earnings are expected to bounce 31% to CHF11.07. Previously, the analysts had been modelling revenues of CHF9.0b and earnings per share (EPS) of CHF11.39 in 2025. Indeed, we can see that analyst sentiment has declined measurably after the new consensus came out, with a substantial drop in revenue estimates and a minor downgrade to EPS estimates to boot.

Check out our latest analysis for Baloise Holding

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. For example, we noticed that Baloise Holding's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 21% growth to the end of 2025 on an annualised basis. That is well above its historical decline of 13% a year over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 2.8% annually. Not only are Baloise Holding's revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Baloise Holding. Unfortunately, analysts also downgraded their revenue estimates, although our data indicates revenues are expected to perform better than the wider market. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of Baloise Holding going forwards.

Worse yet, our risk analysis suggests that Baloise Holding may find it hard to maintain its dividend following these downgrades. You can learn more, and discover the 1 possible risk we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Baloise Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:BALN

Baloise Holding

Primarily engages in the insurance and banking businesses in Switzerland, Germany, Belgium, and Luxembourg.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success