This article will reflect on the compensation paid to Roger von der Weid who has served as CEO of Lalique Group SA (VTX:LLQ) since 2006. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Lalique Group

How Does Total Compensation For Roger von der Weid Compare With Other Companies In The Industry?

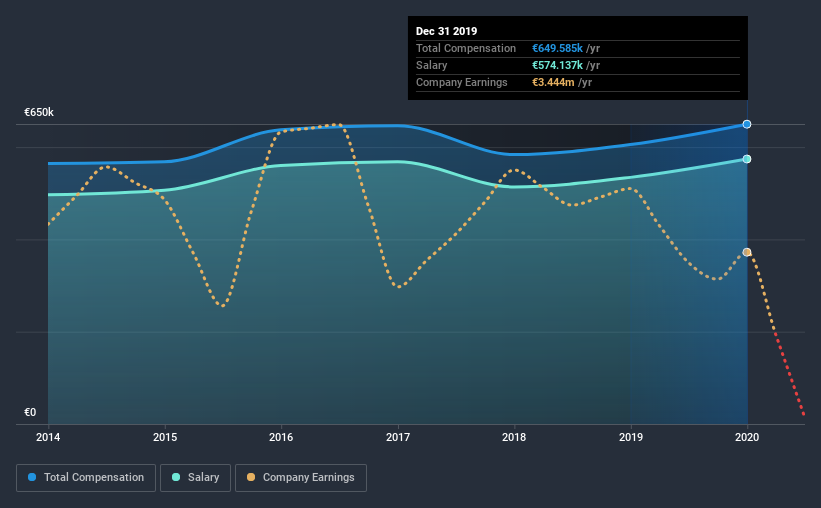

At the time of writing, our data shows that Lalique Group SA has a market capitalization of CHF270m, and reported total annual CEO compensation of CHF650k for the year to December 2019. That's just a smallish increase of 7.3% on last year. Notably, the salary which is €574.1k, represents most of the total compensation being paid.

On examining similar-sized companies in the industry with market capitalizations between CHF91m and CHF363m, we discovered that the median CEO total compensation of that group was CHF414k. This suggests that Roger von der Weid is paid more than the median for the industry. What's more, Roger von der Weid holds CHF135k worth of shares in the company in their own name.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CHF574k | CHF534k | 88% |

| Other | CHF75k | CHF71k | 12% |

| Total Compensation | CHF650k | CHF605k | 100% |

Talking in terms of the industry, salary represented approximately 44% of total compensation out of all the companies we analyzed, while other remuneration made up 56% of the pie. According to our research, Lalique Group has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Lalique Group SA's Growth

Lalique Group SA has reduced its earnings per share by 60% a year over the last three years. It saw its revenue drop 12% over the last year.

The decline in EPS is a bit concerning. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Lalique Group SA Been A Good Investment?

With a total shareholder return of 4.6% over three years, Lalique Group SA has done okay by shareholders. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

As previously discussed, Roger is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. This doesn't look great when you realize that the company has been suffering from negative EPS growth for the last three years. And shareholder returns are decent but not great. So you may want to delve deeper, because we don't think the amount Roger makes is justifiable.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 1 warning sign for Lalique Group that investors should be aware of in a dynamic business environment.

Switching gears from Lalique Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Lalique Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SWX:LLQ

Lalique Group

Lalique Group SA creates, develops, markets, and distributes luxury goods worldwide.

Adequate balance sheet slight.

Market Insights

Community Narratives