- Switzerland

- /

- Insurance

- /

- SWX:BALN

How Investors May Respond To Baloise Holding (SWX:BALN) Winning Swiss Insurance Innovation Award for AI Concierge

Reviewed by Sasha Jovanovic

- Earlier this month, Baloise was awarded the top prize at the Swiss Insurance Innovation Award for its ‘AI Concierge’ project, which uses generative AI to analyze third-party contracts in real time and create personalized insurance policies for motor vehicle clients.

- This recognition underscores Baloise’s industry leadership and highlights the company’s ability to deliver tailored, efficient solutions through ongoing digital innovation efforts.

- We’ll now explore how Baloise’s achievement in AI-driven insurance personalization could influence its current investment narrative and future outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Baloise Holding Investment Narrative Recap

To be a Baloise shareholder today, you need to believe that the company can maintain momentum through digital innovation, manage the changing insurance environment, and emerge stronger from ongoing industry consolidation. The latest AI Concierge award supports Baloise’s reputation for customer-focused technology; however, its main short-term catalyst remains the pending CHF 8.3 billion merger with Helvetia, and neither this achievement nor the award materially impacts the biggest current risk: potential revenue instability from shifting product segments.

Of the recent announcements, the regulatory approval of the Helvetia merger on September 12, 2025, stands out, as it clears a major hurdle and puts the transaction closer to completion. This forms the crux of immediate catalysts for shareholders, with innovation-focused news more relevant to Baloise’s long-term positioning than to short-term stock drivers right now.

By contrast, investors should be aware that while digital innovations strengthen Baloise’s brand, the risk of unstable long-term revenues from shifting market reliance remains...

Read the full narrative on Baloise Holding (it's free!)

Baloise Holding's narrative projects CHF9.0 billion revenue and CHF535.9 million earnings by 2028. This requires 13.7% yearly revenue growth and a CHF151.1 million earnings increase from the current CHF384.8 million.

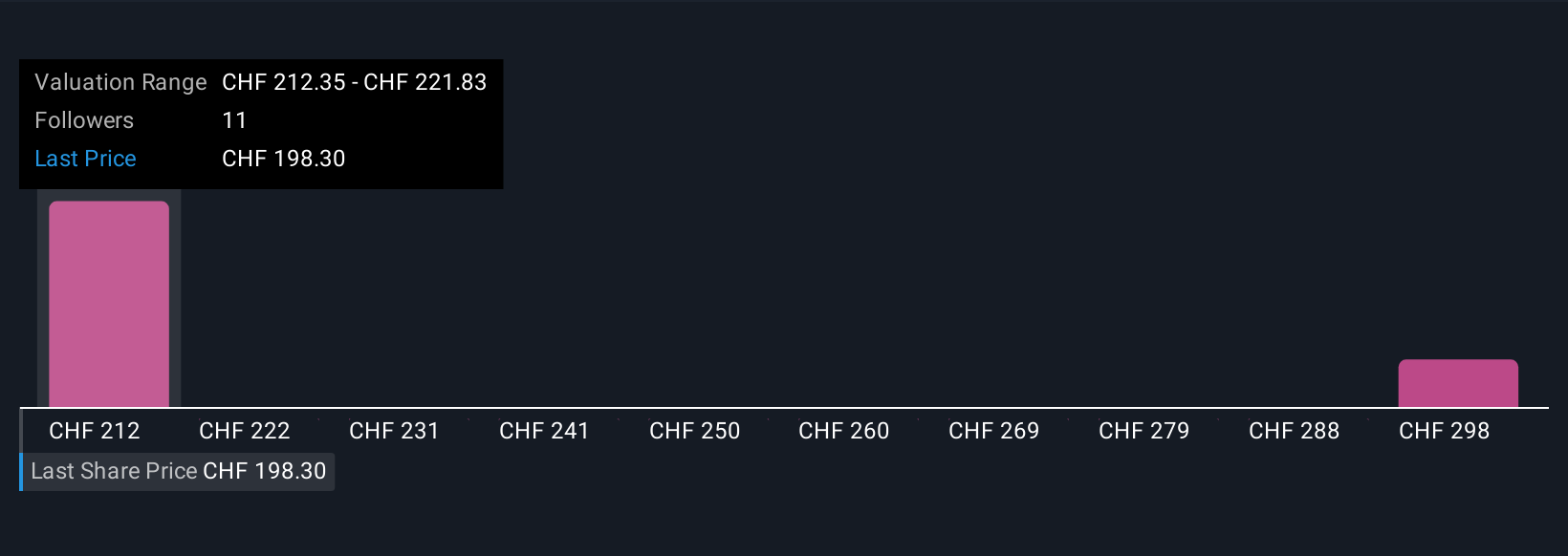

Uncover how Baloise Holding's forecasts yield a CHF218.15 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered three fair value estimates for Baloise, ranging from CHF218.15 to CHF306.36 per share. With opinions spanning almost CHF90 and top-of-mind risks around revenue stability, you can see how market expectations and future performance prospects can sharply differ.

Explore 3 other fair value estimates on Baloise Holding - why the stock might be worth just CHF218.15!

Build Your Own Baloise Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Baloise Holding research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Baloise Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Baloise Holding's overall financial health at a glance.

No Opportunity In Baloise Holding?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baloise Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BALN

Baloise Holding

Primarily engages in the insurance and banking businesses in Switzerland, Germany, Belgium, and Luxembourg.

6 star dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives