- Switzerland

- /

- Capital Markets

- /

- SWX:SQN

Three Stocks On SIX Swiss Exchange Trading At Estimated Discounts Up To 48.8%

Reviewed by Simply Wall St

The Switzerland market closed higher on Friday, tracking positive cues from other European markets amid hopes the Federal Reserve will cut interest rates next week. The benchmark SMI ended with a modest gain of 54.94 points or 0.46% at 12,037.28. In this favorable market environment, identifying undervalued stocks can be particularly rewarding for investors looking to capitalize on potential discounts and future growth opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LEM Holding (SWX:LEHN) | CHF1290.00 | CHF1834.48 | 29.7% |

| Swissquote Group Holding (SWX:SQN) | CHF292.20 | CHF571.01 | 48.8% |

| Georg Fischer (SWX:GF) | CHF62.30 | CHF112.63 | 44.7% |

| ALSO Holding (SWX:ALSN) | CHF260.00 | CHF414.08 | 37.2% |

| lastminute.com (SWX:LMN) | CHF18.80 | CHF29.53 | 36.3% |

| Clariant (SWX:CLN) | CHF12.37 | CHF21.52 | 42.5% |

| Comet Holding (SWX:COTN) | CHF308.00 | CHF531.28 | 42% |

| Barry Callebaut (SWX:BARN) | CHF1456.00 | CHF2370.57 | 38.6% |

| Dätwyler Holding (SWX:DAE) | CHF171.20 | CHF251.92 | 32% |

| SGS (SWX:SGSN) | CHF95.60 | CHF144.82 | 34% |

We'll examine a selection from our screener results.

Swissquote Group Holding (SWX:SQN)

Overview: Swissquote Group Holding Ltd offers a range of online financial services to retail, affluent, and institutional investors globally and has a market cap of CHF4.34 billion.

Operations: Leveraged Forex and Securities Trading are the primary revenue segments, generating CHF93.28 million and CHF488.98 million respectively.

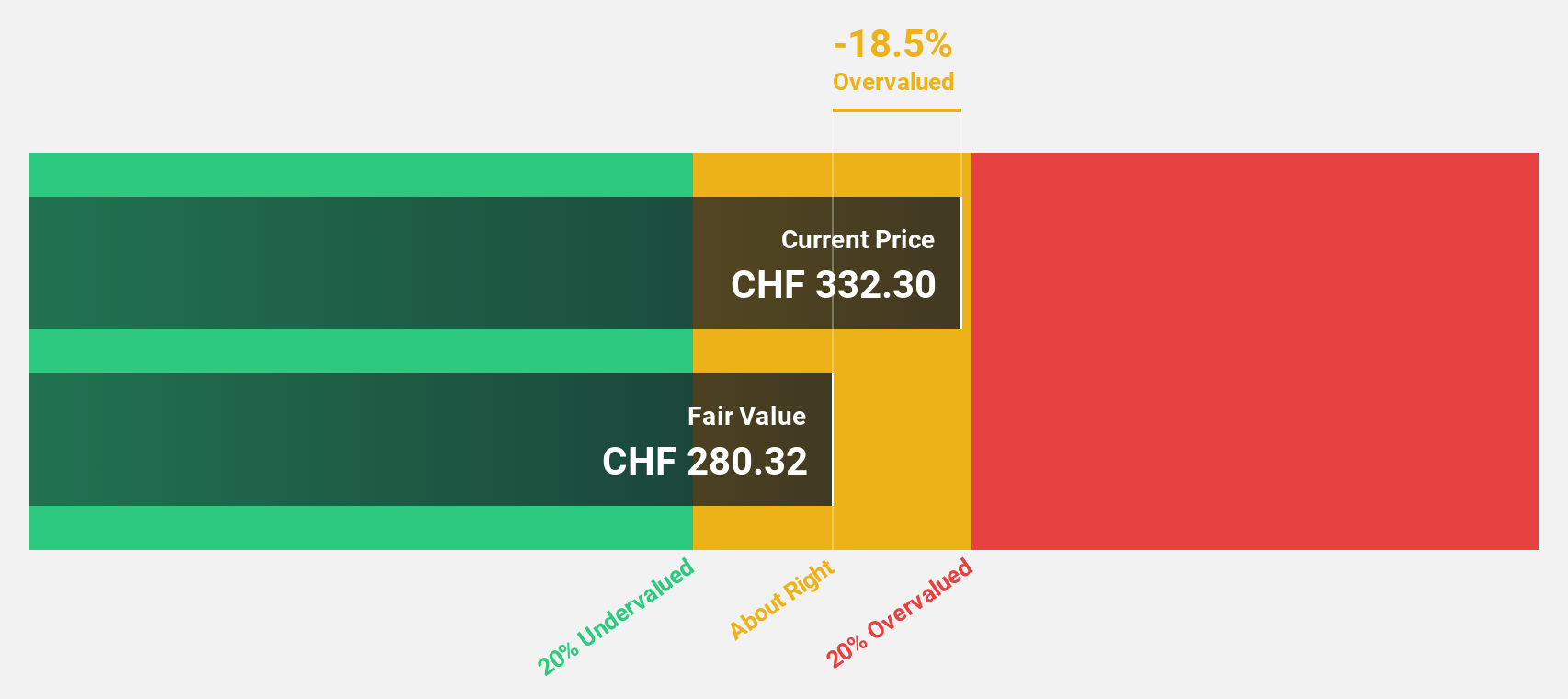

Estimated Discount To Fair Value: 48.8%

Swissquote Group Holding appears significantly undervalued based on cash flows, trading 48.8% below its estimated fair value of CHF571.01 at CHF292.2. The company reported strong earnings for H1 2024 with net income rising to CHF144.56 million from CHF106.53 million a year ago, and basic EPS increasing to CHF9.69 from CHF7.15 last year. Earnings are forecasted to grow annually by 13.07%, outpacing the Swiss market's 11.7%.

- The growth report we've compiled suggests that Swissquote Group Holding's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Swissquote Group Holding stock in this financial health report.

Straumann Holding (SWX:STMN)

Overview: Straumann Holding AG, with a market cap of CHF19.62 billion, provides tooth replacement and orthodontic solutions worldwide.

Operations: Straumann Holding AG generates revenue from various segments including Sales NAM (CHF800.14 million), Operations (CHF1.26 billion), Sales APAC (CHF540.74 million), Sales EMEA (CHF1.20 billion), and Sales LATAM (CHF282.34 million).

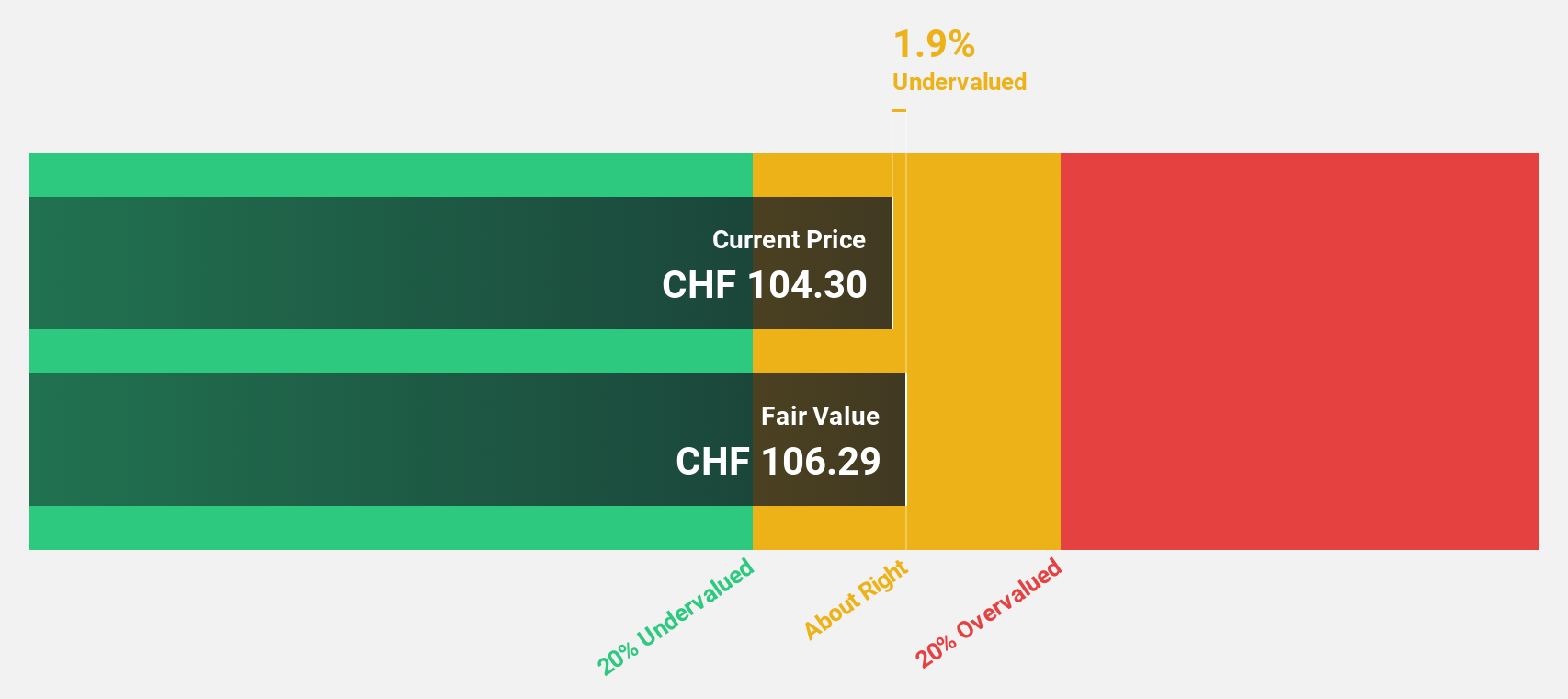

Estimated Discount To Fair Value: 11.9%

Straumann Holding is trading at CHF123.05, below its estimated fair value of CHF139.66, indicating potential undervaluation based on cash flows. The company forecasts low double-digit organic revenue growth and profitability in the 27%-28% range for 2024. Recent H1 earnings showed sales of CHF1.27 billion and net income of CHF230.37 million, up from last year’s figures. Expected annual profit growth (21.8%) outpaces the Swiss market's average (11.7%).

- The analysis detailed in our Straumann Holding growth report hints at robust future financial performance.

- Take a closer look at Straumann Holding's balance sheet health here in our report.

VAT Group (SWX:VACN)

Overview: VAT Group AG, with a market cap of CHF12.07 billion, develops, manufactures, and supplies vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows to various international markets including Switzerland, Europe, the United States, Japan, Korea, Singapore, China and other parts of Asia.

Operations: The company's revenue segments include CHF783.51 million from Valves and CHF163.83 million from Global Service.

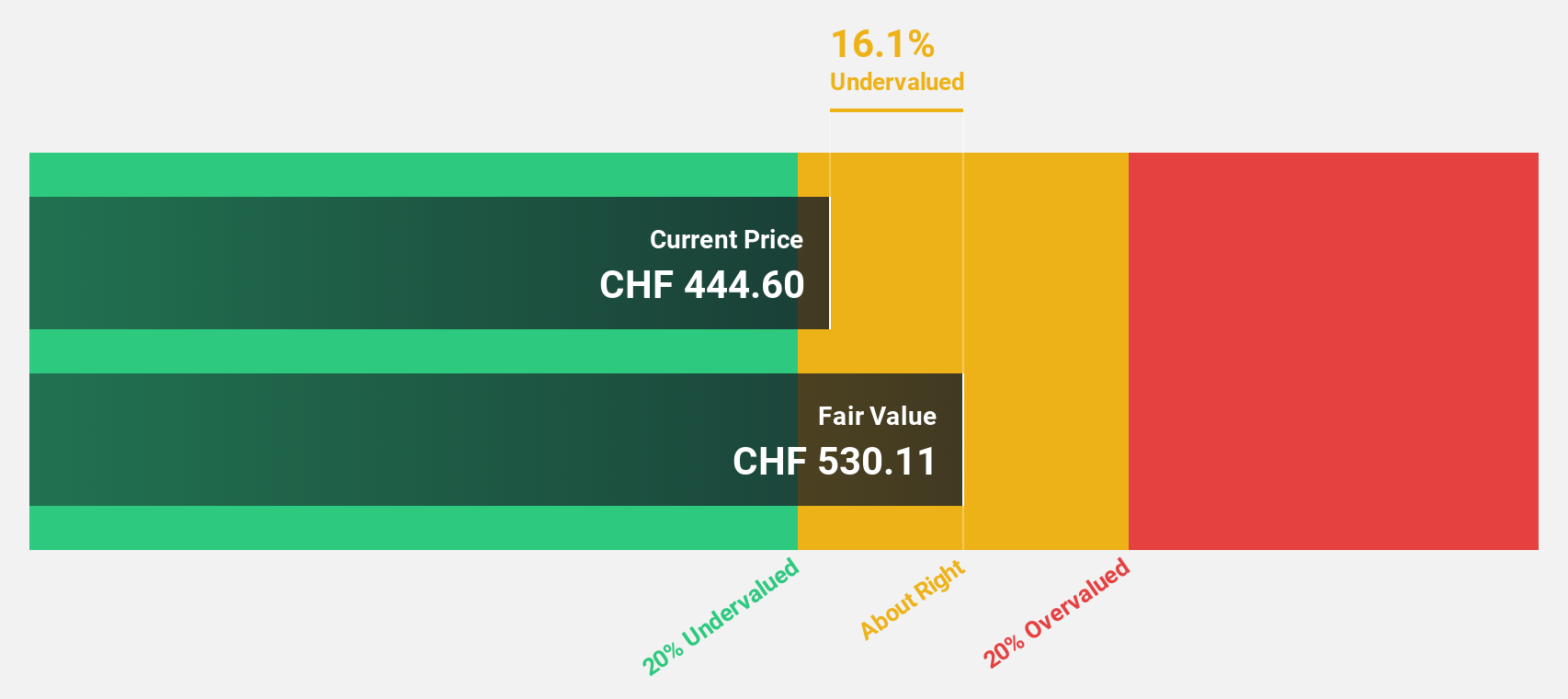

Estimated Discount To Fair Value: 28.1%

VAT Group AG, trading at CHF402.5, is significantly undervalued compared to its estimated fair value of CHF560.19. Despite a highly volatile share price recently, the company’s earnings are forecast to grow 22.48% annually over the next three years, outpacing the Swiss market's average growth rate of 11.7%. Recent H1 results showed net income rising to CHF94 million from CHF84.2 million last year, with basic earnings per share increasing from CHF2.81 to CHF3.14.

- Our earnings growth report unveils the potential for significant increases in VAT Group's future results.

- Click to explore a detailed breakdown of our findings in VAT Group's balance sheet health report.

Next Steps

- Investigate our full lineup of 16 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SQN

Swissquote Group Holding

Provides a suite of online financial services to retail investors, affluent investors, and professional and institutional customers worldwide.

Outstanding track record and good value.