Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Alcon (VTX:ALC), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Alcon with the means to add long-term value to shareholders.

See our latest analysis for Alcon

Alcon's Improving Profits

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. Which is why EPS growth is looked upon so favourably. Commendations have to be given in seeing that Alcon grew its EPS from US$0.74 to US$2.23, in one short year. Even though that growth rate may not be repeated, that looks like a breakout improvement.

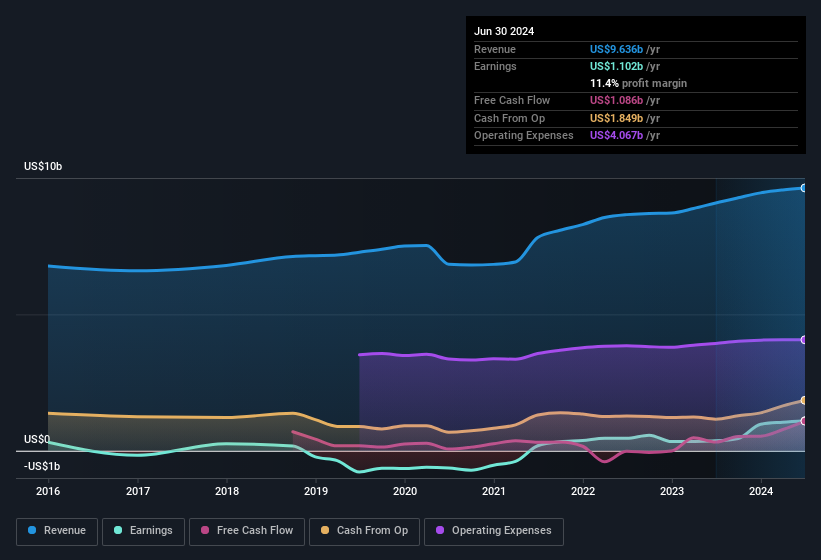

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Alcon shareholders is that EBIT margins have grown from 9.2% to 12% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Alcon's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Alcon Insiders Aligned With All Shareholders?

Owing to the size of Alcon, we wouldn't expect insiders to hold a significant proportion of the company. But we do take comfort from the fact that they are investors in the company. Given insiders own a significant chunk of shares, currently valued at US$57m, they have plenty of motivation to push the business to succeed. This would indicate that the goals of shareholders and management are one and the same.

Should You Add Alcon To Your Watchlist?

Alcon's earnings have taken off in quite an impressive fashion. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So based on this quick analysis, we do think it's worth considering Alcon for a spot on your watchlist. Of course, just because Alcon is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Swiss companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:ALC

Alcon

Researches, develops, manufactures, distributes, and sells eye care products worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives