- Switzerland

- /

- Insurance

- /

- SWX:BALN

Is Improved Half-Year Profitability Altering the Investment Case for Baloise Holding (SWX:BALN)?

Reviewed by Simply Wall St

- Baloise Holding AG announced its half-year 2025 results last week, reporting net income of CHF 275.9 million and basic earnings per share of CHF 6.08, both higher than the prior year.

- This earnings improvement highlights stronger operational performance and signals the company's ability to grow profitably despite a complex insurance market.

- We'll explore how this improved profitability adds a new dimension to Baloise's investment narrative in light of analysts' prior expectations.

Find companies with promising cash flow potential yet trading below their fair value.

Baloise Holding Investment Narrative Recap

For someone considering Baloise Holding, the core belief is in the company’s ability to deliver steady profit growth, strong capital returns, and sound cost management, even when facing industry pressures such as volatile claims or slowdowns in new business. The recent half-year earnings improvement supports the importance of operational discipline, but it doesn’t significantly change the most immediate catalyst, completion of the pending Helvetia merger, or reduce the major risk of revenue instability from shifts in the Swiss Group Life market and reliance on investment-type premiums.

Among the recent company announcements, the Helvetia merger stands out as the most relevant to the investment story, particularly now that Baloise has delivered stronger earnings heading into the transaction. With the deal expected to close by the end of 2025, this combination is the key short-term focus for the stock and will determine whether the improved performance translates into added value for current shareholders.

However, it’s worth noting that despite the positive results, the potential long-term impact of revenue instability from changes in the Swiss Group Life market remains a risk that investors should keep in mind...

Read the full narrative on Baloise Holding (it's free!)

Baloise Holding's outlook anticipates CHF 9.0 billion in revenue and CHF 535.9 million in earnings by 2028. This implies an annual revenue growth rate of 13.7% and a CHF 151 million increase in earnings from the current CHF 384.8 million.

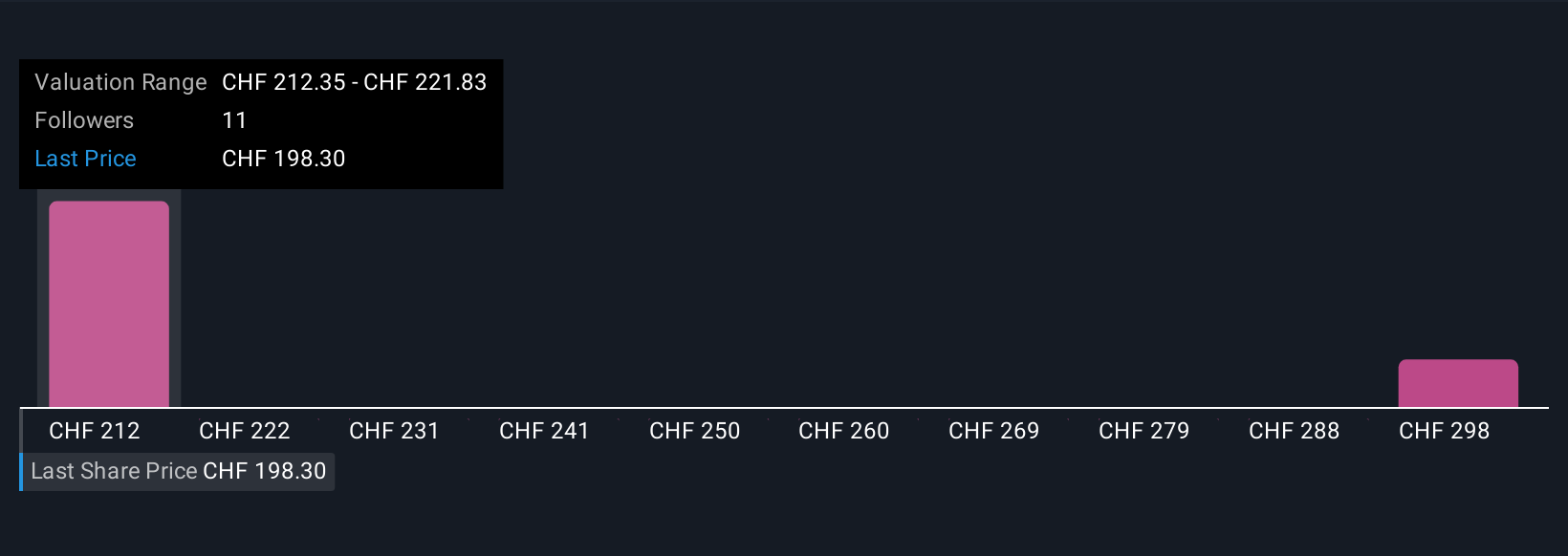

Uncover how Baloise Holding's forecasts yield a CHF212.35 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided three distinct fair value estimates for Baloise, ranging from CHF212.35 to CHF311.34 per share. While many focus on the pending Helvetia merger as a near-term catalyst, these varied viewpoints show why it’s important to consider several different angles before making decisions on Baloise.

Explore 3 other fair value estimates on Baloise Holding - why the stock might be worth just CHF212.35!

Build Your Own Baloise Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Baloise Holding research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Baloise Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Baloise Holding's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baloise Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BALN

Baloise Holding

Primarily engages in the insurance and banking businesses in Switzerland, Germany, Belgium, and Luxembourg.

6 star dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives