- Switzerland

- /

- Medical Equipment

- /

- SWX:SOON

These 4 Measures Indicate That Sonova Holding (VTX:SOON) Is Using Debt Reasonably Well

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Sonova Holding AG (VTX:SOON) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Sonova Holding

What Is Sonova Holding's Debt?

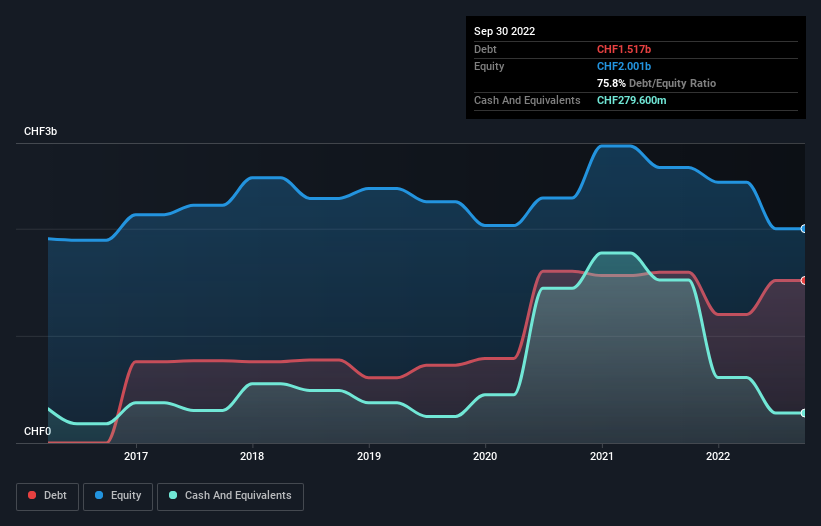

As you can see below, Sonova Holding had CHF1.52b of debt at September 2022, down from CHF1.59b a year prior. However, it also had CHF279.6m in cash, and so its net debt is CHF1.24b.

How Strong Is Sonova Holding's Balance Sheet?

According to the last reported balance sheet, Sonova Holding had liabilities of CHF1.15b due within 12 months, and liabilities of CHF2.04b due beyond 12 months. Offsetting these obligations, it had cash of CHF279.6m as well as receivables valued at CHF495.2m due within 12 months. So its liabilities total CHF2.42b more than the combination of its cash and short-term receivables.

Of course, Sonova Holding has a titanic market capitalization of CHF15.0b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Sonova Holding has a low net debt to EBITDA ratio of only 1.4. And its EBIT easily covers its interest expense, being 55.7 times the size. So we're pretty relaxed about its super-conservative use of debt. But the other side of the story is that Sonova Holding saw its EBIT decline by 2.3% over the last year. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Sonova Holding's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Happily for any shareholders, Sonova Holding actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Sonova Holding's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But, on a more sombre note, we are a little concerned by its EBIT growth rate. It's also worth noting that Sonova Holding is in the Medical Equipment industry, which is often considered to be quite defensive. Zooming out, Sonova Holding seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, when used wisely it can also bring a higher return on equity. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 1 warning sign for Sonova Holding you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:SOON

Sonova Holding

Manufactures and sells hearing care solutions for adults and children in the United States, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives