- Switzerland

- /

- Personal Products

- /

- SWX:LLQ

Lalique Group SA (VTX:LLQ) Looks Just Right With A 30% Price Jump

Lalique Group SA (VTX:LLQ) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 8.2% isn't as attractive.

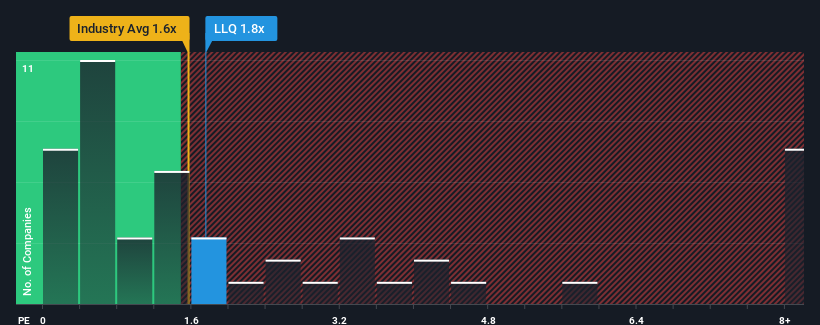

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Lalique Group's P/S ratio of 1.8x, since the median price-to-sales (or "P/S") ratio for the Personal Products industry in Switzerland is also close to 1.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Lalique Group

What Does Lalique Group's Recent Performance Look Like?

There hasn't been much to differentiate Lalique Group's and the industry's revenue growth lately. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Keen to find out how analysts think Lalique Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Lalique Group's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Lalique Group's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 5.5%. Pleasingly, revenue has also lifted 62% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 5.9% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 5.7%, which is not materially different.

In light of this, it's understandable that Lalique Group's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Lalique Group's P/S

Its shares have lifted substantially and now Lalique Group's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at Lalique Group's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Having said that, be aware Lalique Group is showing 4 warning signs in our investment analysis, and 1 of those is a bit concerning.

If these risks are making you reconsider your opinion on Lalique Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:LLQ

Lalique Group

Lalique Group SA creates, develops, markets, and distributes luxury goods worldwide.

Adequate balance sheet slight.

Market Insights

Community Narratives