- Switzerland

- /

- Medical Equipment

- /

- SWX:ALC

Alcon (SWX:ALC) Valuation: Is There Real Upside After Recent Modest Share Price Gain?

Reviewed by Kshitija Bhandaru

See our latest analysis for Alcon.

This latest uptick is a welcome change for Alcon after a sluggish patch, though momentum has generally faded over recent months. Even with solid fundamentals, the stock’s share price return over the past year remains slightly in the red, while its longer-term total shareholder returns suggest only modest gains for patient investors.

If today’s move has you thinking about how healthcare leaders are performing, there is a whole world of stocks with dynamic pipelines and growth stories. See the full list for free.

The recent lift may catch investors’ interest, but with shares trading well below analyst targets despite healthy earnings growth, is there true value still on the table, or is the market accounting for all future upside?

Most Popular Narrative: 24.6% Undervalued

Alcon's current share price of CHF61.34 sits well below the narrative’s fair value estimate, hinting at a significant potential upside according to analyst consensus. This valuation draws attention to the gap between prevailing market caution and the long-term earnings outlook supporting that fair value.

Accelerated new product launches, including Unity VCS (next-gen surgical platform), PanOptix Pro (premium IOL), Tryptyr (first-in-class dry eye Rx), Precision7 (novel contact lens), and recent pipeline-accretive M&A (STAAR, LumiThera, Voyager), provide significant near and medium-term opportunities for share gain, mix improvement, and new market entry. These developments underpin upside to both revenue and net margins as these innovations scale.

Want to know why this narrative sees so much upside? Discover which bold forecasts for innovation-fueled revenue and robust profit expansion are shaping analyst confidence behind that price target. The underlying growth assumptions are not what you might expect for a healthcare giant.

Result: Fair Value of CHF81.3 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, competitive pressures in core markets or setbacks with recent acquisitions could undermine earnings momentum and challenge the bullish growth thesis for Alcon.

Find out about the key risks to this Alcon narrative.

Another View: Is the Market Right?

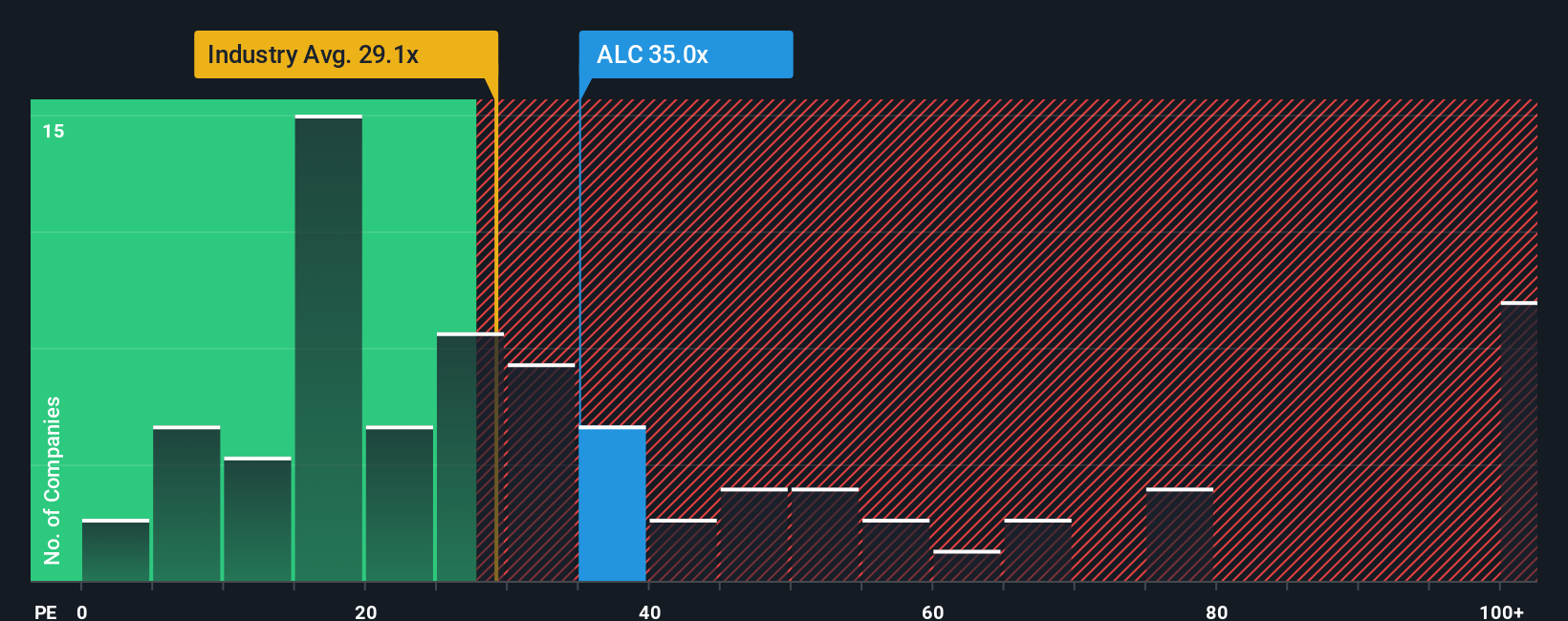

Looking at Alcon through the lens of its earnings multiple, the stock trades at 35.5x earnings. This is pricier than both the European industry average of 29.2x and its peers at 31.5x, yet still slightly below its calculated fair ratio of 38.2x. Does this premium reflect genuine growth potential, or are investors taking on added valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alcon Narrative

If you see the story differently or want to dig into the numbers on your own terms, shaping your own outlook only takes a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Alcon.

Looking for More Investment Ideas?

Get ahead of the crowd by using the Simply Wall Street Screener to uncover unique opportunities most investors overlook. Miss it now and you risk missing tomorrow’s big winners.

- Capture income potential and review these 19 dividend stocks with yields > 3% that consistently deliver yields over 3% for strong cash flow in any market.

- Seize the AI momentum with these 25 AI penny stocks where cutting-edge innovation and market disruption offer serious upside.

- Spot stocks the market has underestimated and tap into these 887 undervalued stocks based on cash flows based on future cash flows and intrinsic value signals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ALC

Alcon

Researches, develops, manufactures, distributes, and sells eye care products worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives