- Switzerland

- /

- Medical Equipment

- /

- SWX:CLTN

Undiscovered Gems in Europe to Watch This November 2025

Reviewed by Simply Wall St

As European markets face a pullback, with the pan-European STOXX Europe 600 Index ending 1.24% lower and concerns about overvaluation in AI-related stocks weighing on sentiment, investors are increasingly looking for opportunities outside the mainstream sectors. In this environment, identifying promising small-cap stocks requires focusing on companies with strong fundamentals and potential for growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Dn Agrar Group | 63.27% | 15.46% | 33.00% | ★★★★☆☆ |

We'll examine a selection from our screener results.

EL.En (BIT:ELN)

Simply Wall St Value Rating: ★★★★★★

Overview: EL.En. S.p.A. is involved in the production, research and development, distribution, and sale of laser systems across Italy, Europe, and globally with a market cap of €901.89 million.

Operations: EL.En. S.p.A. generates revenue primarily from its medical laser systems segment, contributing €421.46 million, and its industrial segment, adding €160.44 million.

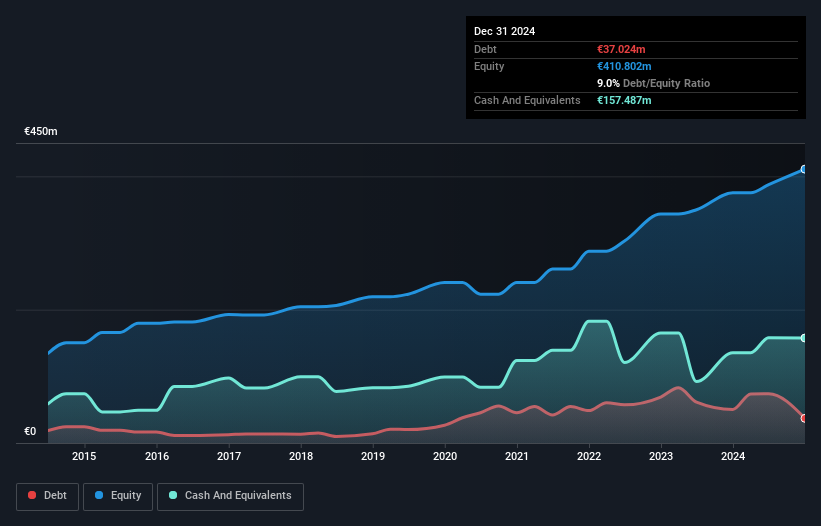

EL.En, a nimble player in the medical equipment space, is making waves with its strategic pivot towards high-margin medical products. The company has impressively reduced its debt-to-equity ratio from 20.3% to 1.8% over five years and boasts a price-to-earnings ratio of 16.9x, undercutting the industry average of 18x. Despite recent challenges like legal disputes and weak Chinese market performance, EL.En's earnings grew by 16.3% last year, outpacing the industry's -2.5%. Analysts forecast annual revenue growth of 5.4%, though margin contraction from 10.8% to 9.8% looms on the horizon for this promising entity.

Zinzino (OM:ZZ B)

Simply Wall St Value Rating: ★★★★★★

Overview: Zinzino AB (publ) is a direct sales company that offers dietary supplements and skincare products both in Sweden and internationally, with a market capitalization of SEK4.32 billion.

Operations: Zinzino generates revenue primarily from its Zinzino (Incl. VMA Life) segment, amounting to SEK2.68 billion, while the Faun segment contributes SEK177.77 million.

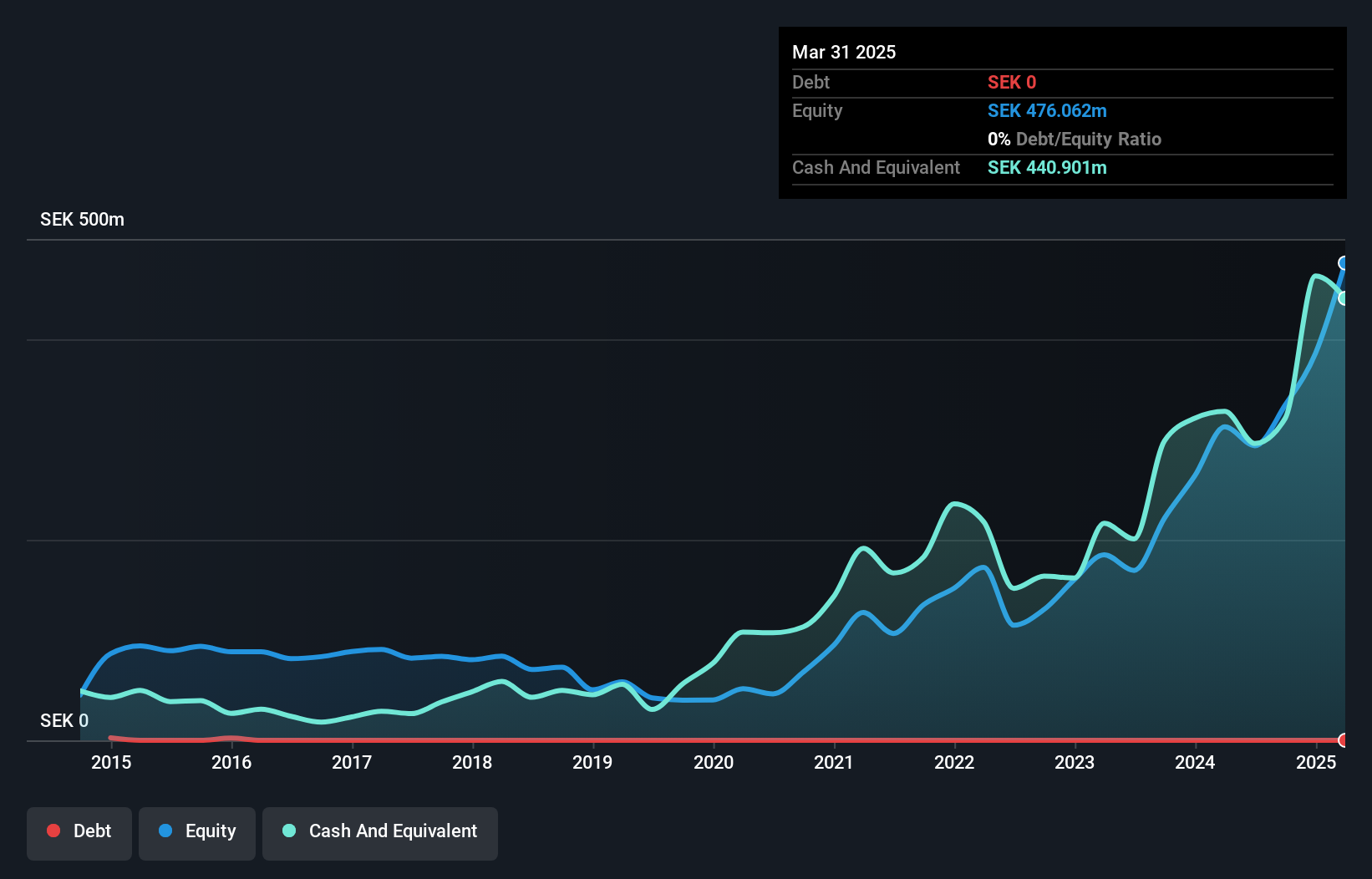

Zinzino, a notable player in the wellness sector, has seen impressive revenue growth with a 65% increase to SEK 327.5 million for October 2025 compared to SEK 198 million last year. The company's innovative gut Health Test highlights its commitment to health solutions and is gaining traction. Despite significant insider selling recently, Zinzino remains debt-free and boasts high-quality earnings. With net income rising from SEK 47.99 million to SEK 55.34 million in the second quarter of this year, the company is trading at a substantial discount of about 64.6% below its estimated fair value, suggesting potential upside for investors seeking opportunities in emerging markets like this one.

- Navigate through the intricacies of Zinzino with our comprehensive health report here.

Gain insights into Zinzino's historical performance by reviewing our past performance report.

COLTENE Holding (SWX:CLTN)

Simply Wall St Value Rating: ★★★★★★

Overview: COLTENE Holding AG specializes in developing, manufacturing, and selling dental disposables, tools, and equipment across various global markets with a market capitalization of CHF284.13 million.

Operations: The company generates revenue of CHF240.71 million from its dental disposables, tools, and equipment segment.

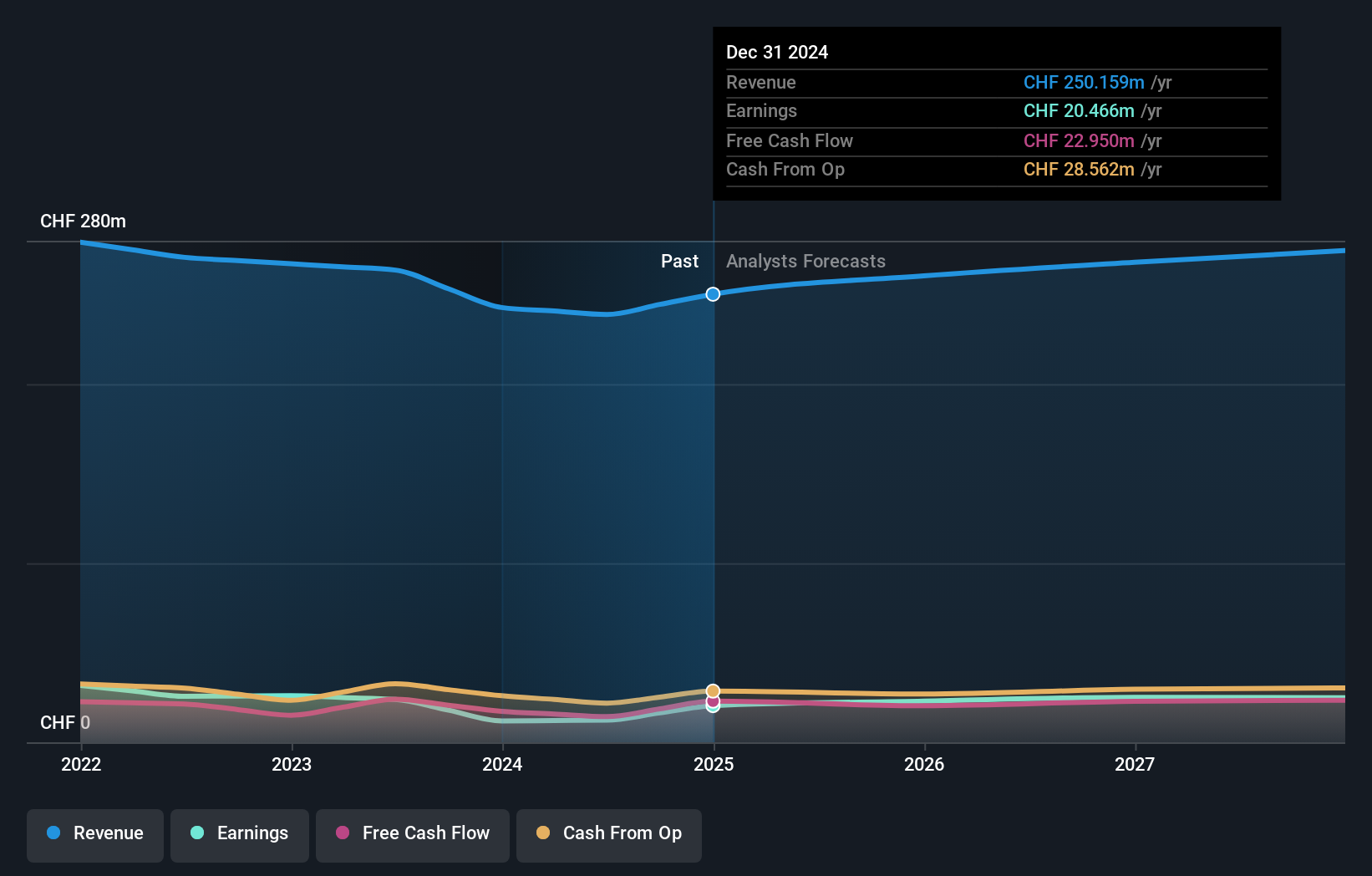

In the medical equipment industry, COLTENE Holding stands out with its robust financial health and growth trajectory. Over the past five years, it has successfully reduced its debt to equity ratio from 101.1% to a satisfactory 56.4%, reflecting prudent financial management. Trading at a notable 30.7% below estimated fair value, COLTENE offers attractive investment potential compared to peers. Its earnings have grown by 16% in the last year, surpassing industry averages of 7.8%. With interest payments well covered by EBIT at a multiple of 6.5x, this company demonstrates strong operational efficiency and promising future prospects with forecasted annual earnings growth of 17.44%.

- Unlock comprehensive insights into our analysis of COLTENE Holding stock in this health report.

Review our historical performance report to gain insights into COLTENE Holding's's past performance.

Key Takeaways

- Delve into our full catalog of 321 European Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CLTN

COLTENE Holding

Develops, manufactures, and sells disposables, tools, and equipment for dentists and dental laboratories in Europe, the Middle East, Africa, North America, Latin America, and Asia/Oceania.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives