- Switzerland

- /

- Medical Equipment

- /

- SWX:ALC

A Fresh Look at Alcon (SWX:ALC) Valuation After Recent Share Price Uptick

Reviewed by Kshitija Bhandaru

Alcon (SWX:ALC) stock has edged up slightly in the latest trading session, following a period of underperformance over the past month. Investors are taking a closer look at how the company's fundamentals might influence its near-term outlook.

See our latest analysis for Alcon.

While Alcon’s share price has slipped more than 21% so far this year and is down 14% over the past three months, the longer-term picture is less discouraging, with a 3-year total shareholder return of 2.6% and 5-year TSR of 11.6%. The latest uptick in price hints at changing sentiment, as investors weigh growth potential against recent lackluster momentum.

For anyone tracking moves in the healthcare sector, it could be the perfect moment to take a look at opportunities using our curated screener: See the full list for free.

With shares still trading well below analyst targets and showing solid improvements in both revenue and net income, is Alcon an undervalued opportunity for patient investors, or has the market already factored in its future gains?

Most Popular Narrative: 25.7% Undervalued

Alcon's most widely followed narrative pegs its fair value far above the last close of CHF59.76, suggesting that the current price leaves a significant margin for future growth catalysts. With this setup, investors are curious about what justifies this optimistic valuation. Below is a quote that packs real narrative clout.

Ongoing global population aging and the rapid increase in diabetes prevalence continue to drive a structural rise in vision correction needs and chronic eye diseases, supporting a steadfast base for future procedural and diagnostic volumes and setting up consistent long-term top-line growth. Accelerated new product launches, including Unity VCS (next-gen surgical platform), PanOptix Pro (premium IOL), Tryptyr (first-in-class dry eye Rx), Precision7 (novel contact lens), and recent pipeline-accretive M&A (STAAR, LumiThera, Voyager), provide significant near and medium-term opportunities for share gain, mix improvement, and new market entry, underpinning upside to both revenue and net margins as these innovations scale.

What’s the real fuel behind this bullish vision? Behind the headline upside is a set of aggressive profit forecasts and bold revenue growth bets, plus an expected jump in margins that could rival sector leaders. Hungry to see which assumptions drive this story and why analysts think Alcon’s value could go much higher? Only the full narrative reveals the game-changing projections and the fierce debates they spark.

Result: Fair Value of $80.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competitive pressures and slower than expected surgical growth could quickly challenge the optimism around Alcon’s current valuation narrative.

Find out about the key risks to this Alcon narrative.

Another View: What Do The Numbers Say?

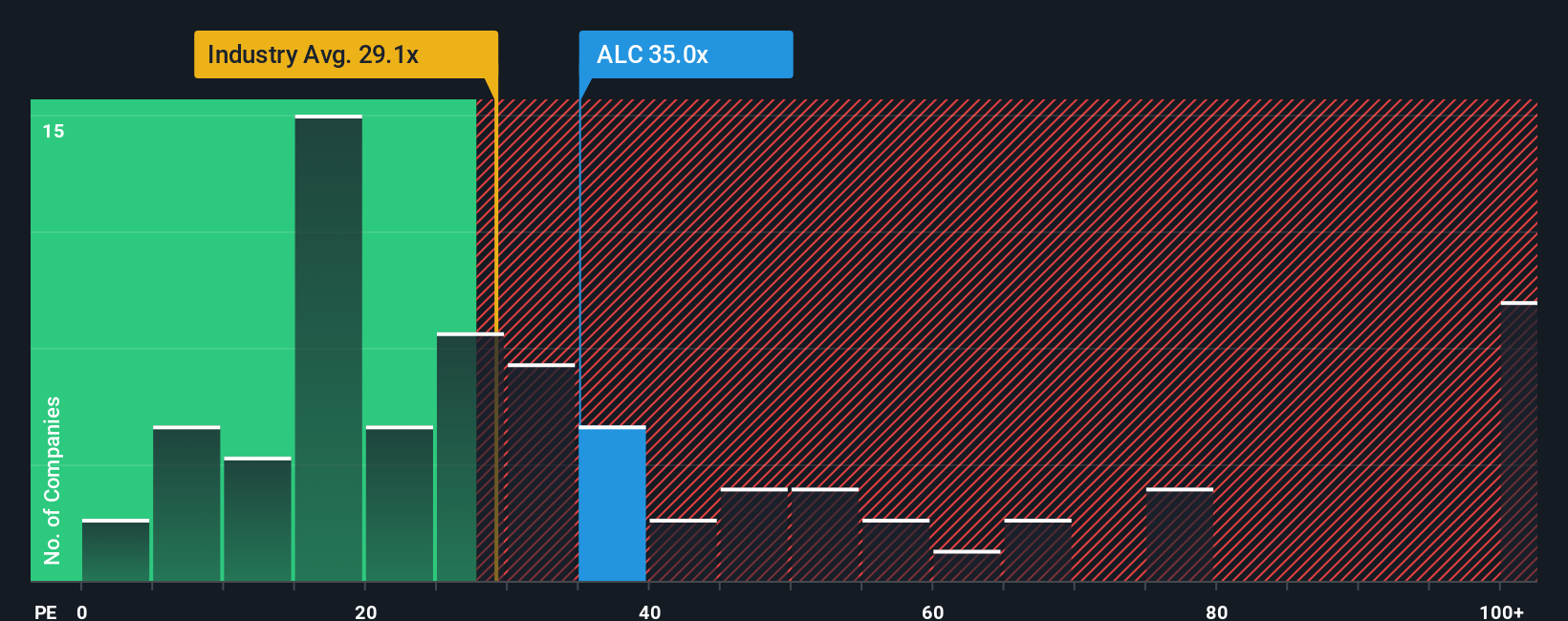

Looking at Alcon's valuation through the lens of the price-to-earnings ratio, there is a different story emerging. The company's ratio stands at 34.6x, making it more expensive than both the European industry average of 29.1x and its peer group average of 30.8x. However, it is still below the fair ratio of 38x that the market might eventually price in. This premium suggests investors are banking on strong future growth, but does it also raise the bar for what Alcon must deliver?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alcon Narrative

If you see the numbers differently or want to dig deeper on your own, it takes just a few minutes to build your own view. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Alcon.

Looking for More Smart Investment Ideas?

Don’t let great opportunities slip by. Broaden your perspective and act now by checking out these handpicked market ideas that could add real strength to your portfolio.

- Boost your income potential with steady payouts. See these 18 dividend stocks with yields > 3% delivering yields above 3%.

- Capture the surge in healthcare’s hottest trend and stay ahead by checking out these 33 healthcare AI stocks pushing boundaries in medical innovation.

- Ride the AI momentum with these 24 AI penny stocks making waves in technology’s next frontier.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ALC

Alcon

Researches, develops, manufactures, distributes, and sells eye care products worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion