As European markets show mixed performance, with the pan-European STOXX Europe 600 Index remaining relatively flat and major indices like France's CAC 40 and Italy's FTSE MIB posting modest gains, investors are keenly observing potential opportunities amid these fluctuations. In such an environment, identifying undervalued stocks can be crucial for investors looking to capitalize on discrepancies between a company's intrinsic value and its current market price.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trøndelag Sparebank (OB:TRSB) | NOK113.70 | NOK222.49 | 48.9% |

| Sulzer (SWX:SUN) | CHF142.20 | CHF277.96 | 48.8% |

| RVRC Holding (OM:RVRC) | SEK45.98 | SEK90.84 | 49.4% |

| Lectra (ENXTPA:LSS) | €25.30 | €49.26 | 48.6% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €56.00 | €110.26 | 49.2% |

| Ion Beam Applications (ENXTBR:IBAB) | €11.84 | €23.16 | 48.9% |

| Ependion (OM:EPEN) | SEK115.40 | SEK225.10 | 48.7% |

| CI Games (WSE:CIG) | PLN2.47 | PLN4.93 | 49.9% |

| Carl Zeiss Meditec (XTRA:AFX) | €53.00 | €105.92 | 50% |

| ams-OSRAM (SWX:AMS) | CHF12.42 | CHF24.71 | 49.7% |

We're going to check out a few of the best picks from our screener tool.

Europris (OB:EPR)

Overview: Europris ASA is a discount variety retailer operating in Norway with a market cap of NOK15.38 billion.

Operations: Europris ASA generates revenue through its operations as a discount variety retailer in Norway.

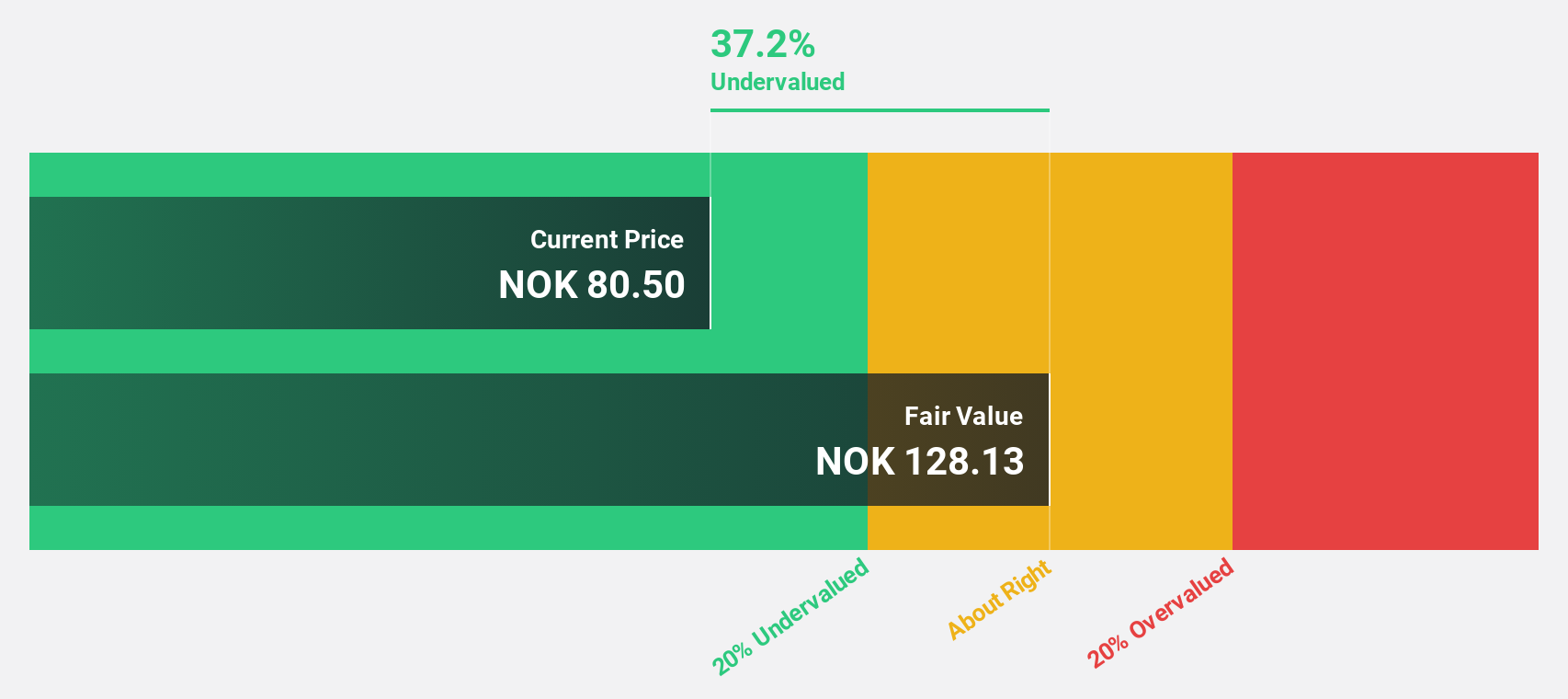

Estimated Discount To Fair Value: 37.2%

Europris is trading at NOK 94, significantly below its estimated fair value of NOK 149.65, suggesting it may be undervalued based on discounted cash flow analysis. Despite a decline in net profit margin from last year, earnings are projected to grow at 16.74% annually, outpacing the Norwegian market's growth rate. Recent earnings reports show increased quarterly sales but a drop in six-month net income compared to last year, reflecting mixed financial performance amidst expansion efforts with new store openings.

- Upon reviewing our latest growth report, Europris' projected financial performance appears quite optimistic.

- Take a closer look at Europris' balance sheet health here in our report.

Sonova Holding (SWX:SOON)

Overview: Sonova Holding AG is a global provider of hearing care solutions for both children and adults, with a market capitalization of CHF14.10 billion.

Operations: The company's revenue primarily comes from Hearing Instruments, generating CHF3.57 billion, and Cochlear Implants, contributing CHF307.50 million.

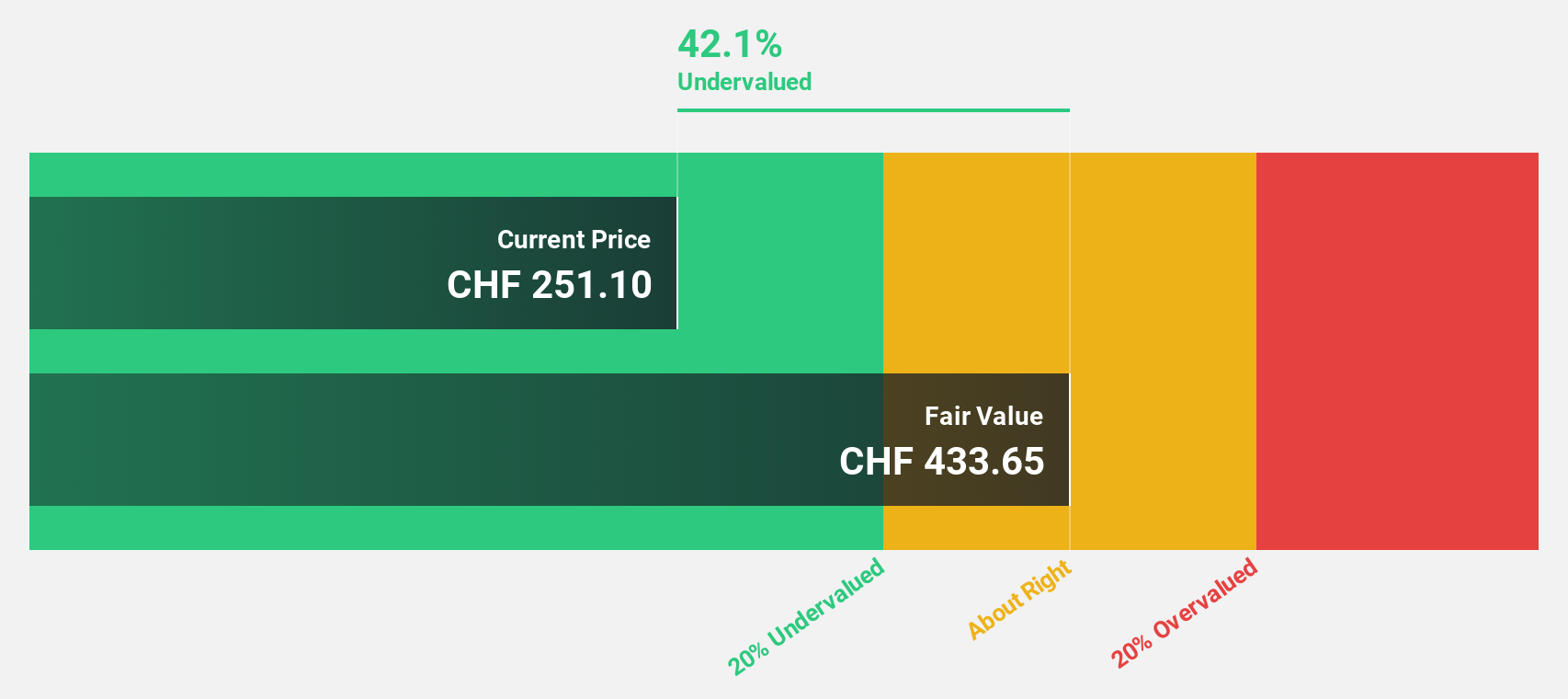

Estimated Discount To Fair Value: 47.8%

Sonova Holding is trading at CHF 236.6, considerably below its estimated fair value of CHF 452.92, highlighting potential undervaluation based on cash flow analysis. Despite a leadership transition with Eric Bernard set to assume the CEO role, the company anticipates revenue growth of 5.4% annually, surpassing the Swiss market rate. Recent earnings report shows sales of CHF 3.87 billion and net income of CHF 547 million, underscoring solid financial health amidst strategic changes and dividend increases.

- Our comprehensive growth report raises the possibility that Sonova Holding is poised for substantial financial growth.

- Get an in-depth perspective on Sonova Holding's balance sheet by reading our health report here.

Infineon Technologies (XTRA:IFX)

Overview: Infineon Technologies AG is involved in the design, development, manufacture, and marketing of semiconductors and semiconductor-based solutions globally, with a market cap of €49.71 billion.

Operations: The company's revenue segments are comprised of Automotive (€8.21 billion), Green Industrial Power (€1.72 billion), Power & Sensor Systems (€3.23 billion), and Connected Secure Systems (€1.47 billion).

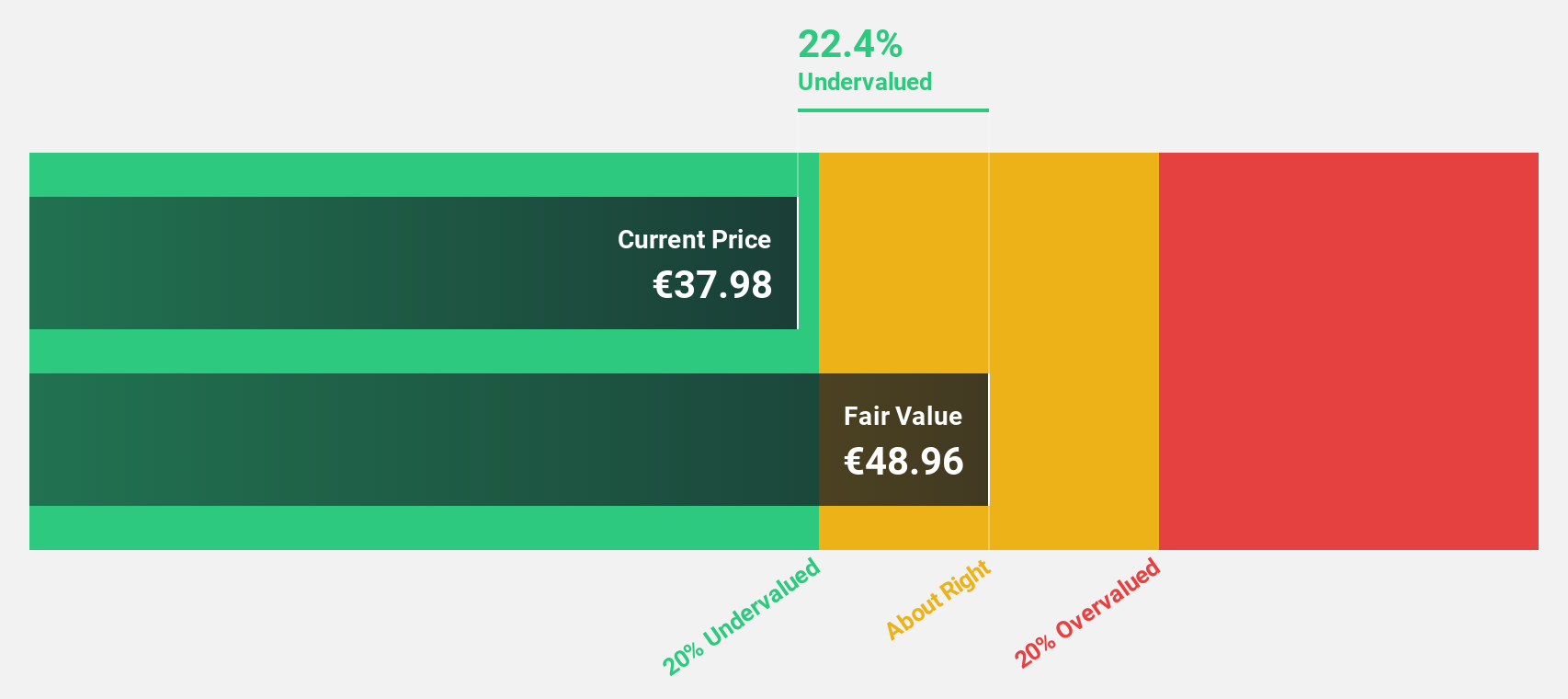

Estimated Discount To Fair Value: 22.1%

Infineon Technologies is trading at €38.26, significantly below its estimated fair value of €49.08, suggesting undervaluation based on cash flow analysis. Despite a decline in net income to €478 million for the half year ended March 2025, the company forecasts robust earnings growth of 25.6% annually, outpacing the German market. Strategic partnerships and technological advancements in quantum chips and automotive solutions bolster Infineon's growth prospects amid fluctuating profit margins and revenue challenges.

- According our earnings growth report, there's an indication that Infineon Technologies might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Infineon Technologies.

Next Steps

- Delve into our full catalog of 177 Undervalued European Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Europris might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:EPR

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives